Bear Of The Day: Chewy, Inc.

E-commerce pet store standout Chewy, Inc. (CHWY - Free Report) has been hit hard by rising costs and supply chain setbacks. The company fell way short of Q4 earnings estimates in late March and provided rather dismal guidance that sent the stock tumbling.

The Chewy Story

Chewy operates a really straightforward digital commerce business. The company sells pet food, supplies, treats, medications, and more for a variety of animals and ships the products to the consumer. CHWY capitalized on massive e-commerce expansion over the past 10 years, as shoppers clamor for convenience.

Chewy’s strength is largely based on its ability to add loyal pet owners to its Autoship business allowing customers to have pet food, toys, and more delivered at regular intervals. Chewy also expanded into telehealth and virtual vet visits. All of these efforts, coupled with the pandemic, helped its 2020 revenue climb 47% to $7.15 billion.

Chewy followed that up with another 24% sales growth in 2021. The company also added 1.5 million new active customers last year to close the period with 20.7 million, up 8% YoY. Unfortunately, Chewy’s fourth-quarter active adds came in softer than expected and its revenue growth slowed to 17%.

The company reported a net loss of $63.6 million in the fourth quarter, as its costs, including labor, freight, and beyond all soared. Analysts raced to lower their earnings estimates for 2022 and 2023 after its March 29 financial release, with Chewy’s near-term headwinds not set to die down anytime soon.

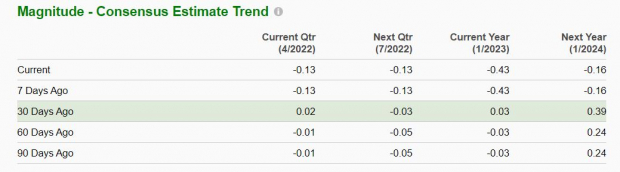

Image Source: Zacks Investment Research

Bottom Line

The nearby chart showcases that Chewy’s consensus adjusted FY22 EPS estimate dropped from +$0.03 per share before its fourth quarter release to a loss of -$0.43 a share right now. CHWY’s FY23 consensus also slipped all from +$0.39 to -$0.16 per share. These rough bottom-line revisions help Chewy land a Zacks Rank #5 (Strong Sell) at the moment.

Chewy’s revenue is still projected to grow another 16% both this year and next to hit $12 billion in 2023. The company’s actives users and Autoship customers continue to drive sales, and CHWY might succeed over the long haul.

However, CHWY stock has tumbled 45% since the start of November and investors are likely wise to stay away from Chewy amid the current market and economic conditions. And its Consumer Products – Staples space currently sits in the bottom 6% of over 250 Zacks industries.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more