Bank Of America Revenue Tumbles, Trading Misses But Earnings Beat On Plunge In Loss Reserves

After yesterday's results from JPMorgan and Citi which initially surprised with the plunge in their Q3 loss provisions (which however the banks explained was not due to some optimism over the economy but merely due to previous overprovisions), today this trend continued when Bank of America reported Q3 results which were generally in line however boosted largely by another far lower than expected provision for loan losses.

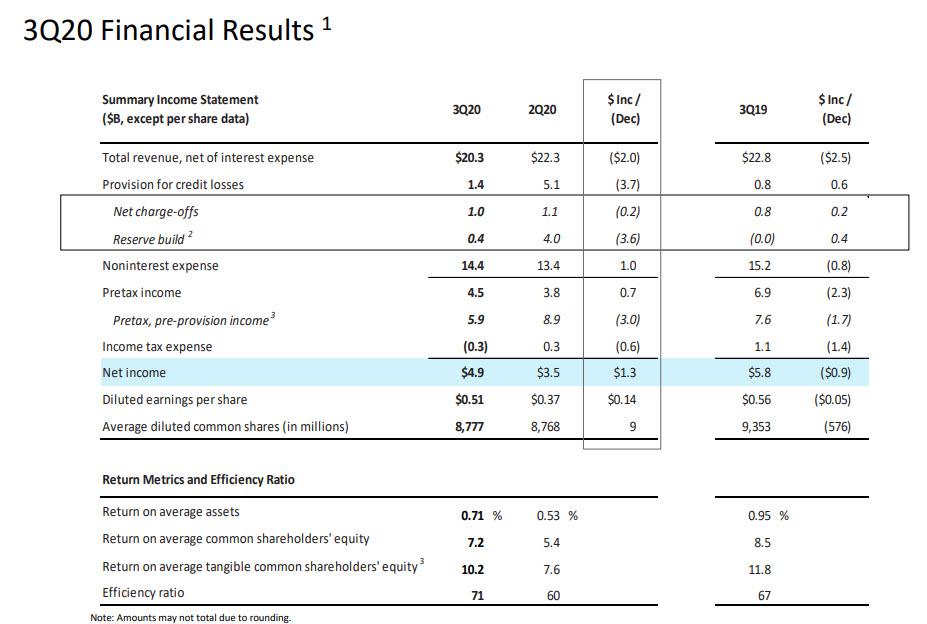

The bank reported that in Q3, revenues tumbled by 11% to $20.3BN, down from $22.8BN a year ago, pressured "by low-interest rates", and missing estimates of $20.8BN. This resulted in Net Income of $4.9BN and adjusted EPS of $0.51, also well below last year's $5.8BN and $0.56, respectively, but slightly better than the $4.3BN and EPS $0.49 expected.

According to the bank's presentation, these were the key revenue and net income highlights:

- Revenue of $20.3B declined 11%, driven by lower net interest income and noninterest income

