Bears Back Off

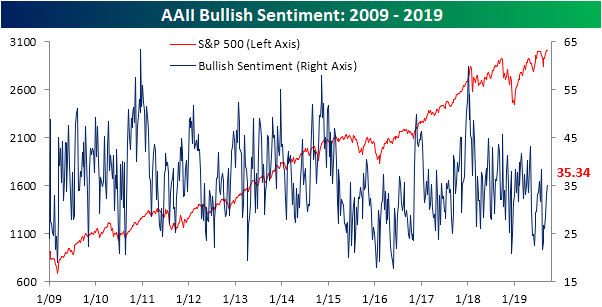

As the S&P 500 has come within half a percent of its all-time highs today, sentiment has continued to lean more positive. AAII’s weekly investor sentiment survey for the past week showed 35.34% of respondents reporting as bullish. That is up from 33.13% last week and is the third straight week with an increase. Despite these consistent increases in the past month, bullish sentiment is still below its historical average of 38.11% as it has been for the past seven and 18 of the last 19 weeks. If the S&P 500 manages to take out previous highs, it would be reasonable to expect bullish sentiment to make a larger move higher.

(Click on image to enlarge)

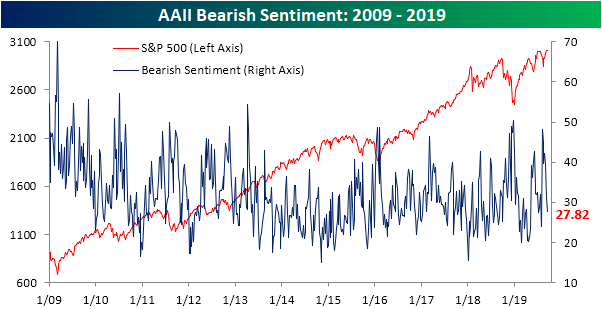

The biggest move in sentiment this week was actually in bearish sentiment. In the past month, bearish sentiment has fallen considerably. In fact, the 14.39 percentage point drop over the past four weeks is the largest such move since January 10th when negative sentiment was working off even higher levels in the wake of the Q4 2018 downturn. Now at 27.82%, bearish sentiment is back below its historical average for the first time since August 1st.

(Click on image to enlarge)

Still, the largest percentage of investors don’t know what to make of the market as neutral sentiment checked in at 36.84% which represents a 1.2 percentage point increase from the prior week. Granted, relative to its historical average, neutral sentiment is still elevated as it has been for most of this year. In fact, 32 of the 37 total weeks so far this year have seen above-average neutral sentiment readings.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much ...

more