Bank Of America Slashes Expenses As Trading Revenues Slump

BofA joined the bank earnings procession this morning, when it reported Q1 results, that similar to Goldman, beat on the bottom line but missed on the top line as trading revenues shrank, however, this was more than offset by an even greater drop in expenses.

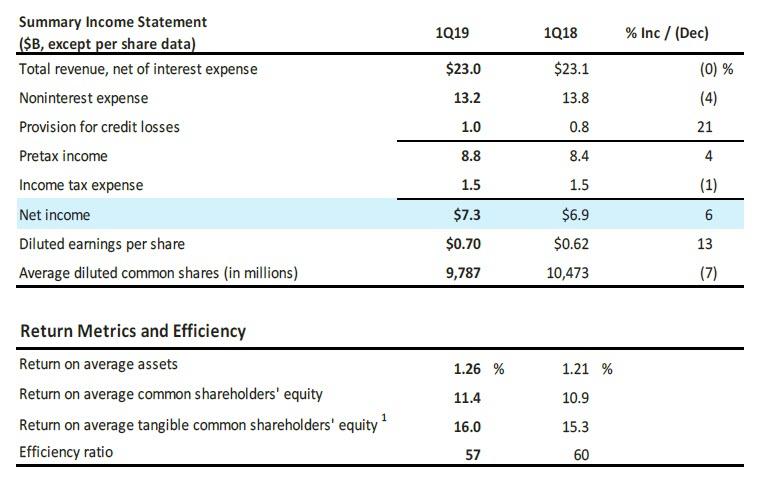

Specifically, BofA reported adjusted EPS of $0.71, slightly above the $0.66 expected, up 6% Y/Y even as revenues dropped from a year ago, shrinking modestly from $23.1BN to $23.0BN, and missing expectations of a $23.3BN print.

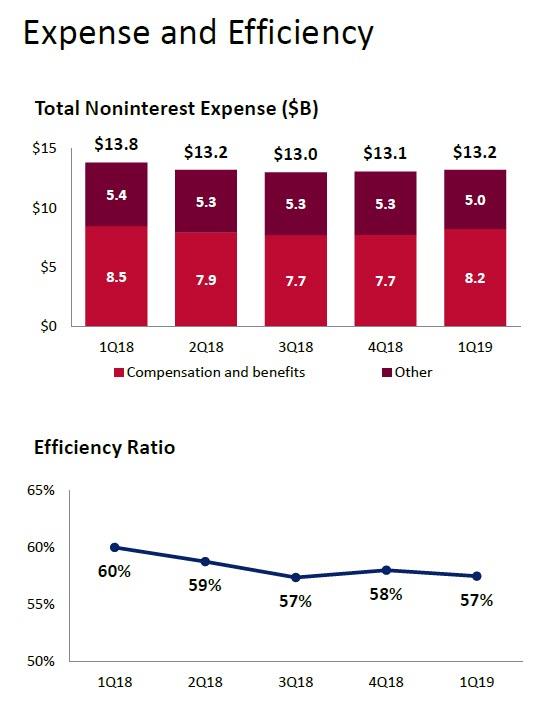

Despite the bank's top-line decline, it managed to post another quarter of record profits, which in Q1 rose 6% to $7.3BN (from $6.9BN), thanks to a 4% drop in non-interest expense, as "efficiency savings, lower FDIC insurance costs and lower amortization of intangibles were partially offset by investments." That said, expense increased sequentially by $0.2B from 4Q18, as

"seasonally elevated payroll tax costs of $0.4B were partially offset by timing of marketing and technology initiative spend as well as lower deferred compensation expense."

