Arista Networks Down 30%: Buying Opportunity?

Arista Networks (ANET) is down by almost 30% from its highs of the last year. This is mostly due to a broad market selloff particularly affecting growth stocks in the tech sector lately. Besides, there have been rumors about the possibility of Amazon (AMZN) increasing its presence in the networking sector.

However, the big picture is Arista Networks looks as strong as ever, and chances are that the recent pullback will turn out to be a buying opportunity for investors with a long-term horizon.

A High Growth Company

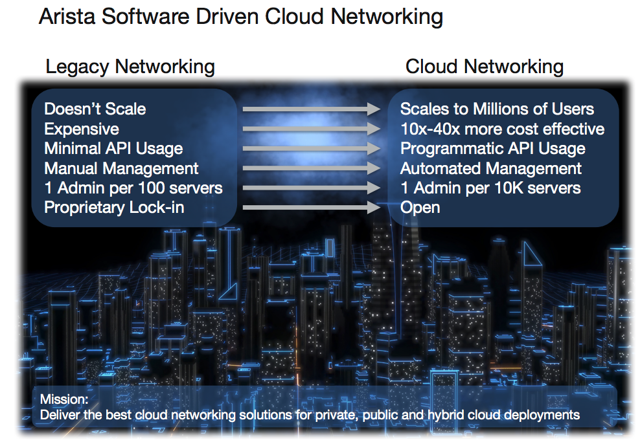

Arista Networks delivers software-driven cloud networking solutions for large datacenter and cloud computing companies. The company offers a wide variety of Gigabit Ethernet switches that significantly improve the price and performance equation of datacenter networks.

Source: Arista

According to management, the data center switching market is projected to grow to $13 billion in 2021, and Arista Networks is currently the number two player in terms of size and the fastest growing supplier of products to this market. The company has also entered the routing market with its R-Series platform, which could be an additional multi-billion dollar opportunity in the years ahead.

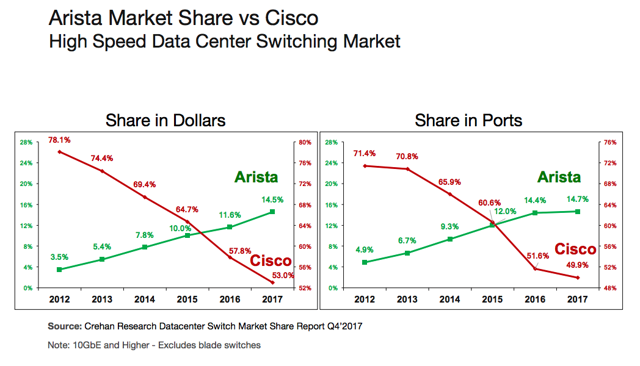

Arista Networks competes against bigger companies with deeper pockets such as Cisco (CSCO). But the company is outgrowing Cisco and stealing market share from its larger rival. This speaks volumes about Arista’s technological prowess and its ability to successfully compete against all kinds of players.

Source: Arista

There have been rumors about Amazon entering the networking space lately, and this is creating some uncertainty around Arista Networks' stock. Amazon has denied those rumors, and it doesn't really make a lot of sense for Amazon to enter this market. In any case, Arista Networks has proven its ability to compete and win versus larger rivals, so selling Arista because of unfounded rumors about Amazon entering the space is short-sighted at least.

Outstanding Financial Performance

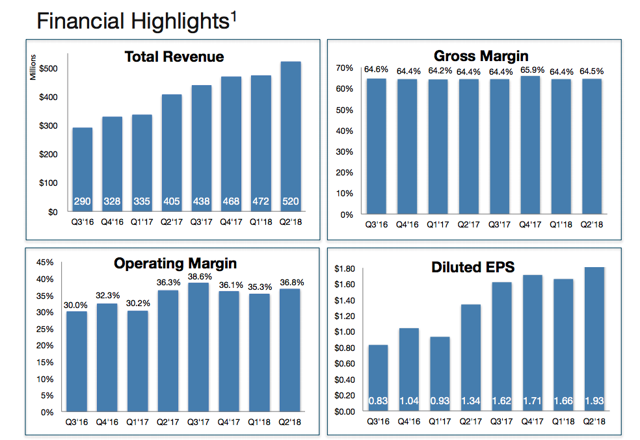

Financial performance is clearly strong, with revenue increasing by 28.3% and net income growing by 47% year over year last quarter. The business model is also remarkably profitable, with a gross profit margin in the range of 64%-65% and operating profit margin reaching 36.8% of revenue last quarter.

Source: Arista

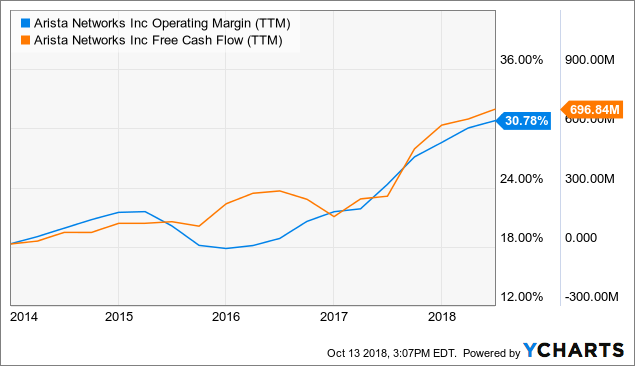

Management has done a great job at delivering both revenue growth and expanding profitability over the years, with both operating profit margin and free cash flow moving in the right direction over time.

