Bandwidth Could March Lower When Lockup Expires

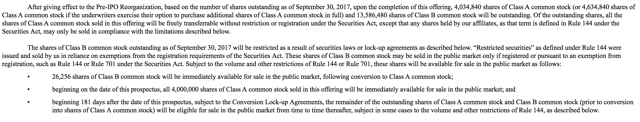

The adjusted 180-day lockup period for Bandwidth Inc. (BAND) ends on May 21, 2018. When this six-month period ends, the company’s pre-IPO shareholders will have the opportunity to sell 13.5 million currently restricted shares. The potential for a sudden increase in the volume of shares traded on the secondary market could negatively impact the stock price of BAND. Less than 4.1 million shares of BAND are currently trading.

(Click on image to enlarge)

Currently, BAND trades in the $36 to $37 range. BAND had a first day return of 6% and has had a return from IPO of 78%.

Note: While the 180-day IPO lockup expiration for BAND was scheduled for May 9, 2018, this date is usually delayed when the company reports earnings within close proximity to the IPO lockup expiration. BAND is scheduled to report Q1 results on May 2, 2018.

In our seven-year study of IPO lockup expirations, we have found this period of delay to be 17 calendar days from the date of earnings, making the adjusted lockup expiration for BAND 5/21/18 (May 19th falls on a Saturday).

Business Overview: Platform-as-a-Service Provider

Bandwidth offers a software-powered, cloud-based communications platform-as-a-Service within the United States. The company has two divisions: CPaaS and Other. Bandwidth markets its services as giving companies the ability to create, operate, and scale across text or voice communication services over connected or mobile devices. The company also offers data resale, SIP trunking, and hosted VOIP services.

(Source: S-1/A)

The company’s solutions include an array of software application programming interfaces (APIs) for text and voice functions. Its Internet protocol (IP) voice network competes with the largest such networks in the United States.

In its SEC filings, Bandwidth noted it is the only CPaaS provider with its own countrywide IP voice network, which is tailored specifically for its platform, and the company believes these proprietary applications comprise a significant competitive edge within the industry. Bandwidth’s clients include ZipRecruiter, Rover, Kipsu, GoDaddy, Dialpad, Skype for Business, Microsoft Office 365, and Google Voice.

Bandwidth currently does not target the residential or consumer markets, although its clients use the CPaaS to serve those segments. Usage of the platform went from zero minutes and messages in 2008 to approximately 10 billion messages and 27 billion minutes for the twelve months that ended June 30, 2017.

As of February, Bandwidth provided the following estimates for fiscal 2018.

- First-quarter CPaaS revenue is expected to be between $36.0 million and $36.5 million. Total revenue is projected to be between $47.0 million and $47.5 million.

- For the full fiscal year 2018, CPaaS revenue is projected to be $156.0 million to $158.0 million. Total revenue is projected to be between $188.0 million and $190.0 million.

Bandwidth Inc. was founded in 2000 and keeps its headquarters in Raleigh, North Carolina. The company has approximately 340 employees.

Company info was sourced from the firm's S-1/A.

Financial Highlights

For the fourth quarter and fiscal year ended December 31, 2017, Bandwidth Inc. reported the following financial highlights:

Fourth Quarter 2017 Financial Highlights

- Revenue was $42.5 million, up from $38.8 million the prior year.

- Gross profit was $19.6 million, up from $17.7 million in 2016. Gross margin was 46%, which is unchanged from the previous year.

- Net loss from continuing operations was $(0.6) million.

Full Fiscal Year 2017 Financial Highlights

- Revenue was $163.0 million, up from $152.1 million in 2016.

- Gross profit was $73.7 million, up from $66.9 million in 2016. Gross margin was 45%, up from 44% in 2016.

- Net income was $5.3 million, which represents $0.37 per share.

Financial highlights were sourced from the company's press release.

Management Team

Co-founder, Chairman, and CEO David Morken also co-founded Republic Wireless and Durham Cares. Prior to these activities, Mr. Morken served in the Marine Corps as a Headquarters Company Commander and Judge Advocate. Mr. Morken earned a B.A. in Political Science from Oral Roberts University and a J.D. from the University of Notre Dame Law School.

President and Board member John Murdock was previously Bandwidth’s General Counsel. He is also a board member of Republic Wireless. His previous experience includes founding a specialized law firm that provided national level civil litigation services. In addition, he served as a Marine Corps officer on active duty that included combat duty in Operation Desert Shield/Storm. Mr. Murdock earned a B.S. in Finance from Miami University of Ohio, with an NROTC scholarship and a J.D. from the University of Notre Dame Law School.

Company biographical information was sourced from the company's website.

Competition: Nexmo, Twilio, AT&T and Others

Bandwidth divides its competition into two categories. CPaaS companies that offer software APIs include Nexmo and Twilio (NYSE:TWLO). Network service providers that offer some developer functionality in addition to their own physical infrastructure and networks include AT&T (NYSE:T), Verizon (NYSE:VZ), and Level 3 (NASDAQ:LVLT). Morningstar lists the company’s top peers as Microsoft (MSFT), Oracle (ORCL), VMware (VMW), Cielo, and Wirecard.

Early Market Performance

The underwriters for Bandwidth Inc. priced its IPO at $20 per share, at the low end of its expected price range of $20 to $22. The stock closed on its first day of trading at $20, then traded within the range of $20 to $24 until mid-February, which is when the company announced its fourth quarter and full fiscal year financial results. The stock subsequently began to climb and now trades in the $36 to $37 range.

Conclusion

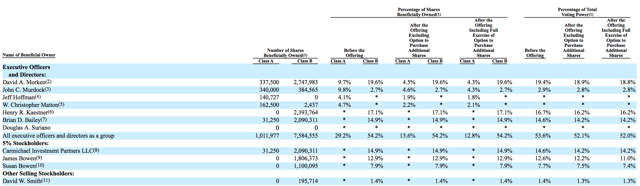

When the BAND IPO lockup expires on May 21st, pre-IPO shareholders and company insiders will finally be allowed to sell their 13.5 million shares of currently restricted stock for the first time. This group of pre-IPO shareholders and insiders is comprised of 10 individuals and one corporate entity.

(Click on image to enlarge)

With fewer than 4.1 million shares of BAND currently trading, any significant sales of currently restricted stock could flood the secondary market and result in a sudden, short-term downturn in share price.

Aggressive, risk-tolerant investors should short shares of BAND before the IPO lockup expiration on May 21st. Interested investors should cover short positions during the May 22nd and May 23rd trading sessions.

Disclosure: I am/we are short BAND.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more