Best Companies To Buy This Week Ahead Of Their Earnings Call

NVIDIA, Walmart, and Home Depot are three of the large US companies reporting their earnings this week. The market estimates rising EPS for all three.

This week is dominated by large-cap US companies reporting their quarterly earnings. Among them, three stand out of the crowd as the market expects rising EPS for all of them: NVIDIA, Walmart, and Home Depot.

NVIDIA (NVDA)

NVIDIA is one of the largest companies in the world operating in the semiconductors industry. It offers solutions for gaming platforms or autonomous vehicles, among others.

The company is reporting its quarterly earnings this week, on November 17. The market expectations are that the company will deliver higher EPS compared to the same period last year. More precisely, the expectations are that the EPS for the quarter will reach $1.08, higher by 48.48% YoY. Moreover, the annual revenue estimates for the fiscal period ending January 2022 are $25.77 billion, while for the fiscal period ending January 2023 are $29.12 billion.

NVIDIA’s stock price is on a tear higher. It is up 132.78% this year alone and recently broke above $300. The company operates with a gross profit margin of 63.76%, much higher than the 49.52% sector median.

(Click on image to enlarge)

Walmart (WMT)

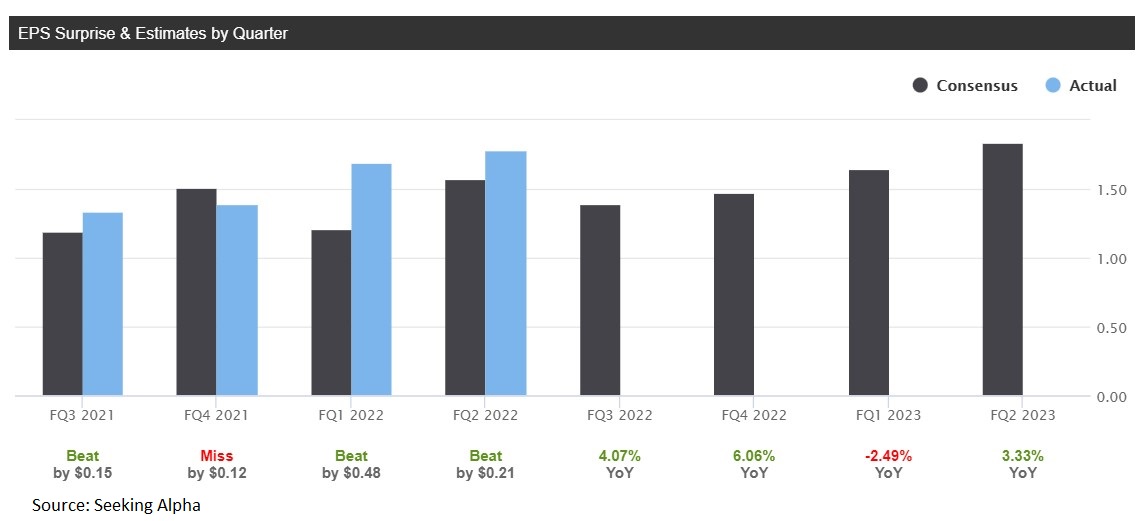

Walmart is another company reporting its quarterly earnings this week. This time, the market expects higher EPS when compared to the same period of last year by only 4.07%. The annual revenue estimates for the fiscal period ending January 2022 are $560.62 billion while for the fiscal period ending January 2023 are $576.12 billion.

Walmart’s stock price is flat this year, as it consolidated most of the time. The company operates with a gross profit margin of 25.10%, smaller than the sector median of 10.04%.

(Click on image to enlarge)

Home Depot (HD)

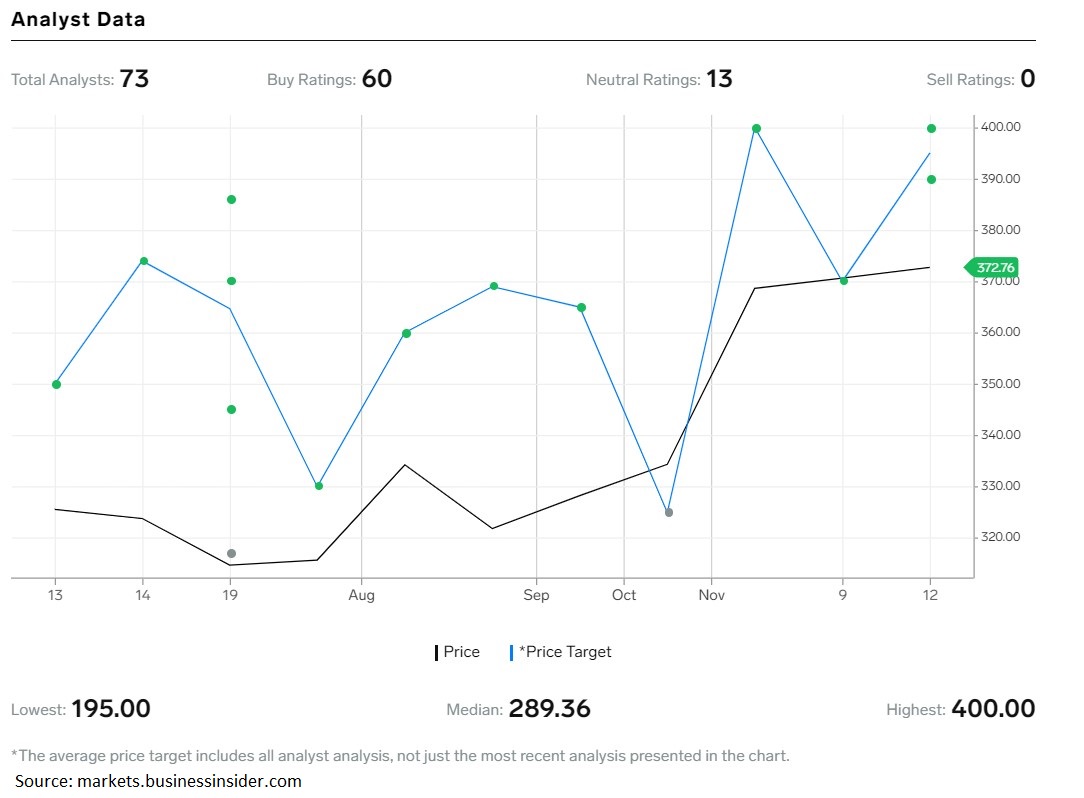

Home Depot reports its quarterly earnings tomorrow in pre-market hours and investors expect EPS of $3.38, higher than the same quarter last year by a little over 6%.

Analysts are bullish on Home Depot's stock price. Out of the 73 analysts covering the stock price, 60 have issued buy ratings and 13 have issued neutral ratings. No analyst has issued sell ratings.

(Click on image to enlarge)

Most recently, Raymond James Financial has maintained its buy rating with a price target of $400 for the stock price, while Wells Fargo did the same, with an identical price target. The share price trades at a P/E ratio of 23.85 in 2021, expected to decline to 16.05 by 2026.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more