August Dividend Income Summary

We are one month closer to financial freedom. I cannot remember the last time that I desired, so much, to be financially free. August was a very busy month and a fantastic month for dividends. So lucky on the activity, growth, and increases that occurred, but I know it was the hard work, the power of saving and staying consistent with purchases that is allowing me to be here. Time to review August’s dividend income summary!

Dividend Income

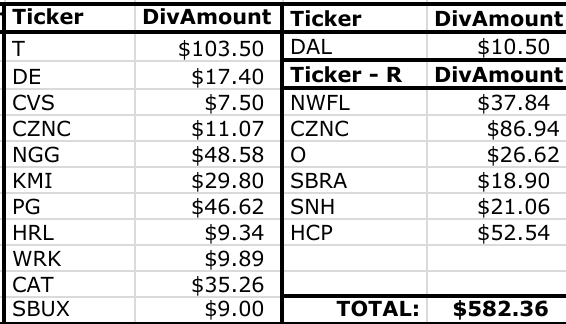

I received a total of $816.20 of dividend income in August. A record August baby and getting closer to $1k for an off month, again! Each month, luckily, I have been able to have a record month throughout 2019, each beating the prior year’s comparable month. Additionally, my wife earned $170.55 this month. Since we were married in October, I believe that will be the month that I will incorporate ours together and have a true comparison going forward, from a year-over-year basis. Therefore, combined, we earned almost $986.75 for the month!

Further, the 401(k), Health Savings Account (HSA) and all dividends are automatically invested/reinvested and helps take the emotion out of timing & making a decision.

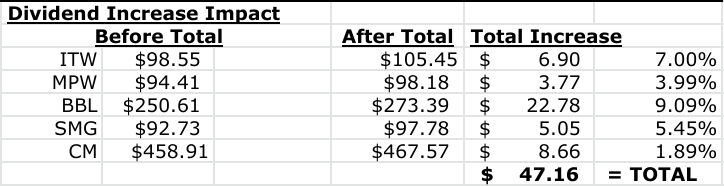

The dividend increases add quite a bang to the portfolio, as well. As you saw from my recent post in July, dividend increases added almost $200 for the year through June! I will update this again, at the next quarter-end, to show you how critical this can be for YOUR portfolio.

Here is the breakdown of dividend income for the month of August!

Big hitters coming in hot! AT&T (T) coming in with a nice $110.88 and that easily covers 3 months of internet expense at the household. Love that it pays for itself now! Then, National Grid (NGG), which was one of my first stocks from when I started, spruced to over $100 this time around. I invested into this dividend-utility company consistently over the last year and it sure is paying off.

Further, I am looking forward to Starbucks (SBUX) crossing the $10 mark soon and am eager to see CVS (CVS) jump-start that dividend growth engine again. I am placing a personal/internal bet that they do this 4th quarter of 2020. Any bets on if they increase their dividend this year? In addition, HCP, Inc. (HCP) should get their dividend growth back, too. Come on now!

Here, it shows that I received a total of $250.81 (up from $243.90 last year) or 31% of my income from retirement accounts and the other 69% was from my individual taxable account portfolio. This % for retirement accounts decreased by 11% from last year. Why? This is due to significant investments into my taxable account, towards dividend income companies, such as WestRock (WRK), Delta (DAL) and a strong dividend increase from Kinder Morgan (KMI).

Dividend Income Year over Year Comparison

2018:

2019:

Wow, is that an increase of $233.84? This increase represents a staggering 40% growth rate from prior year. Holy smokes. The biggest difference is the National Grid (NGG) dividend, which is post additional purchases (especially since I never made additional purchases in ~8 years for NGG!). In addition, Delta (DAL) was drastically bigger, due to additional investments, as well.

Outside of that, and additional investments with CVS (CVS) & WestRock (WRK), dividend increases and reinvestment took the rest of the pie.

In total, this August was higher by $233.84 or 40%. At this rate, $1,143 for next year? I would LOVE this.

Dividend Increases

August is starting to become a small gathering of dividend income growers for me! This feels like receiving 5 raises from work! How many places will give you that? Further, the range is 1.89% all the way to 9.09%.

My favorite, honestly, is Medical Properties (MPW), as I wasn’t sure if they were going to be on their dividend increase ways, that we shareholders have been accustomed to. I try to be conservative with my BHP BIlliton (BBL) dividend growth rate, as the dividend is $1.56 vs. $1.26 (23.8%). However, I simply used a trailing twelve-month growth, in a sense. I don’t want to assume their dividend is going to remain at these levels, just to cut it back down!

Overall, $47.16 added would require an investment of $1,347 at 3.50% yield, in order to produce that result.

Dividend Income Conclusion & Summary

The name of the game is to apply what you learn through financial education. The next steps are to maximize every dollar for investment opportunities and live a balanced life. My plan is to show that dividend income can be a revenue engine. A revenue engine that allows you to take back control of your life. Dividend investing, once you learn the right way, becomes easier and starts to immensely make sense!

There is a nice adjustment to my most recent monthly expenditures article. Sadly, my property taxes increased by 14%. Therefore, my new average is $1,040 per month. Therefore, my current dividend income would cover 78% of that amount. Keep in mind, this isn’t including my wife’s income she earned, which would only help in the equation. In other words, there is still work to be done here to cover my housing expenses.

Accordingly, if I keep the same growth rate up, could I hit over $1,100 going forward? If I do, that should clear my monthly expense, on average, for the house. I’ll strive for that figure, no doubt. Further, all of the investing from last year and moves this year shows that my aim to save 60% of my income, and making every dollar count, has allowed promising results already this year.

Wow… only 1/3 of the year is left and what a year it has been. I can taste it, one month closer to the goal baby! Financial Freedom, Financial Independence, insert your freedom phrase here, awaits! Please share your thoughts, questions, and feedback below! Excited to read how everyone did this month, as well. Thank you again, good luck and happy investing!

Disclaimer: I do not recommend any decision to the reader or any user, please consult your own research. Thank you.