Bear Market Rally Or Resumption Of ’09 Advance? Watch Volatility.

In our previous May 7th Stock Market Update & Asbury Investment Management Video, we said the benchmark S&P 500 (SPX) was at a major inflection point, but that our Asbury 6 tactical model was still on an April 6th Positive bias. You can learn more about the Asbury 6 by here.

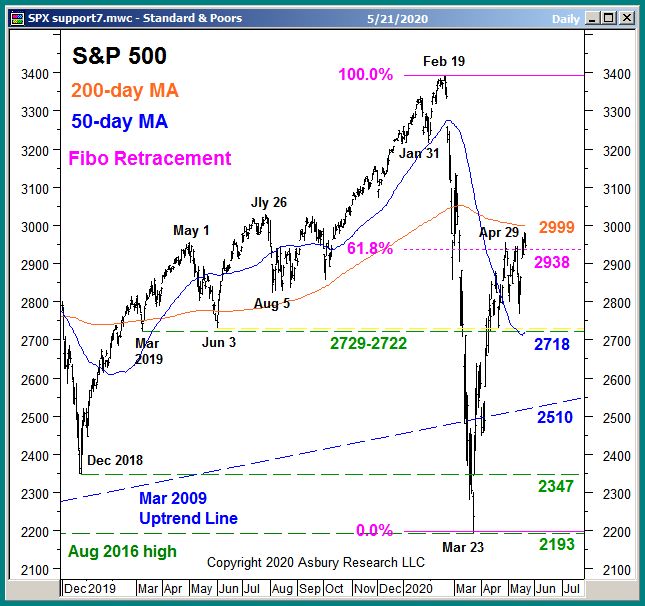

SPX has since risen by an additional 99 points or 3.4%, but Chart 1 below shows the US broad market index is situated just below major overhead resistance at 2938 to 2999. This overhead resistance represents the 61.8% retracement of SPX’s February decline and the 200-day moving average, the latter a widely-watched major trend proxy. This is where the larger February decline should resume if it’s still intact.

Chart 1

So, even though the Asbury 6 remains Positive, the danger for investors is putting a significant amount of new money to work right below this major resistance area — right before the February decline resumes. And now you’re spending the next two months trying to work your way out of a poor execution.

In addition to the Asbury 6, another metric we are closely watching for an indication that the February decline may be resuming is the CBOE Volatility Index, more commonly known as the VIX or the Fear Gauge. The blue line in the lower panel of Chart 2 plots the VIX daily since February along with its 21-day moving average, the latter which we use to define its monthly (our Tactical time period) trend.

(Click on image to enlarge)

Chart 2

The green highlights on the right side of the chart show that the VIX has been below its 21-day MA since March 31st and that this has closely coincided with the current late March rally in the S&P 500. The red highlights on the left side show that, previously, a sustained rise in the VIX above its 21-day MA between Feb 19th and Mar 30th closely coincided with the 35% collapse in the S&P 500.

As long as the VIX remains below its 21-day MA, it will indicate that investors are complacent enough to keep the current US broad market rally alive. A move about the moving average, however, will indicate investors are becoming more fearful and will warn that market’s larger February decline is resuming.

Disclosure: None.