Banks Provide Mixed Start To Q4 Earnings Season

Image: Bigstock

JPMorgan (JPM - Free Report) and Citigroup (C - Free Report) shares lost ground as they kick-started the Q4 earnings season for the banks. JPMorgan beat EPS estimates but missed on revenues that were up +1.7% from the same period last year. Citi also missed top-line expectations, with 2021 Q4 revenues down -0.9% from the year-earlier period.

The tone and substance of management commentary about the current and coming periods was cautious, with JPMorgan, in particular, warning about “…a couple of years of sub-target returns.” A notable disappointment for the market was the outlook for costs at JPMorgan, which are expected to reach $77 billion in 2022 up from $71 billion in 2021.

The capital markets business remained red hot, though activity levels in Q4 were below the record levels of the preceding quarters. Trading revenues were down -11% at JPMorgan and -17% at Citigroup, mostly on weakness in fixed income trading.

On the positive side, the outlook for loan demand has been steadily improving, with consumers starting to rely more on credit to sustain spending. The loan portfolio increased +6% at JPMorgan and +3% at Wells Fargo, with the same at Citigroup only modestly above the year-earlier level.

This is a favorable setup for the regional banks that will be reporting December-quarter results in the coming days. And with the outlook for interest rates improving given expectations of multiple Fed rate hikes in 2022, this core banking activity promises to become a lot more profitable than has been the case in recent years.

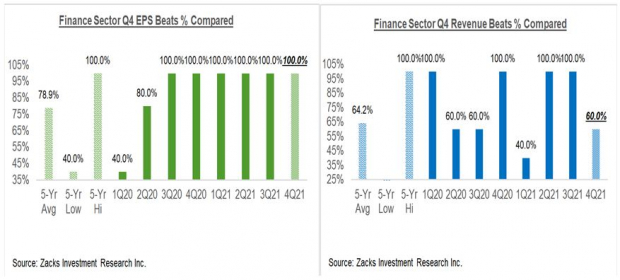

With respect to the sector’s Q4 earnings season scorecard, we now have results from 17.6% of the sector’s market capitalization in the S&P 500 index. Total earnings for these Finance sector companies are up +3.6% from the same period last year on +1.8% higher revenues, with all the companies beating EPS estimates (100% EPS beats percentage) and 60% beating revenue estimates.

This is a weaker showing than we have seen from this group of banks in other recent periods, as you can see in the comparison charts below that show how Q4 EPS and revenue beats percentages stack up to other recent periods.

Image Source: Zacks Investment Research

Next week will bring results from Bank of America BAC, Goldman Sachs GS, Morgan Stanley MS, and all the regional banks. Trends in loan portfolios and the outlook for costs will likely determine how the market responds to those results.

The Overall Earnings Picture

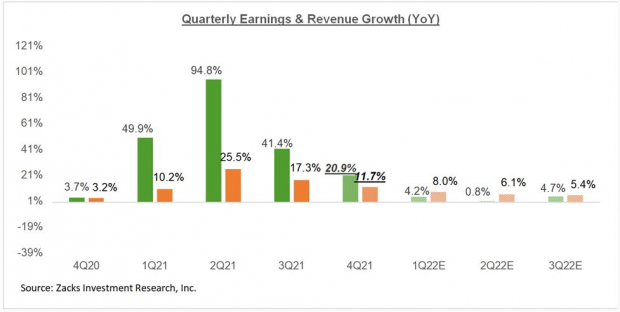

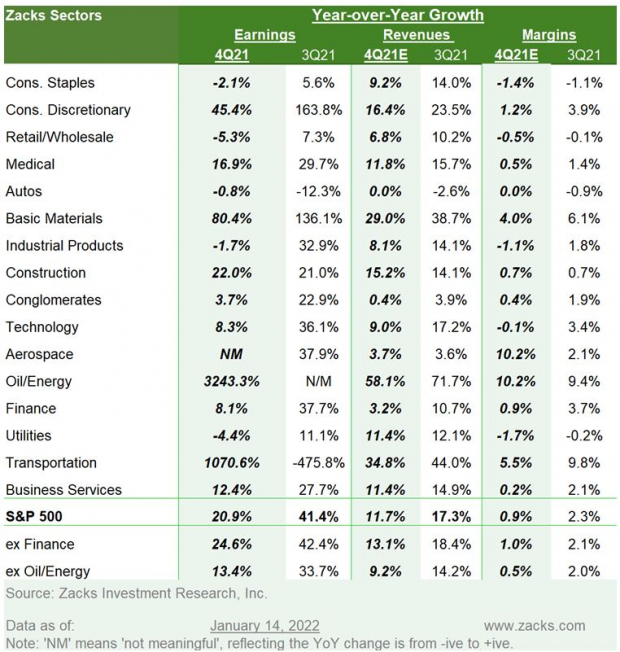

Beyond the Finance sector, the expectation is for Q4 earnings for the S&P 500 index to be up +20.9% from the same period last year on +11.7% higher revenues. This would follow +41.4% earnings growth on +17.3% revenue growth in 2021 Q3.

The chart below takes a big-picture view of S&P 500 quarterly expectations, with earnings and revenue growth expectations for the next three quarters contrasted with actuals for the preceding four periods; expectations for 2021 Q4 have been highlighted.

Image Source: Zacks Investment Research

As you can see in the above chart, the growth pace is expected to decelerate meaningfully over the coming quarters, but still remain positive.

The chart below provides a big-picture view on an annual basis.

Image Source: Zacks Investment Research

Q4 Earnings Season Gets Underway

Friday’s results from JPMorgan, Citi, and others (unofficially) kick-started the Q4 earnings season. But from our perspective, the reporting cycle was well underway before these banks' results arrived. Including the three major banks that reported Friday morning, we now have 26 S&P 500 members.

We have more than 90 companies on deck to report results this week, including 37 S&P 500 members. The Finance sector dominates this week’s reporting docket, with Netflix and few airlines and railroad operators as the other major reports this week.

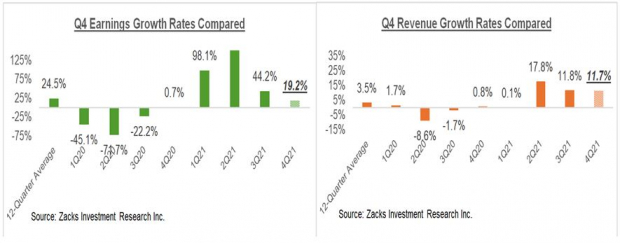

For the 26 index members that have reported already, total Q4 earnings or aggregate net income is up +19.2% from the same period last year on +11.7% higher revenues, with 88.5% of the companies beating EPS estimates and 84.6% beating revenue estimates.

This is too small a sample to draw any firm conclusions from. That said, the comparison charts below put the earnings and revenue growth rates for these 26 companies in a historical context.

Image Source: Zacks Investment Research

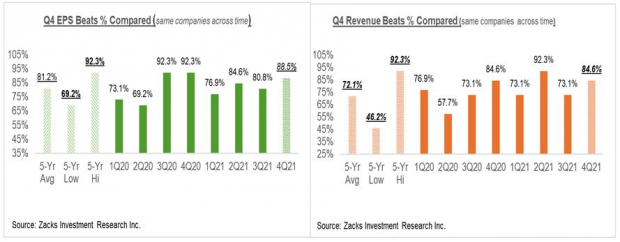

The comparison charts below put the Q4 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

The summary table below shows Q4 expectations in the context of what we saw in the preceding period.

Image Source: Zacks Investment Research

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more