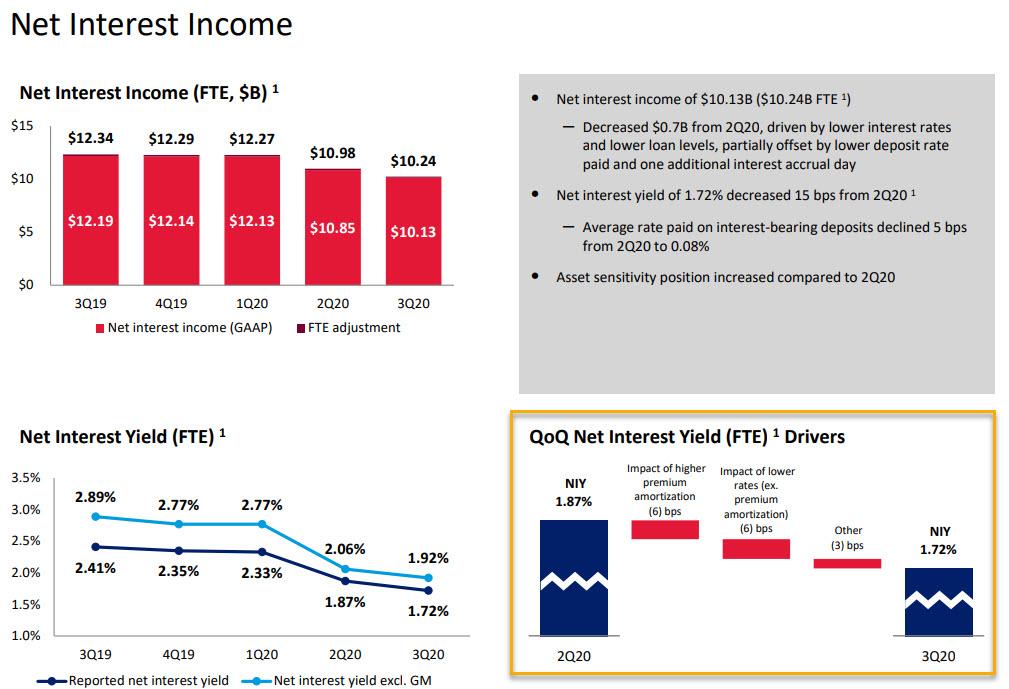

- Net interest income of $10.1B ($10.2B FTE 1), down 7% from Q2, driven primarily by lower interest rates as well as lower loan levels

- Sales and Trading revenue of $3.2B and Investment Banking fees of $1.8B declined from robust 2Q20 levels

- Noninterest expense of $14.4B increased $1.0B, or 7%, driven by elevated litigation expense, higher net COVID-19 expenses, and the addition of merchant services expenses

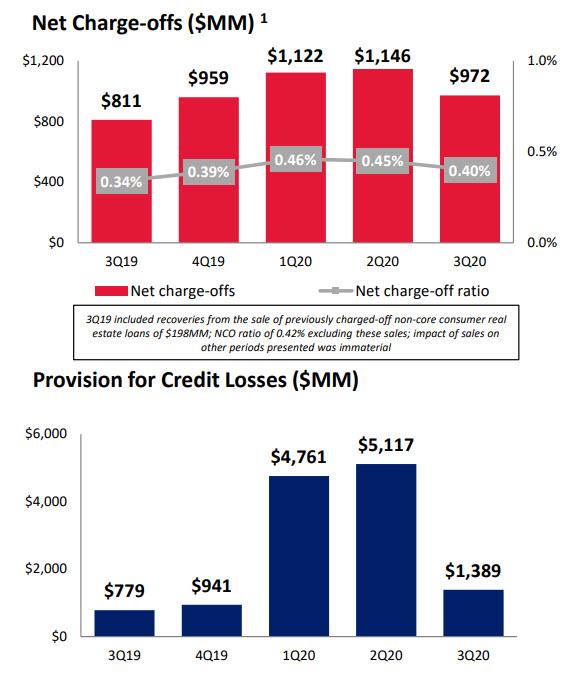

- Provision expense of $1.4B declined $3.7B

- Included a $0.4B net reserve build in an allowance for credit losses; Net charge-offs of $1.0B were down $0.2B

One of the things investors will focus on was BofA's warning up top that while consumer spending improved and deposit growth was strong (this is a function of QE now), loan demand weakened, a clear confirmation that the US economy remains very sick.

Notable on the revenue side was that net interest income plunged 17% in the third quarter to $10.1 billion, driven by the impact of lower interest rates. As a reminder, BofA has historically been one of the most sensitive to low rates due to the makeup of its balance sheet. Worse, BofA's net interest margin of 1.72% plunged decreased 15 bps from 2Q20. At least it didn't have to pay interest on deposits, as the average rate paid on interest-bearing deposits declined 5 bps from 2Q20 to 0.08%.

However, as noted above and just like yesterday, there was just one thing investors were looking at, and that's the bank's loan loss provisions. And in keeping with what appears to be the narrative on Wall Street, Bank of America toed the party line, as the loss provision plunged from $5.1BN to just $1.4BN, well below the $1.8BN consensus estimate, if still up 78% from a year ago. According to the bank, the provision expense of $1.4B decreased $3.7B from 2Q20 driven by a lower net reserve build, with Q3 including a net reserve build of $0.4B. The commercial reserve build of $0.7B for COVID-19 impacted industries such as travel and entertainment; At the same time, a consumer reserve release of $0.3B driven by improved economic outlook and lower card balances.

