Banco Santander: Europe's Brazilian Bank

When I look across the banking landscape in Europe, there is one bank that stands out as most willing and likely to take advantage of the single market in Europe and also emerging markets opportunities around the world, and this bank is Banco Santander (NYSE:SAN).

I like Banco Santander for a number of reasons. Firstly, its base is in Spain and as that economy turn the corner, the drag on its share price due to investor perception of the country and the bank will diminish thus making its share price far more buoyant going forward.

This is currently the case as its profits rose in Q1 to 1.6 billion euros which has increased its shares price by 1.2% and thus outperforming its domestic peers.

Unlike many of its European competitors such as Deutsche Bank (DB,) Credit Suisse (CS), and UBS, one can clearly see the effects of SAN's restructuring on the balance sheet as crucially it has improved its solvency significantly by lifting its Common Equity Tier 1 ratio (CET1); the market agrees that it can achieve 11% or over by 2017.

While I agree that the CET1 is important from a risk perspective, particularly when one considers the global market risks, I believe that its influence has had an unduly negative impact on the share price.

Banks needs to constantly strike that balance between risk and return and in this case, I believe that in this season of lower interest rates, Banco Santander made the right call by first going after revenue and profitability rather than purely managing risks; furthermore, they have phased in the increase of CET1 gradually in order to continue to invest in revenue growth.

It is a myth that CET1 needs to be at 12% or above for all banks because each bank is different, their markets are different and thus there can be some room for individual discretion when it comes to determining the optimal level of CET1 for banks.

It is not necessary for Banco Santander to have more than 10% because their core business is very diversified across geographical region so there is already a built in risk management function in their core business structure. They are already the most European bank in the EU and also have a significant global presence in the emerging markets, particularly in South America where they intend to expand their operations significantly.

The importance of the CET1 is that it is one of the most importance measure of a bank's liquidity and ability to withstand stress events, but at the moment European banks are very well capitalized so the problem is not a lack of funding but the profitable deployment of funds.

This is the essence of the profitability challenge facing the banking sector at the moment because with most financial assets currently showing high risks and low profitability particularly as a result of low interest rates and the distortion of the pricing of risks in the markets.

This is what makes following the Basel rules so challenging at the moment for banks, because the Basel rules are static risk and liquidity measures but monetary policies are much more fluid. As a result of the current unconventional monetary policies, it has become far more challenging for banks from a risk management perspective because the goalposts on risk weightings and liquidity management are constantly shifting and evolving.

This is why I suggest that Banco Santander has played the game in a very strategic manner, because banking risk management is fundamentally about getting the ratios right so in almost a counterintuitive way, greater profitability will give a bank more manoeuvre room with regards to their Basel III requirements as it relates to their capital requirements, leverage ratios and liquidity requirements.

This is an important principle for analysing banks from an investment and risk perspective, because most banks at the moment are seeking to meet the Basel requirements primarily by focusing on cutting off more risky, but more profitable, ventures and markets.

This is currently the method favoured by banks like Deutsche Bank and Credit Suisse; but the problem with this strategy is it reduces profitability and drives them into this capital and liquidity straitjacket from where it becomes very difficult to break out.

This is what we are seeing, particularly with Deutsche Bank and Citi (C). Banco Santander, on the other hand, has chosen a different strategy, one which rests on its broad market reach that enables it to 'borrow cheap and lend dear' in markets where loan demands are rising not falling.

This means that going forward, the bullish arguments in favour of Banco Santander go well beyond Spain. Its structure means that it takes advantage of ridiculously low borrowing rates in Europe and lends more profitably in Latin America.

This is a trend that will continue especially when we look at Brazil where interest rates are likely to rise as inflation rises. This increase in inflation will be spurred on by higher commodities prices, which will create two inflationary pressures in Brazil.

Firstly, the price of goods will increase as the low oil price has caused energy, transportation and electricity costs to increase at a slower pace and helped offset an increase in food prices. With higher oil prices, we will see all of those three increase, thus causing significant inflationary pressures in Brazil.

As a result of this, we will see interest rates begin to rise in order to combat rising inflation. The key here will be how high crude oil is likely to go between now and 2018, when we will see a stabilization of the price.

Secondly, spending power will also increase as they will be selling their commodities at more attractive prices on the global market thus contributing to inflation and likely interest rate rises.

