Battle Of The Dow 30 Pharmas — PFE Vs. MRK

Pfizer (PFE) and Merck (MRK) have been the two pure pharmaceutical plays in the Dow Jones Industrial Average since PFE was added to the index in April 2004 (MRK was added in 1979). Over the years, these two Health Care behemoths have trended mostly inline with each other, as the correlation between their daily prices going back to 1980 is 0.96. Every now and then, however, the two diverge as has been the case recently.

Below is a price chart of Pfizer (PFE) since 1980 with special focus on the last five years. As you can see, the stock trended higher from 2014 through late 2018, but this year it has struggled, especially recently as the company lowered guidance at the end of July and announced a deal to combine its Upjohn business with Mylan (MYL). To many analysts in the sector, the terms of the deal with MYL seemed to be expensive for PFE. As of today, PFE is down 20% year-to-date.

(Click on image to enlarge)

Merck (MRK), on the other hand, has had a great 2019 (up 12% YTD) and is finally approaching its all-time closing high of $89.80 reached on November 29th, 2000.

(Click on image to enlarge)

Below is a chart showing the ratio between PFE’s share price and MRK’s share price since 2000. (Both of these stocks last split in 1999.)When the line is rising, PFE’s share price is outperforming MRK’s share price and vice versa. You can see that since 2008, the ratio has traded back and forth between 0.4 and 0.7. PFE’s recent underperformance has left the ratio at the very bottom of the range over the last 10+ years.

(Click on image to enlarge)

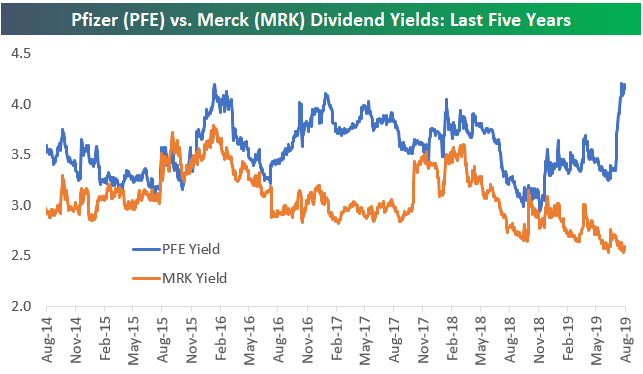

Both of these blue-chip pharmas are big dividend stocks, but along with price their dividend yields have started moving in opposite directions. PFE last upped its dividend in December 2018 right as its stock price was peaking. With its share price down 20% YTD, PFE’s dividend yield has shot up to 4.16%. Merck (MRK) last hiked its dividend in July 2018, and while that caused its yield to move above 3% for a short period of time, the rise in its share price has left it with a yield of just 2.57% at the moment.

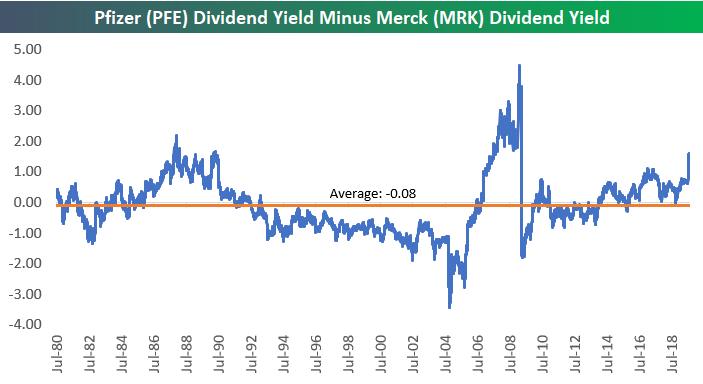

Since 1980, the average spread between PFE’s dividend yield and MRK’s dividend yield has been extremely close at just -0.08 percentage points. As shown below, the current spread of 1.59 ppts is as high as it has been in more than ten years.

Start a two-week free trial to Bespoke Premium for more of Bespoke’s actionable equity market ...

more