Berkshire Overtakes Apple In Record Cash Holdings Despite Unexpected Profit Drop

There is a new cash king in town.

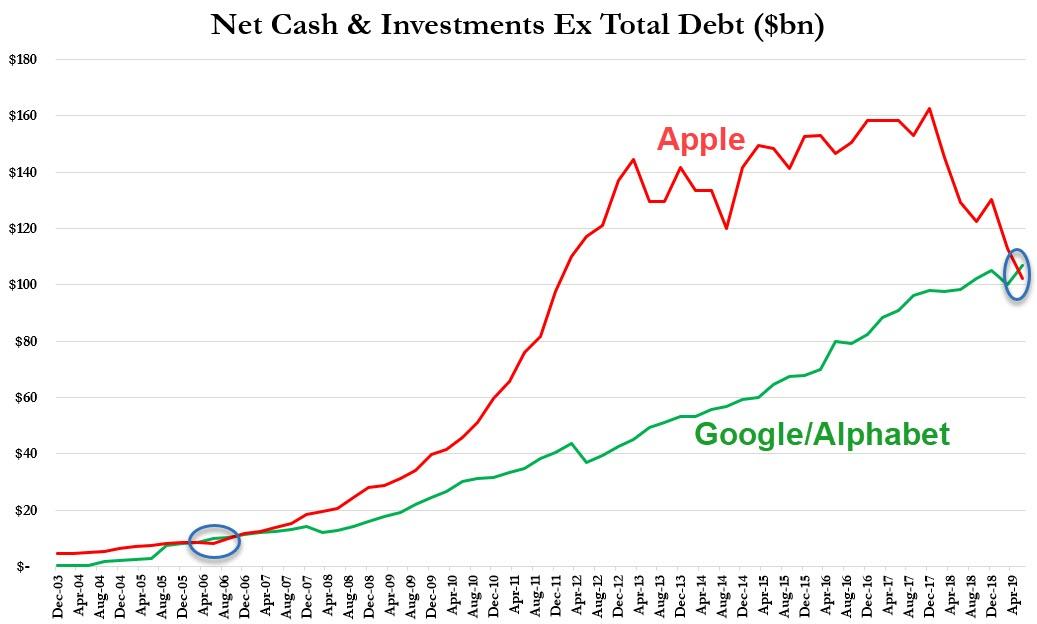

Just a few days after we reported that Apple's once gargantuan cash hoard (net of debt) has tumbled from a record high of $163 billion at the end of 2017 to just $102 billion at Q2, after aggressively funding tens of billions in buybacks and dividends, so much so that in the second quarter Google's net cash of $107 billion surpassed AAPL for the first time ever.

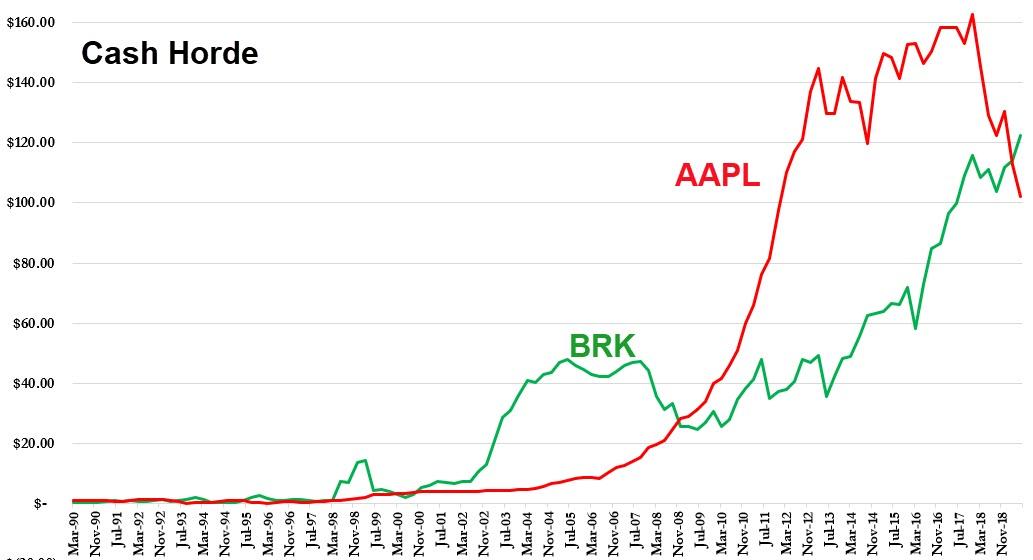

It is now Berkshire's turn to also upstage the former cash giant, with Buffett's sprawling conglomerate reporting a record $122.4 billion in cash at the end of the second quarter, rising above its prior cash record of $116 billion in 2017, reflecting Buffett’s nearly 4-year drought in finding major acquisition opportunities since buying Precision Castparts. As Bloomberg notes, Buffett has been struggling to find enough well-priced opportunities to keep up the growth that allowed him to beat broader markets for decades.