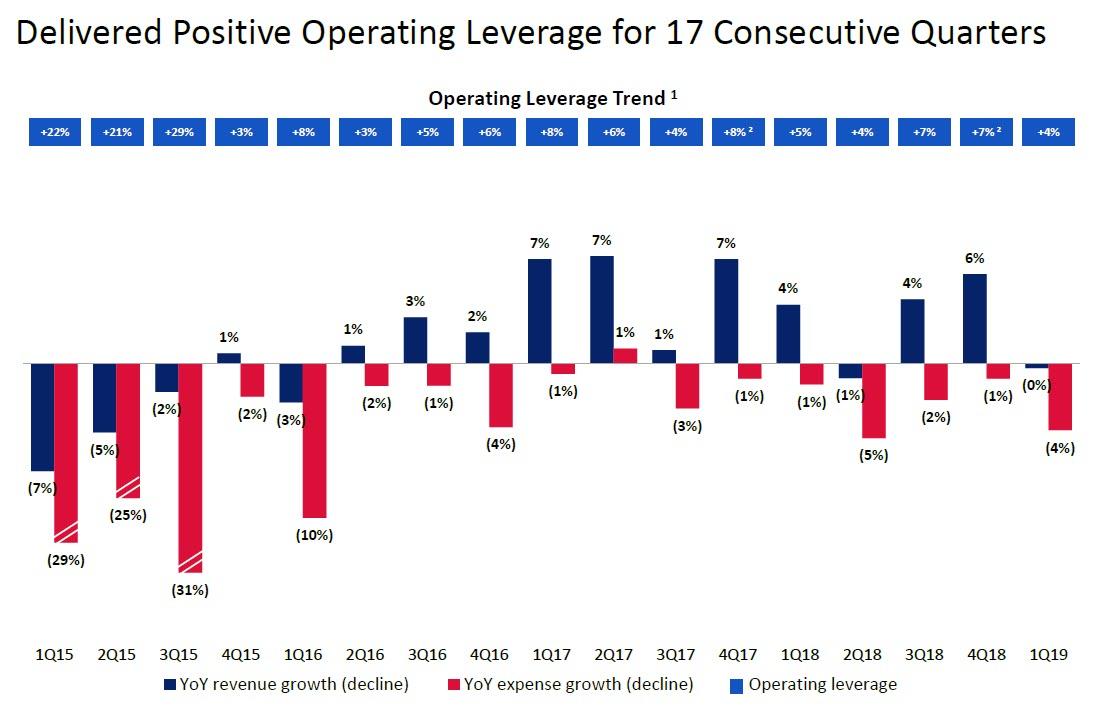

The modest decline in revenue coupled with the 4% drop in expenses resulted in the 17th consecutive quarter of positive operating leverage as BofA continues to grow expenses less than revenues.

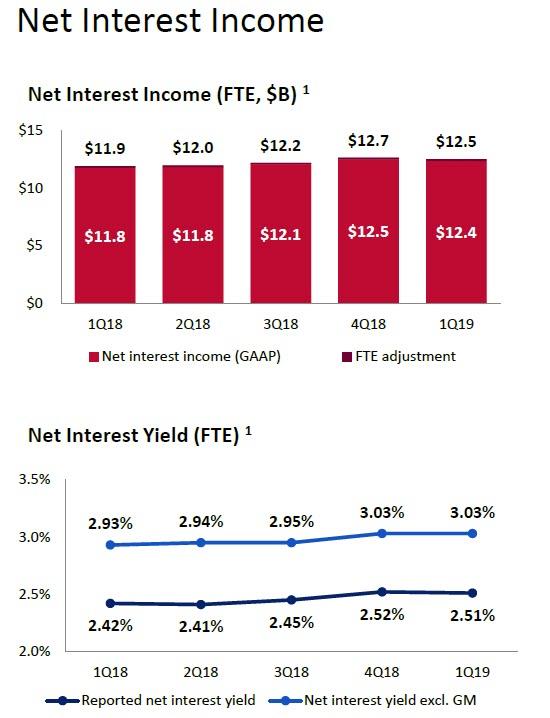

While the decline in expenses was welcome, the decline in revenues was more troubling, as Net Interest Income posting a $0.2BN drop sequentially in Q1, if a $0.6BN increase Y/Y, or 5%, "reflecting the benefits from higher interest rates as well as loan and deposit growth, modestly offset by loan spread compression." After rising for two quarters, Net Interest Margin decline modestly from 2.52% to 2.51% (if better than the 2.48% expected), which however was 9bps higher than a year ago. Excluding Global Markets, the net interest yield was 3.03%,

up 10 bps from 1Q18.

