Aurora Q2 Financial Results: Static Revenue Growth; 71% Improvement In EBITDA

Aurora Cannabis Inc. (ACB), a constituent in the munKNEE Pure-Play Pot Stock Index, announced its Q2 financial results last Thursday for the period ended December 30, 2020 (see Q1 summary here). The highlights are as follows:

Q2 Financial Highlights (All results are presented in Canadian dollars - go here to convert into USD - and compared to the previous quarter.)

- Total Net Revenue: almost unchanged at $67.7M

-

- Adj. Gross Margin: decreased to 42% from 48% due to a) the purposeful reduction in production levels at Aurora Sky resulting in an increase in cash cost of sales due to the under-utilization of capacity and a $1.8 million increase in actual net returns, price adjustments and provisions primarily relating to company-initiated product returns meant to open channels to a newer, higher-potency flower that Aurora is now producing. Normalizing for these impacts, adjusted gross margin was 52%.

- Consumer Cannabis Net Revenue: decreased 17% to $28.6M driven by product launches in vapes, edibles, and concentrates.

- Adj. Gross Margin: decreased to 22% from 38% primarily driven by a $3.3 million increase in the cost of sales due to under-utilized capacity as a result of the scaling back production at Aurora Sky and sales of their lower margin Daily Special value brand which was not present in the prior comparative period.

- Medical Cannabis Net Revenue: increased 16% to $38.9M primarily attributable to a continued strong performance in both the international and Canadian medical businesses. International medical sales grew by 562% over the prior year comparative period.

- Adj. Gross Margin: declined to 56% from 59% primarily driven by the increase in the cost of sales due to the under-utilized capacity as a result of the scaling back of production at Aurora Sky.

-

- SG&A/R&D: decreased 5% to $44.4M as a result of cost savings related to restructuring charges, and severance and benefit costs associated with the Business Transformation Plan. Excluding these impacts, Q2 2021 SG&A and R&D was $42.3 million

- Adj. EBITDA: loss reduced by 71% to $(16.8)M primarily driven by the substantial decrease in SG&A and R&D expenses.

- Cash-on-Hand: $434.4M

Operational Highlights

- Kilograms Sold: decreased by 5%

- Average Net Selling Price/g of Dried Cannabis: increased 8% to $4.00/g

- Capital Expenditures: reduced by 41%

Management Commentary

Miguel Martin, Chief Executive Officer, said:

- "...Our core revenue strength in medical and consumer was complemented by initial rollouts in vape products and concentrates...[as] part of...[our] CPG strategy.

- ...Several decisions were made in the quarter that we believe will clear a path for our premium product focus and more variable cost model...[and] give Aurora maximum flexibility and position the organization to drive significant cash flow in the coming quarters.

- To further support this strategy, we have also focused on improving our cash burn, margins, and overall financial flexibility...”

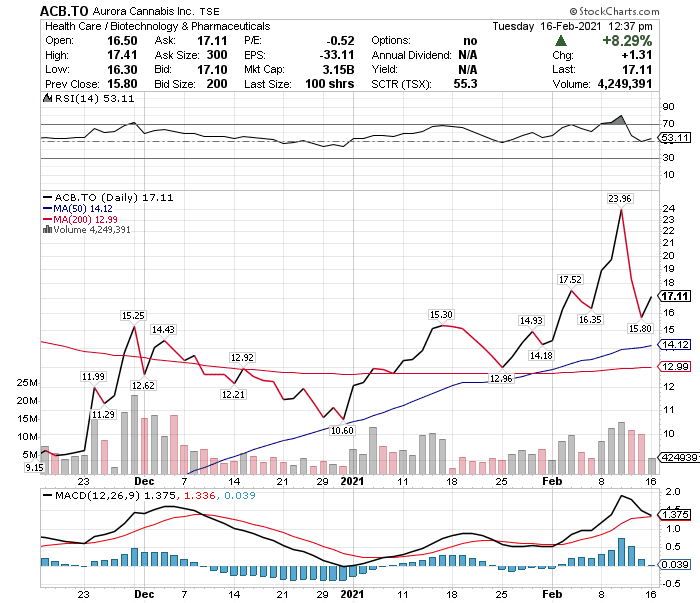

Stock Performance

The Aurora stock price is up 50% YTD, up 11.9% in the first 2 weeks of February, and up a further 8% so far today as can be seen in the chart below. (Chart below is in Canadian dollars - go here to convert into USD).

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more