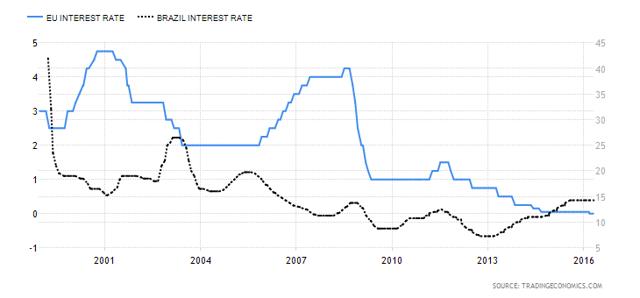

This chart above gives a lot of credence to Santander's business strategy in Brazil and South America as a whole, because it shows that the interest rates in the Eurozone, the home market, are stabilizing at a very low level and of course, the interest rate at which they borrow from the ECB is even lower.

On the other hand, inflation and interest rates in Brazil and indeed most of South America are rising and will continue to rise and hold steady possibly with inflation holding at between 15-17%.

This is not necessarily because of bad policies but rather represents a phase that the Brazilian and indeed the South American economies are going through because of a combination of young and vibrant populations, fast-developing economies and higher commodities prices.

The net effect of all of this will be higher revenues and profitability from the higher profit spread for Banco Santander from borrowing from the ECB and lending in Brazil and also the increasing borrowing from Brazilian clients. It is essentially the ultimate carry trade business whereby profits and volume are both increasing.

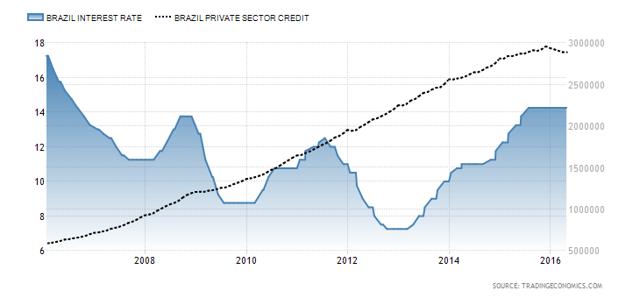

This second chart shows that the private sector credit market is pretty inelastic to increases in interest rates because despite the increases in interest rates, private sector credit numbers continue to grow higher.

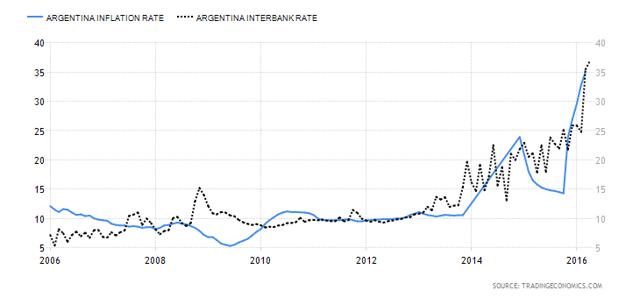

Another large South American market that holds promise for Banco Santander is Argentina. It is the third largest in Argentina and as the graph below shows, the inflation/interest rate dynamics that we see in Brazil is similar in Argentina.

These dynamics holds throughout South America and with its supply leg firmly established in Europe, Banco Santander has a great advantage over its other European banking rivals because it is also firmly established in a region where demand and the price of money is constantly growing.

Conclusion

As we see the commodities prices begin to move higher and South America begins to stabilize further, we will see Banco Santander continue to grow steadily. Out of all the European banks, it has the nimbleness and reach which its rivals lack and it can use this to continue to profit even as the European banking sector continues to restructure itself to take into account low interest rates and falling loan demand in the EU.

There is also a possibility of Banco Santander succeeding where Barclays (BCS) failed in Africa, especially in Spanish- and Portuguese-speaking Africa like Angola, Mozambique, Equatorial Guinea and a few others.

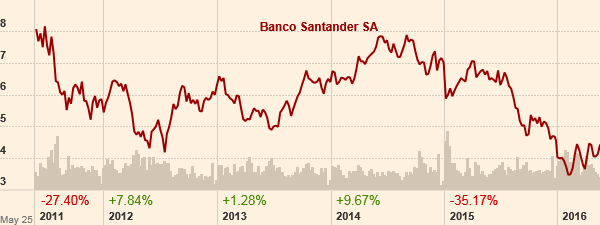

This is what the chart looks like at the moment whereby it is at a medium term low, I expect a significant upturn in prices by 2018 to regain the 35.17% it lost last year and also add possibly another 10-15% to its share price as more investors see the potential in its business model.