And while provisions tumbled, Net Charges off eased only slightly, dropping by $174MM to $972MM in Q3, as consumer net charge-offs of $564MM decreased $170MM "aided by the benefits of deferrals and government stimulus", while commercial net charge-offs of $408MM were flat to 2Q20.

The total allowance for loan and lease losses of $19.6B represented 2.07% of total loans and leases, a number which may prove far too low before this is all said and done. Nonperforming loans increased $0.2B from 2Q20 driven by consumer real estate due to expired deferrals.

And another notable observation: as BBG points out, BofA’s allowance for possible losses on consumer loans fell from Q2, from around $11 billion to $10.7 billion. The bank attributes this to “an improved macroeconomic environment and lower credit card balances." Meanwhile, the allowance on the commercial side increased from Q2.

* * *

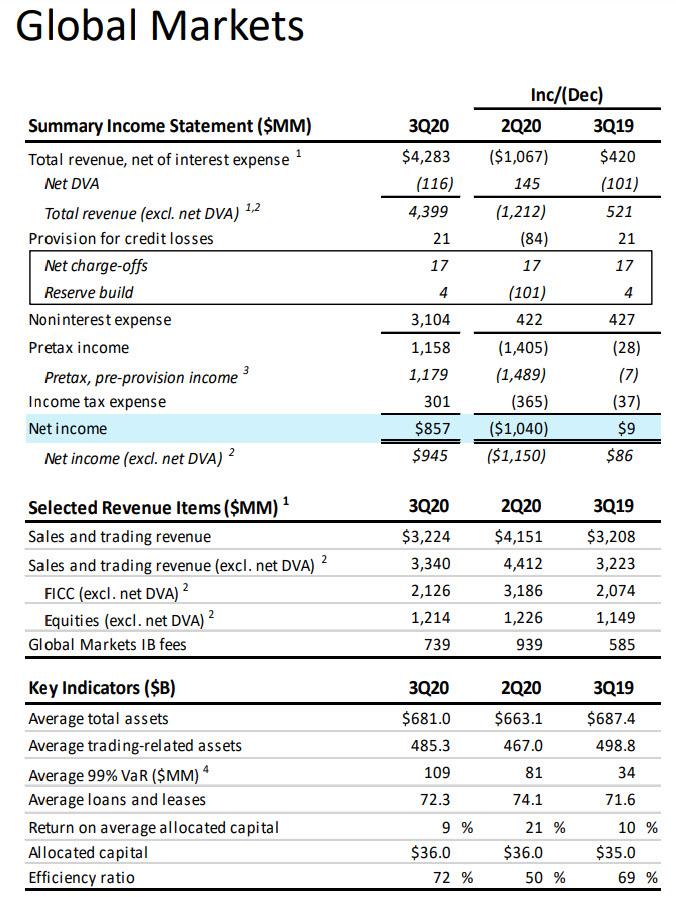

Away from the bank's accounting for covid, the next thing investors were focused on was results from Sales and Trading, and here there was more disappointment, as total Q3 trading revenue excluding DVA was $3.34 billion, up +3.8% y/y, but below the estimated $3.51 billion, consisting of:

- Equities Trading Rev. Ex-DVA $1.21B, Est. $1.22B, "driven by increased client activity in Asia"

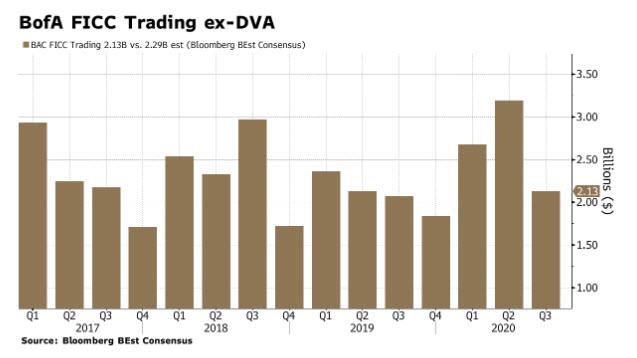

- FICC Trading Rev. Ex-DVA $2.13B, up 3%, Est. $2.29B, "driven by stronger performance in mortgage and foreign exchange products"

As shown below, FICC was a big disappointment in Q3, as all the Q2 momentum was gone and the FICC was virtually unchanged from last year.

