AT&T: Key Items To Watch In Q1 Earnings

AT&T (T) is due to report its first-quarter earnings on April 22. Investors would be curious to see whether the company meets or beats the street’s revenue estimates. But along with tracking the company’s revenue figures, investors should also look at its subscriber additions, churn rate, ARPUs as well as management comments around how the coronavirus outbreak has impacted their business. These items are likely going to dictate how AT&T’s shares react post its earnings release.

Mobility Subscriber trends

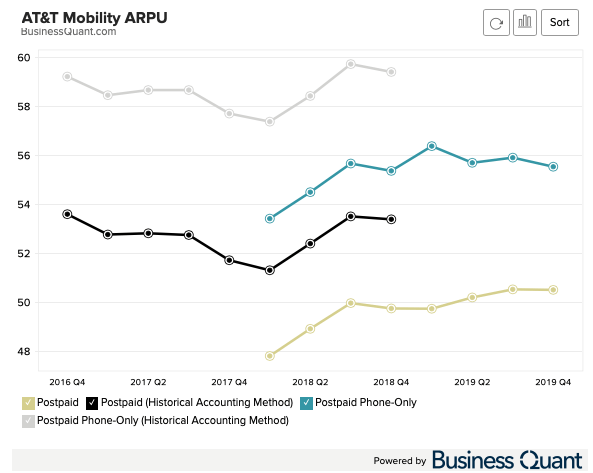

First of all, AT&T’s mobility division accounts for 38.8% of its overall revenue. So, any operational disruption in this segment could significantly impact the company’s revenue and profitability in 2020. This makes it all the more important for us to track the performance of its mobility division at a granular level.

Companies in the US, in general, have asked their employees to work from home in light of the coronavirus outbreak over the past few weeks. This has given people more free time at home which has benefited wireless and telecom operators. If we talk about comparables, then Vodafone and BT saw a 50% to 60% increase in their network traffic very recently, as more and more people switched to working from home.

The effects were seen in major streaming sites as well. Netflix and Youtube have had to throttle their streaming quality in order to avoid network congestion. So, if there is a similar situation with AT&T, we could see a noteworthy increase in its ARPU during Q1.

(Click on image to enlarge)

(Source: Business Quant)

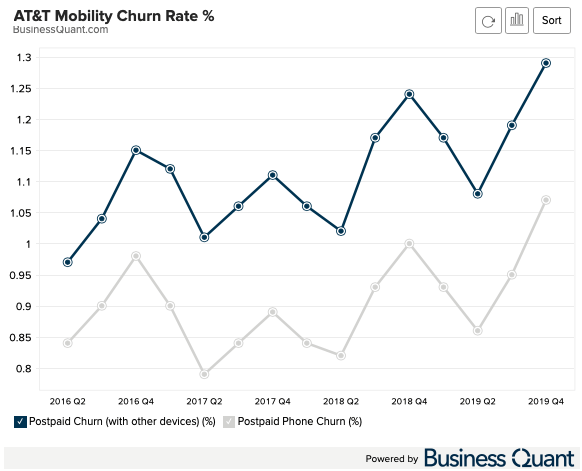

Besides, companies across the US have also had to lay off a certain portion of their workforce in recent weeks to cut on costs. The laid-off employees may disconnect their wireless services in order to be frugal with their bills. On top of that, AT&T’s staff may not be able to conduct maintenance on its network infrastructure from time-to-time due to restricted access and lack of spare parts available, which might cost them to lose a few of their subscribers. So, I’m also expecting a marginal increase in AT&T’s churn rate during Q1.

(Click on image to enlarge)

(Source: Business Quant)

Entertainment Group Trends

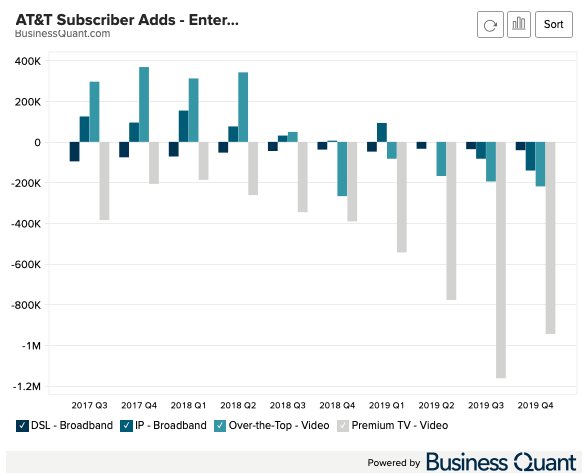

AT&T’s second-largest segment by revenue is its entertainment group, which accounts for a sizable 23.3% of the company’s overall revenues. Unfortunately, for long-side investors at least, this division also has its share of striking challenges.

(Click on image to enlarge)

(Source: Business Quant)

It’s evident from the chart below that AT&T’s video subscriber base has seen a substantial decline over the last few quarters. Its management had noted during their Q4 earnings call that their subscriber losses had peaked during Q4.

However, the coronavirus outbreak has led to the cancellation of live events across the globe. This would make it harder for the telecom giant to justify its pricey channel packages and consumers might just end up disconnecting their connections — thereby accelerating cord-cutting. This suggests that AT&T’s video subscriber losses may not have peaked out yet.

So, investors should also closely monitor AT&T’s video subscriber losses in its upcoming earnings report.

Other items

In addition to the mentioned items, investors should also look out for management’s comments around how the coronavirus outbreak has impacted their business, financially and operationally. Its management had initially planned to roll out nationwide 5G services by the end of the year, but this looks to be in doubt given the disruptions in the global supply chain. So, look for management’s comments around whether they stick to the original 5G deployment timeline or defer it to next year.

Moreover, the company is scheduled to launch its arguably pricey HBO max platform next month. Any delay in the launch of original content due to difficulties in filming make it difficult for the company to justify its pricey streaming platform.

Lastly, coming to its dividend policy. Companies of late have suspended their share buyback programs and slashed their dividend payouts in a bid to save on costs. Income seeking investors should listen in on management’s comments around the same — can they can sustain dividend payments, or will they slash them in order to compensate for any reduction in cash flows? I think it’s needless to say but a major cut in its dividend payouts may force income investors to sell AT&T’s stock and look for alternative investment options.

Final Thoughts

AT&T’s upcoming earnings call would be an opportune time for investors to gain clarity about its state of operations and its future prospects. Investors should closely monitor AT&T’s mobility churn rate and ARPU, its video subscriber losses and listen in on management’s comments around how the coronavirus outbreak has impacted their business. These items are likely going to determine where AT&T’s shares head next over the coming weeks.

Disclaimer: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should ...

more