Avoid This Bias When Investing

A funny thing happens as markets go down: Investors panic and sell stocks. When stocks go up, the opposite happens: Investors have a fear of missing out, and buy stocks.

There is a basic principle in psychology for this called the normalcy bias. It states that if a disaster hasn’t happened to a person, they’ll think the disaster will never occur.

Think of it this way. When the markets go up, the normalcy bias states that most expect the market to continue that direction for the foreseeable future.

And as stocks go down, according to normalcy bias, we see that as the continued direction for the foreseeable future.

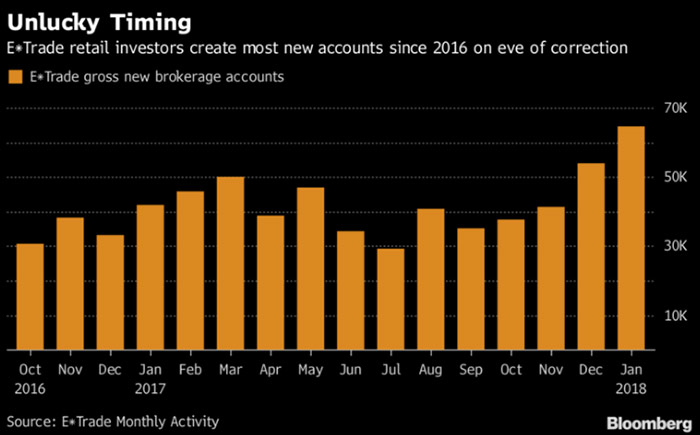

That explains why E-Trade, a retail brokerage firm, saw a surge in new accounts in January.

Investors were worried they were going to miss out on this stock market rally. 2018 kicked off one of the fastest stock market increases in history, and investors noticed. In hindsight, they poured money into the markets at one of the worst times to do so.

Now is a much better buying opportunity compared to any point in January, and we should see retail firms like E-Trade flooded with new brokerage accounts as investors want to get in on a dip. But that won’t happen — because of normalcy bias.

If you can overcome that bias and buy stocks today, it will reward you handsomely in the coming weeks and months.

Editor’s Note: For most people, it’s impossible to tell the difference between a cryptocurrency that’s going to fall 100% and one that will shoot up 1,000%. But with his ...

more