Additionally, BofA investment bankers generated $1.8 billion, 14% more than last year, and more than analysts expected. ECM revenue of $664 million was a huge beat -- up 116% from last year.

Some more details on the markets mix and distribution:

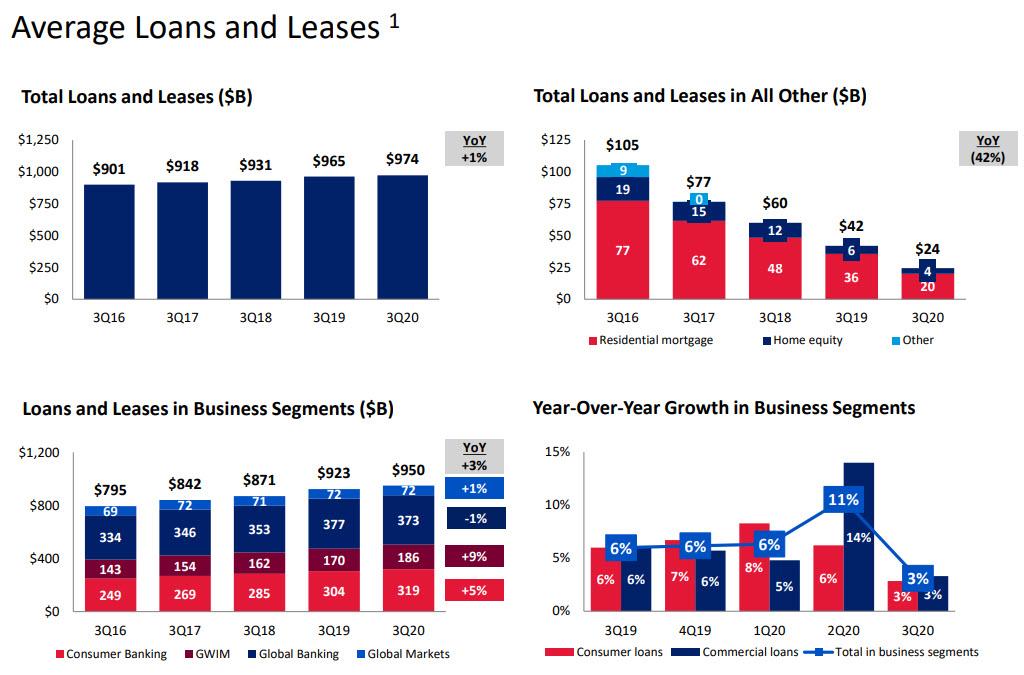

Going back to the balance sheet, and our observations from yesterday that loans do not create deposits, BofA reported that while total loans rose by just 1% Y/Y to $974BN...