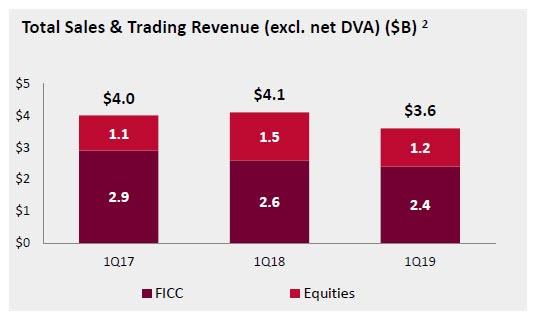

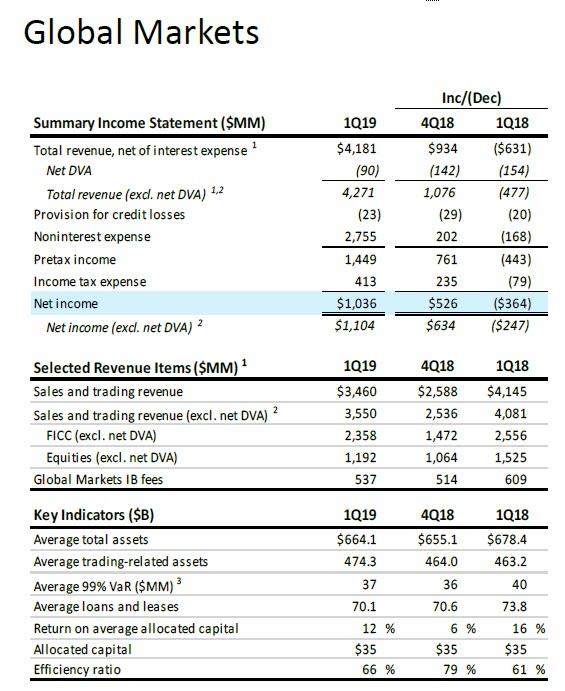

But while interest income tends to be boring, if stable, investors were largely focused on the bank's Markets division, where the same decline observed in other banks was also evident. Indeed, Q1 Sales and Trading revenue of $3.5BN slumped 17% from 4.1BN a year ago, as a result of weakness across the board, as FICC revenue of $2.4B decreased 8% from 1Q18, "primarily due to lower client activity across most businesses." At the same time, equities revenue of $1.2B decreased 22% from a record 1Q18 as "the year-ago quarter benefited from higher client volumes and a strong performance in derivatives on elevated market volatility." In other words, the central banks' intervention to crush volatility continues to adversely impact bank top and bottom lines.

Yet despite the sharp Y/Y declines in various segments, the results were still modestly better than Wall Street's reduced expectations, as follows:

- Total trading revenue excluding DVA $3.55 billion, above the estimate $3.49 billion

- FICC trading revenue excluding DVA $2.36 billion, above the estimate $2.27 billion

- Investment banking revenue $1.3 billion, above the estimate $1.29 billion (BN)

- Wealth & investment management total revenue $4.82 trillion

The only disappointment was Equities trading revenue, which printed at $1.19 billion, missing the estimate of $1.21 billion.

Of note, and a testament to how little confidence trading desks have in the current market environment, BofA average VaR remained near record low at just $37MM in 1Q19, down from $40 a year ago, if slightly above the $36MM reported during the turbulent fourth quarter.

