Are FirstCash Shareholders Reaping The Benefits Of Exiting Payday Lending?

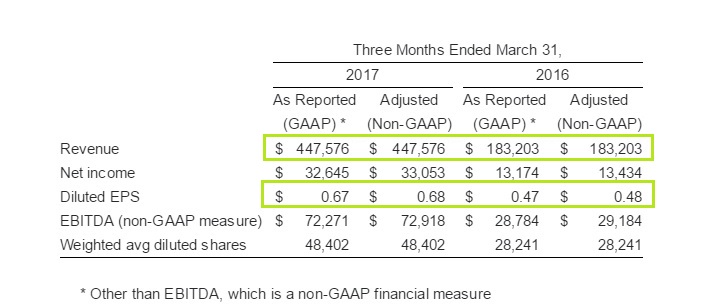

FirstCash Inc. (NYSE: FCFS) reported its Q1, 2017 results last week. The company posted massive increments in revenue and income following its merger with Cash America last year, which saw it add 815 pawn stores in the US and a further 220 in Latin America. The company’s revenues for Q1 came at $448 million compared to last year’s figure of about $183 million. Diluted EPS was $0.68 compared to $0.48 reported in Q1, 2016. FirstCash Inc's stock price has been on a rally since the end of January and has shown no signs of slowing.

The company is in the process of phasing out its payday loans business to concentrate solely on pawn stores. It is expecting earnings drag of about $0.3 per share in 2017 as it continues to close more payday lending units.

One of the reasons the company is doing this is because of increased regulation of payday lending in various States while at the same time, more entrants continue to make life difficult in the business. Currently, there are numerous payday lending businesses in the US that are solely online-based. These businesses have taken advantage of a particular group of borrowers that seem unlikely to get credit from other lenders.

For instance, MatchedLoans is an online platform that offers loans to people with no jobs, and given the emphasis major US lending institution place on a borrower’s credit score, it makes sense why there are so many businesses interested in this section of the credit market.

However, due to the sensitivity of the credit market, more states are now moving in to impose various rules on the market. These include capping interest rates charged on loans, as well as, the minimum number of months required to repay loans in the payday loans market.

These regulations alongside the ease of entry into the online payday loans business have been making life difficult for companies that are predominantly involved in pawn store lending, and this is why FirstCash is strategizing to focus on pawn shops.

Why payday lending exit could be a smart move for FirstCash

FirstCash is in no position to compete with privately-held online payday lenders. This is simply because, as a publicly traded company, it is under more scrutiny than its rivals in the private sector.

The company’s rivals have the freedom to change things as often as they wish to adjust to the changing environment in the market. FirstCash cannot afford this luxury because every major tweak in its operations is highly scrutinized and has to go through the board of directors.

On the other hand, most private payday lenders are owned by a few individuals making it simpler to make changes. Since the industry is currently transitioning into a more formal arena where certain regulations must be met, flexibility will be key to remaining competitive.

In its fiscal 2016 results, FirstCash said that one of the reasons for reducing exposure to the payday lending market was to maximize shareholder wealth in the long term. Since state restrictions began taking effect, small-dollar lenders can no longer charge exorbitant interest rates on loans, which used to go as high as 500%. Now, given the level of risk exposure to businesses involved in this market, it means the level of return they are getting may not be able to match the risk they take to give these small-dollar loans.

As noted earlier, these loans are at times given to people with no jobs as a fallback plan while hunting for new opportunities. In some cases, the borrowers default from payment thereby resulting in businesses losses for the lenders.

Now, for a company like FirstCash, which has the responsibility of creating wealth for its shareholders, it is pretty clear that the risk involved in the payday lending market outweighs any benefits that come with for publicly traded companies, especially following the capping of interest rates.

Conclusion

FirstCash’s merger with Cash America made it the largest pawn stores lender in the US and Latin America. The company has been shutting payday lending outlets since 2014 following a dogged campaign by various authorities to regulate the market.

By capping interest rates, the business became too risky for FirstCash and its publicly traded counterparts and that’s why the small-dollar loans market in the US has been experiencing a squeeze over the last few years. Right now, it is dominated by online payday lenders as these have the flexibility to adjust to adverse situations. Shares of FirstCash are up 11% over the last three months.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor ...

more