Aptiv - All Time High

Summary

- 100% technical buy signals.

- 14 new highs and up 24.43% in the last month.

- 69.93% gain in the last year.

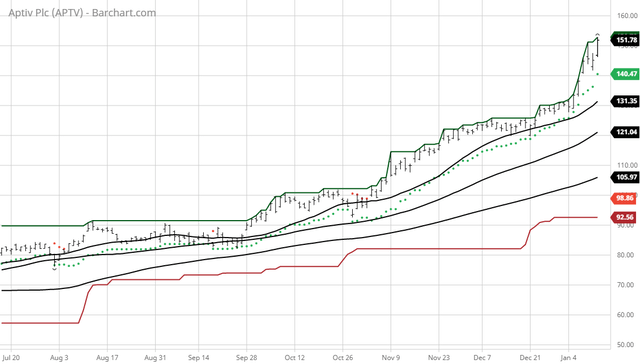

The Barchart Chart of the Day belongs to the auto parts company Aptiv (NYSE: APTV). I went on the assumption that stocks that have consistently hit new highs might continue to hit new highs. I sorted Barchart's New All-Time High list by the highest Weighted Alpha then used the Flipchart feature to review the charts for consistent upward momentum. Since the Trend Spotter signaled a buy on 11/3 the stock gained 24.43%.

Aptiv PLC designs manufactures and sells vehicle components worldwide. The company provides electrical, electronic, and safety technology solutions to the automotive and commercial vehicle markets. It operates through two-segment, Signal and Power Solutions, and Advanced Safety and User Experience. The Signal and Power Solutions segment designs manufactures and assembles vehicle's electrical architecture, including engineered component products, connectors, wiring assemblies and harnesses, cable management products, electrical centers, and hybrid high voltage and safety distribution systems. The Advanced Safety and User Experience segment provides critical components, systems integration, and software development for vehicle safety, security, comfort, and convenience, such as sensing and perception systems, electronic control units, multi-domain controllers, vehicle connectivity systems, application software, and autonomous driving technologies. The company was formerly known as Delphi Automotive PLC and changed its name to Aptiv PLC in December 2017. Aptiv PLC is headquartered in Dublin, Ireland.

(Click on image to enlarge)

Barchart technical indicators:

- 100% technical buy signals

- 106.369+ Weighted Alpha

- 69.93% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 24.43% in the last month

- Technical support level at 142.04

- Recently traded at 151.78 wiht a 50 day moving average of 121.05

Fundamental factors:

- Market Cap $39.18 billion

- P/E 78.26

- Revenue expected to grow 20.10% next year

- Earnings estimated to increase 128.00% next year

- Wall Street analysts issued 4 strong buy, 15 buy, 5 hold and 2 under perform recommendations on the stock

- The individual investors following the stock on Motley Fool voted 40 to 0 that the stock will beat the market

- 15,390 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

Disclosure: None.