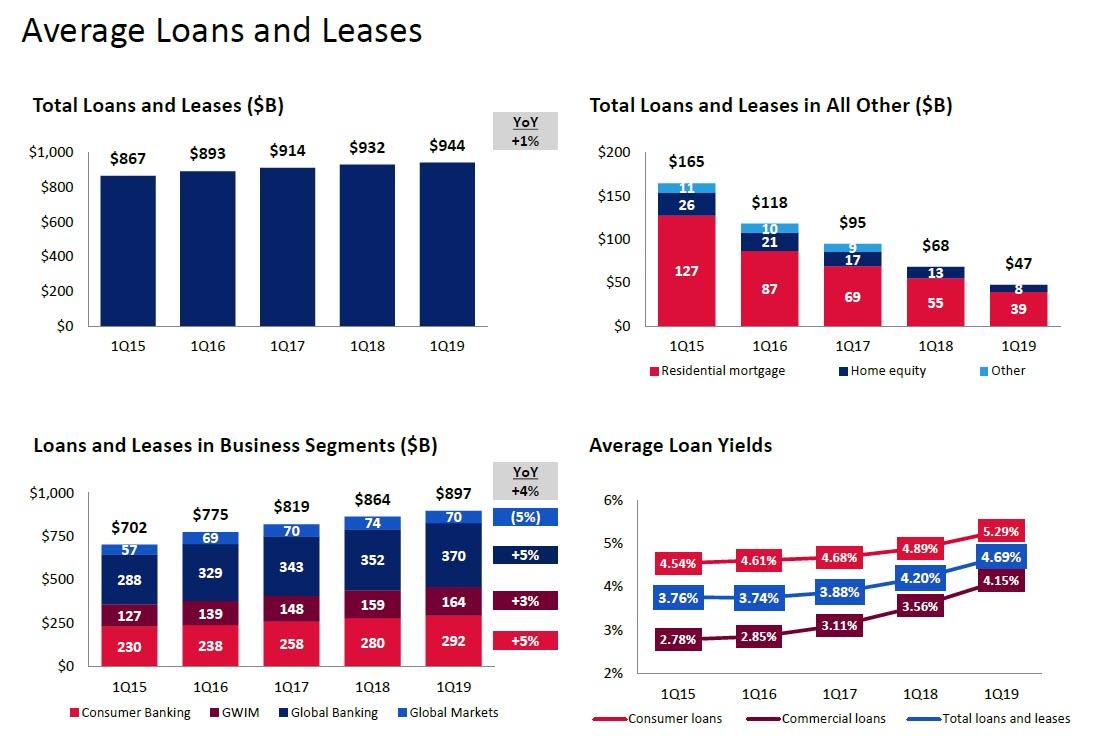

Moving away from the income statement, and taking a look at the Balance Sheet, there were no major surprises here, with subdued if stable loan growth of 1%...

