Bear Of The Day: Starbucks Corp.

Starbucks (SBUX - Free Report) operates as a roaster, marketer, and retailer of specialty coffee worldwide. The company offers roasted whole beans, coffee and tea beverages, single-serve products, and various food items such as pastries and breakfast sandwiches.

SBUX provides its services under the Teavana, Seattle’s Best Coffee, Evolution Fresh, Ethos, Princi, and Starbucks brands. The coffee retailer operates approximately 16,830 company-operated and licensed stores in North America, as well as over 17,000 stores internationally. Starbucks was founded in 1971 and is based in Seattle, WA.

The Zacks Rundown

SBUX is a Zacks Rank #5 (Strong Sell) stock and has been severely underperforming the market this year. Shares topped out in July of last year and have been in a price downtrend ever since. The stock has been hitting a series of 52-week lows and represents a compelling short opportunity as the market continues its volatile start to the year.

Starbucks is part of the Zacks Retail – Restaurants industry, which currently ranks in the bottom 17% out of approximately 250 industries. Because this industry is ranked in the bottom half of all Zacks Ranked Industries, we expect it to underperform the market over the next 3 to 6 months. Candidates in the bottom half of industry groups can often represent solid potential short candidates.

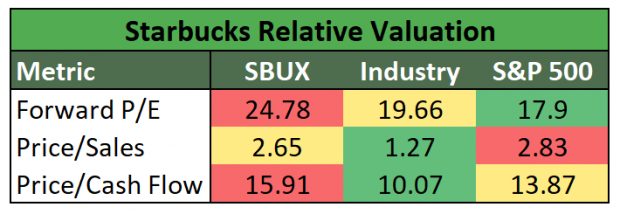

While individual stocks have the ability to outperform even when included in poor-performing industries, their industry performance provides a headwind to any rally attempts. Also note this industry group is relatively overvalued:

Image Source: Zacks Investment Research

Recent Earnings Misses and Deteriorating Outlook

After a long period of consistently beating earnings estimates, SBUX has missed the mark in each of the past two quarters. The company most recently reported fiscal Q2 earnings earlier this month of $0.59 per share, slightly missing the $0.60 consensus estimate by -1.67%.

In its fiscal first quarter, SBUX reported EPS of $0.72/share, equating to a -10% earnings miss. This trend of falling short of estimates may spell continued trouble for SBUX investors.

Another warning sign is the fact that future earnings estimates have been on the decline. Analysts have slashed fiscal Q3 earnings estimates by -22% from 60 days ago. The Zacks Consensus Estimate now sits at $0.78, reflecting -22.77% negative growth relative to the same quarter a year ago.

As we zoom out and view the year as a whole, analysts covering SBUX have also reduced their full-year EPS estimates by -12.84% in the past two months. This estimate is now $2.92/share, reflecting a -9.9% earnings regression relative to 2021. Declining earnings estimates are a good sign for the bears.

Let’s Get Technical

As we can see below, SBUX is in a sustained downtrend. Note how the stock has plunged below both the 50-day (blue line) and 200-day (red line) moving averages and is making a series of lower lows. It’s also important to point out that both of the moving averages have rolled over and are sloping downward, the opposite of what the bulls would like to see:

Image Source: StockCharts

Starbucks has continued its descent into the new year, with shares falling nearly -37%. Even with the recent price decline, the stock is still relatively overvalued which could continue to hurt performance in the short term:

Image Source: Zacks Investment Research

Final Thoughts

Our Zacks Style Scores illustrate a deteriorating investment picture for SBUX, as the company is rated a second-worst possible ‘D’ in our overall VGM score. Recent earnings misses and declining future estimates signal more trouble on the horizon. The fact that SBUX is included in a bottom-performing industry group simply adds to the growing list of concerns. Investors will want to steer clear of an overvalued SBUX until the situation shows major signs of improvement.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more