ANET Operating Margin (TTM) data by YCharts

Attractive Valuation

Wall Street analysts are on average expecting Arista Networks to make $8.53 in earnings per share during 2019. Under this assumption, the stock is trading at a forward price to earnings ratio of 26. As a reference, the average price to earnings ratio for companies in the communications equipment industry currently stands at 33.1.

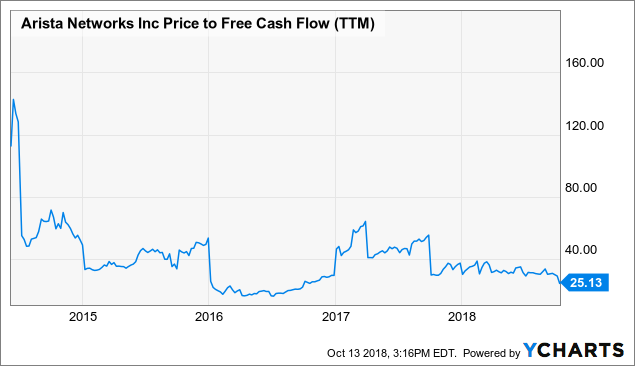

Offering a similar perspective, the price to free cash flow ratio stands at 25. This is quite reasonable for such a dynamic growth company, and also comparatively low by historical standards.

ANET Price to Free Cash Flow (TTM) data by YCharts

Importantly, valuation is not an ecstatic concept, since earnings expectations for a company can rise and fall, and this can many times have a material impact on both the current stock price and the underlying valuation metrics.

Arista has substantially outperformed expectations over time. The table below shows earnings expectations, the actual reported number, and the earnings surprise, both in absolute numbers and percentage terms over the past four quarters. Not only is the company consistently reporting above expectations, but Arista is also doing better than expected and by a wide margin.

| 9/29/2017 | 12/30/2017 | 3/30/2018 | 6/29/2018 | |

| EPS Est. | 1.19 | 1.41 | 1.51 | 1.7 |

| EPS Actual | 1.62 | 1.71 | 1.66 | 1.93 |

| Difference | 0.43 | 0.3 | 0.15 | 0.23 |

| Difference % | 36.10% | 21.30% | 9.90% | 13.50% |

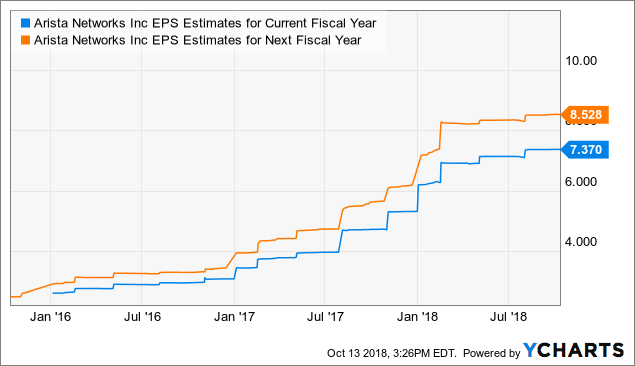

Wall Street analysts have consistently been running from behind when it comes to Arista and its earnings power. The chart below shoes how earnings expectations for both the current year and the next fiscal year have substantially increased over time.

ANET EPS Estimates for Current Fiscal Year data by YCharts

As long as this trend remains in place, Arista could be even more undervalued than what the numbers indicate if the company continues delivering earnings above expectations in the years ahead.

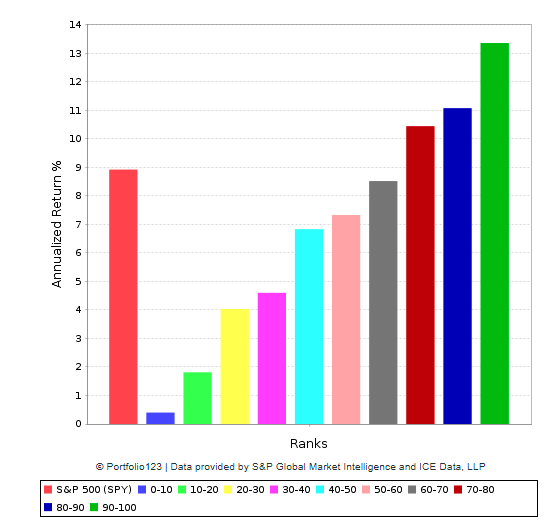

The PowerFactors system is a quantitative investing system available to members in my research service, "The Data Driven Investor." This system basically ranks companies in a particular universe according to quantitative indicators such as financial quality, valuation, fundamental momentum, and relative strength.

The system has produced solid performance over the long term. The chart below shows the annualized returns for companies in different PowerFactors ranking buckets since January of 1999 in comparison to the SPDR S&P 500.

There is clearly a direct relationship between the PowerFactors ranking and annualized returns, meaning that companies with higher rankings tend to produce superior returns and vice versa. In addition, stocks with relatively high quantitative rankings tend to materially outperform the market over the years.

Data from S&P Global via Portfolio123

Arista Networks is among the best 10% of stocks in the market based on the quantitative algorithm. The company has a PowerFactors ranking of 93.7, which means that the stock is well positioned for attractive returns when considering financial quality, valuation, fundamental momentum, and relative strength.

The quantitative system alone does not tell you the whole story - it's important to understand the business behind the numbers in order to truly understand the main risks and return drivers in Arista's stock.

Arista operates in a high-growth industry prone to technological disruption. It's important for investors to monitor the competitive landscape in order to make sure that the company remains strategically well-positioned for growth and market share gains in the years ahead.

That being acknowledged, it's good to know that Arista Networks offers attractive upside potential from current price levels in the years ahead if management plays its cards well.

Disclosure: I am/we are long AMZN, ANET.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more