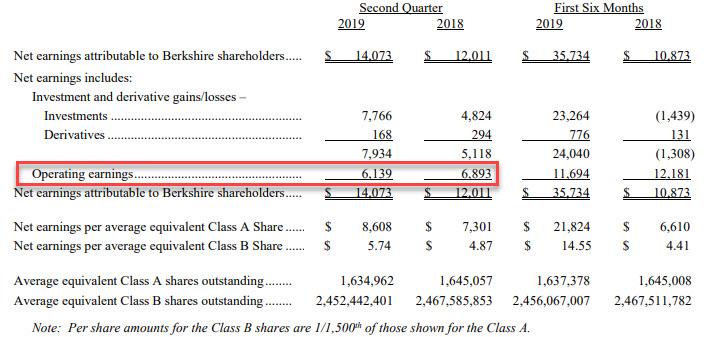

And speaking of Berkshire's lack of growth which has resulted in its Class B stock declining 0.7% this year , significantly underperforming the market and 10% below their peak last October,it was on full display in the just completed second quarter, in which Berkshire's operating profit fell more than expected, declining 11% to $6.14 billion, or roughly $3,757 per Class A share, from $6.89 billion, or roughly $4,190 per Class A share, a year earlier. Analysts were expecting an operating profit of $3,851.28 per share.

Operating earnings declined as Berkshire’s auto insurer Geico suffered a larger number of accident claims, while competition from foreign producers, lower imports and “trade policy” dampened cargo volumes for consumer and agricultural products at its BNSF railroad, Reuters noted. Earnings also barely budged at Berkshire’s manufacturing businesses, where U.S. tariffs hurt sales of gas turbine and pipe products at its Precision Castparts unit, and its service and retailing businesses.

Some more details:

- Buffett’s railroad generated a modest profit in the quarter, bolstered by shipments of industrial products. BNSF’s profit rose 2% to $1.34 billion, while revenue was essentially unchanged. Profit was also flat in Berkshire’s manufacturing, services and retailing businesses, totaling $2.49 billion. That could help bat down concerns about its ability to weather a slowdown in the sector.

- On the flip side, underwriting income at Berkshire’s insurers fell by almost 63% to $353 million. The life and health business at Berkshire’s namesake reinsurance group changed a contract with a major U.S. reinsurer, which reduced the earned premiums it raked in. Geico’s pre-tax underwriting gain fell 42%, as a higher ratio of loss claims to premiums earned more than offset growth in policies written, while expenses rose, partly due to advertising and employee costs. Underwriting at Berkshire’s reinsurance, property/casualty and commercial insurance units also weakened, reflecting higher claims payouts, changes in the expected timing of future payouts, and currency fluctuations, among other factors.

- While Berkshire said more people flew NetJets corporate jets - indicating that the 0.1% are doing just great - "soft consumer demand" weighed on sales at home furnishings businesses, indicating that the less than 0.1% are not doing just great. Berkshire Hathaway Energy saw profit rise 4%.

- Meanwhile, as Bloomberg notes, Kraft Heinz was once again missing from Berkshire’s results. Kraft Heinz, which is set to report results on Aug. 8, appointed a new CEO and finally issued its delayed 10-K filing in June as it worked to clean up from a $15.4 billion writedown. The restatements in June caused a $34 million hit for Berkshire, it said Saturday.

It wasn't all bad news: Berkshire said quarterly net income rose 17% to $14.07 billion, or $8,608 per Class A share, from $12.01 billion, or $7,301 per Class A share, a year earlier, however that increase was entirely due to the rise in the stock market i.e., the higher unrealized gains on Berkshire’s investments. The company reported a whopping $7.9 billion in investment gains, up 55% from a year earlier. In other words, more than half, or 55%, of Berkshire's net earnings came from the ongoing levitation in the S&P, which came with an abrupt halt in the past week (as a reminder, a recent accounting rule forced Berkshire to report such gains with earnings. That rule adds volatility to Berkshire’s net results, and Buffett says it can mislead investors, although when the market is rising - as it did in Q2 - nobody complains).

Meanwhile, in lieu of pursuing full-blown acquisitions in companies with "sky high valuations", Berkshire has had to make do with equity purchases in public companies: he has built a $50.5 billion stake in Apple and controversially committed $10 billion in April to help Occidental buy rival Anardako. However, even when it comes to what upside is left in stocks Buffett appears to be having second thoughts as he was a net seller of stocks in the quarter. Nowhere was the billionaire's market skepticism more visible than in the company's buybacks of its own stock: Berkshire repurchased only $400 million in shares, down sharply from $1.7 billion in the first three months of the year.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more