Banks: Where Good News Is Bad

Earnings season is now in full swing, and we’ve already seen reports from seven of the largest and most significant banks and brokerage firms. While the results have been positive, investors have been reacting with a "sell the news" attitude.

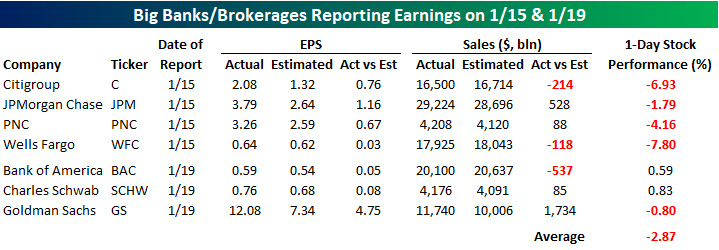

As shown in the table below, all seven of the major banks and brokerage firms reporting so far have topped EPS forecasts. Revenues, on the other hand, haven’t been as positive relative to expectations, with four beats and three misses.

Where the real weakness has been, however, is in stock price reactions. Of the seven names reporting, five have either had, or are on pace to have, a negative one-day reaction to their earnings report, while just two – Bank of America (BAC) and Charles Schwab (SCHW) – are just marginally higher today in reaction to their reports.

While these two stocks are higher, we would note that BAC was down 3% in sympathy with the other banks on Friday, Jan. 15, so the only one of the seven listed that is at the same levels or higher now than it was at last Thursday’s close is SCHW.

With the seven stocks listed below are all beating EPS expectations yet averaging a decline of close to 3% in reaction to their earnings reports, we wondered how common it is for EPS relative to expectations to come in so strong in an earnings season while having the stocks react so poorly. Using our Earnings Database and running some filters, we found only five other quarters in the last ten years where all seven stocks reported better than expected EPS.

Interestingly enough, of those five periods, the average one-day reaction of the seven stocks in that earnings season was negative four times. The only earnings season where the seven stocks averaged a gain on their earnings reaction day was the Q4 2018 reporting period in January 2019.

The worst reaction of these seven stocks in an earnings season when they all topped EPS forecasts was last earnings season in October, when they averaged a decline of 2.95% with five of the seven names declining. It was only three months ago, but already last October seems like so long ago.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more