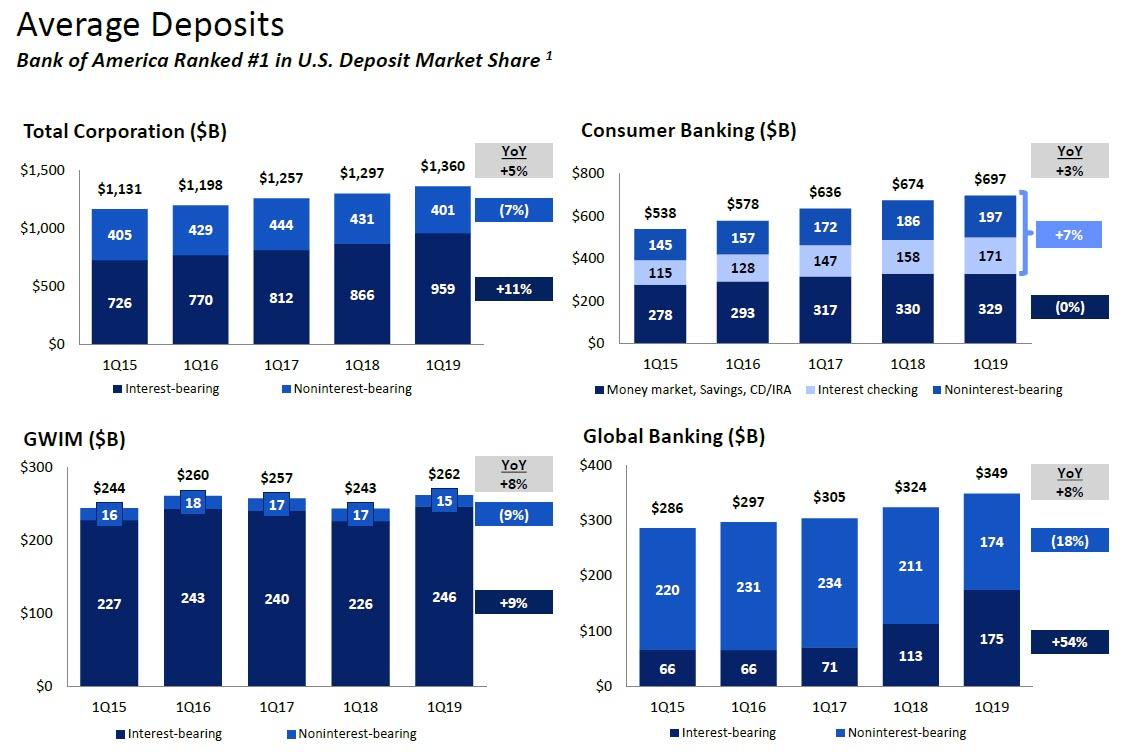

... which was matched by far stronger deposit growth of 5% Y/Y at the corporate level.

Also of note, BofA Wealth Management Assets Under Management (AUM) balance rose to $1.1Trillion with flows of $13B in 1Q19.

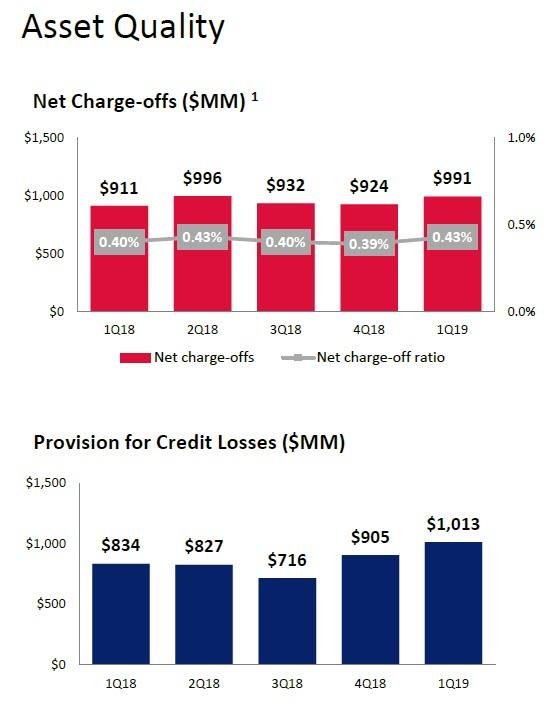

Finally, while there was some modest deterioration in the bank's asset equality, it was not really worth writing home as total net charge-offs of $1.0B increased $67MM from 4Q18 and $80MM from 1Q18, as consumer net charge-offs of $0.8B increased $31MM from 4Q18 driven primarily by credit card seasonality; stable from 1Q18. And just as Charge Offs hit a 1 year high, so did provisions for credit losses, which rose to $1.0B, an increase of $0.1B from 4Q18 – 1Q19, which included a small reserve build of $22MM.

In total, the allowance for loan and lease losses of $9.6B represented 1.02% of total loans and leases, even as Nonperforming loans (NPLs) of $4.9B decreased $0.1B from 4Q18, driven by improvements in Consumer; Finally, BofA boosted its reserves fractionally, as commercial reservable criticized utilized exposure of $11.8B increased $0.8B from 4Q18, but decreased $1.5B from 1Q18 and remains near historic lows.

Overall, BofA's results were in line with expectations, as shrinking revenues will likely prevent much upside to the stock today, however, the even faster drop in expenses should limit stock downside. And sure enough, the stock is trading mostly unchanged in the premarket.

Full BofA earnings presentation below (pdf link).