Arista, Skyworks And Nvidia Not Seeing China Health Impact: Bullish

We've listened to numerous earnings conference calls and some companies speak at the recent Goldman Sachs conference. One amazing consistency is that companies are not talking about a big China health-related slowdown. It sounds like customers are still ordering and consumers may be buying to build up their work-at-home presence.

The Chinese health outbreak is definitely one of the biggest risks out there in the stock market today. But for some strange reason, it's not yet hitting results.

As long as this doesn't hit results, it's not a negative for stocks. And more than that, I think, when this outbreak passes, it's going to be a huge boost for sales thereafter. If sales managed to hold up during this outbreak, you have to believe that sales get stronger after the outbreak passes.

Let's listen to what a few companies have talked about.

Here's what Nvidia (Nasdaq: NVDA) said on their earnings call:

"Again, it's still very early regarding the coronavirus. Our thoughts are out with both the employees the families and others that are in China. So our discussions both with our supply chain that is very prominent in the overall Asia region, as well as our overall AIC makers, as well as our customers is as about as timely as we can be. And that went into our discussion and our thoughts on the overall guidance that we gave into our $100 million. We'll just have to see how the quarter comes through and we'll discuss more when we get to it. But at this time that was our best estimate at this time."

When Nvidia says it's still very early that tells me they are not getting hit. It's not so early actually. This health scare has been happening since November or December with major shutdowns. It's not early at all if they were seeing a slowdown. But since they are likely not seeing a slowdown they think it's early and want to be on the safe side to adjust their guide down by $100mm.

Skyworks (Nasdaq: SWKS) said at the Goldman Sachs conference last week that they saw no change in customer orders.

Micron (Nasdaq: MU) did say they saw some slowdown in China when speaking at the Goldman conference but said they are still on track with their quarterly targets. Micron said that trends outside China were still strong.

Here's what Arista (Nasdaq: ANET) said on their earnings call about China's health concerns:

"So far we haven't seen any big impact, because it's just been a few weeks after - really a few days after the end of the Chinese New Year. And our manufacturers are saying that's OK for the short term. However, if the situation continues for a long period and there's where the supply is label of raw materials and over an extended time then it can have an impact in the future. But it's too early to say anything right now. And we expect more answers from the Chinese suppliers to the factories through the rest of the month and even in March. So it is too early, but for now we're OK."

As we mentioned in our take on Nvidia's wording, here Arista clearly says "too early" means they "haven't seen" an impact.

The timing currently doesn't hit companies as much because it's during a Chinese New Year break so there typically is scheduled downtime for many companies.

Still, to me, it's odd that there hasn't been that much economic pain as per companies that have had public comments.

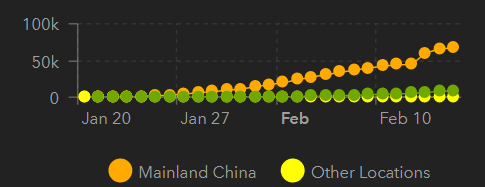

Huge Jump In Numbers

Apparently there was a catch up in reported cases in China so the numbers spiked a few days ago. That doesn't necessarily mean that the number of cases jumped. It likely means that actual numbers had previously been suppressed.

Previous to the spike the number of new cases had been up 3,000-4,000 per day. It sounds like after the spike new cases have tracked back to about 3,000 new per day.

Obviously we're hoping for a speedy recovery and an end to this outbreak and health scare.

For businesses, we also care how it affects quarters and earnings reports.

If the outbreak doesn't slow obviously risk builds for companies exposed to China.

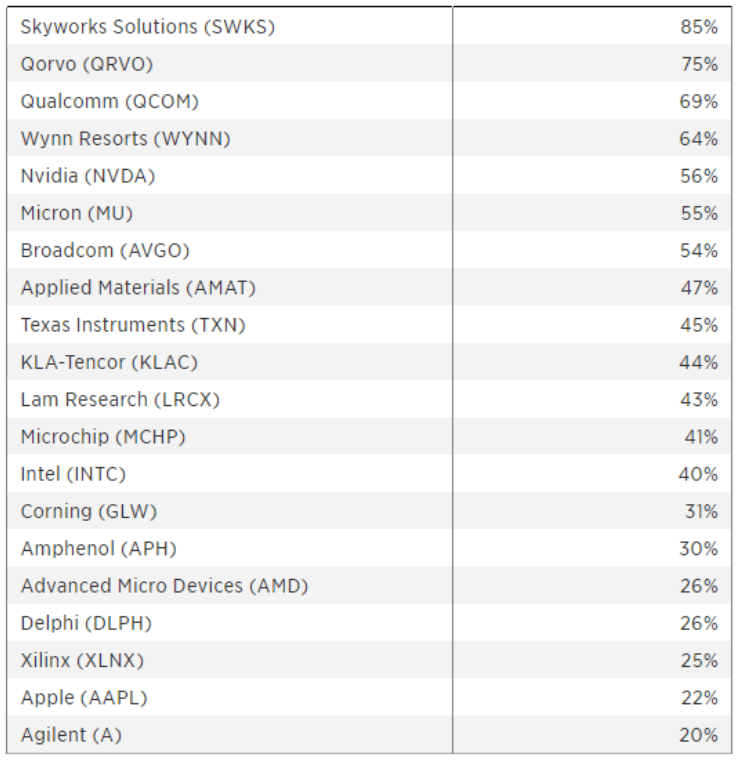

Companies With the Largest China Exposure

Here are companies with the largest exposure to China.

Above you have who's most exposed to China. We told you what we heard from Skyworks, Micron and Nvidia. They are companies with big exposure. They all spoke to the Street last week.

If they aren't really seeing a hit yet it's bullish for companies in general and the general market.

Why No Impact Yet?

The health risk has forced many to work from home. It's also left people with more time on their hands. The combination may have caused consumers to purchase from home and also build up their home offices. That can actually drive sales rather than crimp sales.

Conclusion

We've seen a spike in numbers due to reporting adjustments but the companies that are speaking don't seem to be talking about a big risk from China. So far timing of the Chinese New Year may have lessened the blow. But also consumers maybe beefing up their home offices, actually driving tech sales.

If companies survive unscathed during this outbreak, when it's finally over I think it's fair to assume there could be a big jump in sales helping the stocks.

Ready to Nail Tech Earnings? Start your free trial today.

Disclaimer: Stocks reported by Elazar Advisors, LLC are ...

more