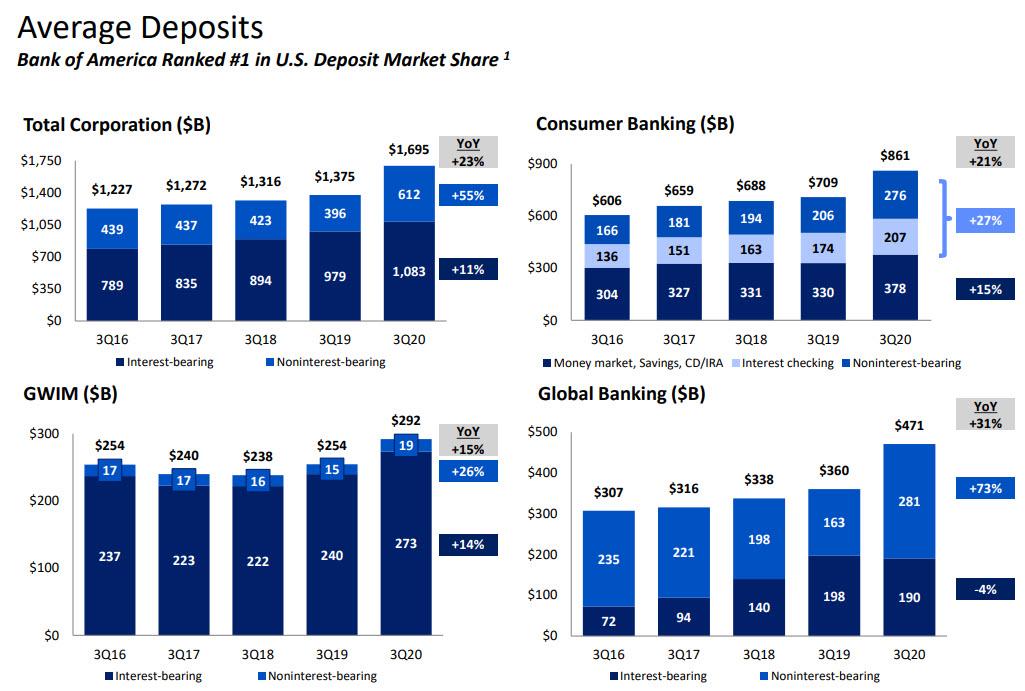

... total deposits soared by 23% to $1.7TN, confirming once again that deposits and loans have absolutely no connection, no matter what MMT-supporting idiots may claim.

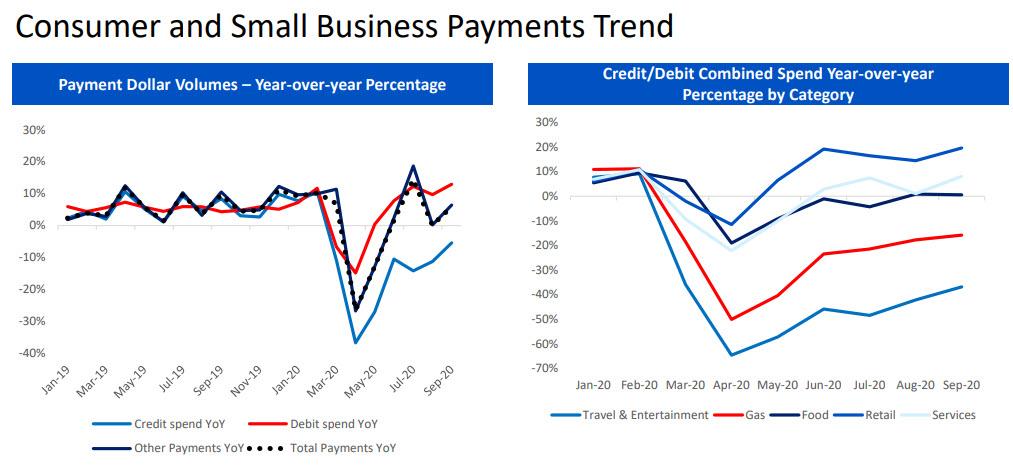

There was some good news in the post-covid recovery, where payment dollar volumes have rebounded, even though credit card spending remains subdued.

Some more observations from the bank:

- On a YoY basis, total monthly payments were down 26% at its lowest point during 2Q20, but have since improved, turning positive in June

- Debit spend continued to improve steadily, led by necessary spending

- Credit spend had a small and gradual improvement but continued to be heavily impacted by much lower travel & entertainment spending

- Spending was influenced by stimulus and unemployment stop and start but was offset in large part by reopening of parts of the economy

- Retail and services led the improvement and made up over half of debit and credit spend; travel & entertainment spend in September was down 37%

- YoY and restaurant spend down 18% YoY (but improved from April lows)

Finally, some thoughts from CEO Brian Moynihan:

“As the economy continued to recover, we generated nearly $5 billion in earnings this quarter, reflecting the diversity of our business model, our industry-leading market position and digital capabilities, and our adherence to responsible growth.”

However, with the stock sliding after the company's report, investors were clearly disappointed with the "responsible" growth, whatever that means.

Full Q3 presentation below (pdf link).

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more