Apptio IPO Set Up To Fall At Lockup Expiration

Apptio Inc. (NASDAQ: APTI) - Event Date 3.22 - Short Term PT $11.90

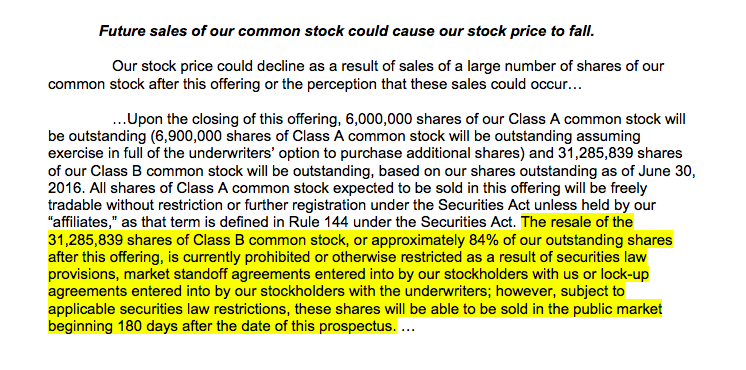

The 180-day lockup period for the Apptio Inc. IPO is scheduled to expire on March 22, 2017. At that time, the pre-IPO insiders will be allowed to sell their 31M shares.

(Source: SEC Filings/Risk Factors)

We previewed this event and short opportunity on our IPO Insights platform.

The combination of major pre-IPO shareholders, a substantial amount of restricted shares, and solid market debut could combine to push insiders to take early profits, thereby temporarily depressing APTI stock price around the lock-up expiration.

Business summary: Provider of technology business management solutions

Apptio Inc. offers a suite of technology business management solutions through both SaaS and cloud-based applications. The company pioneered its category because it identified a need within IT departments for data-driven systems on the same level as those for other sectors, like HR and finance. It counts more than 40 percent of the Fortune 100 companies among its customer base, and it reports that it is growing its customer base quickly.

Apptio has focused on growing its business, and it reported total revenues of $73.8, $106.6 and $129.3 million for 2013, 2014 and 2015, respectively. It also reported losses of $23.7 million, $32.9 million and $41.0 million in those years. Losses are typical to see in start-ups focused on growth.

Management overview

Sunny Gupta is a co-founder, chief executive officer, a director and the president of Apptio Inc. Gupta served as the CEO of iConclude Co. until it was acquired by Opsware Inc. He then served as an executive vice president of Opsware until it was acquired by Hewlett-Packard. Gupta also has prior experience working at IBM and Rational Software. He holds a Bachelor of Science in computer science from the University of South Carolina.

Lawrence Blasko has served as the chief revenue officer of Apptio since July 2016. Before that, he was a senior vice president of worldwide sales and a vice president of enterprise sales. Before joining the company in 2008, Blasko held leadership roles at Opsware Inc., Veritas Software and Computer Associates. Blasko holds a Master of Business Administration from The George Washington University and a Bachelor of Science from the University of Scranton.

Financial highlights

In its annual report, Apptio reported that it had total revenues of $160,569,000 for the year ending on Dec. 31, 2016. This was a substantial increase over its reported revenues of $129,251,000 for the year that ended on Dec. 31, 2015, demonstrating its continued growth. During 2016, the company reported a net loss of $28,151,000, which was a decrease from the reported net loss of $39,579,000 it reported for the year that ended on Dec. 31, 2015.

Early market performance

Apptio priced at $16, which was above its marketed price range of $13 to $15. During its market debut, its shares surged by 43 percent to $22.88. Since that time, the company's share prices have been falling, and it most recently closed at $12.89 on March 8, 2017, below its marketed price range and its initial pricing.

(Click on image to enlarge)

(Nasdaq.com)

Conclusion: Short or Sell Ahead Of Lockup Expiration

Given APTI's solid market debut, we expect early investors will be eager to take initial profits.

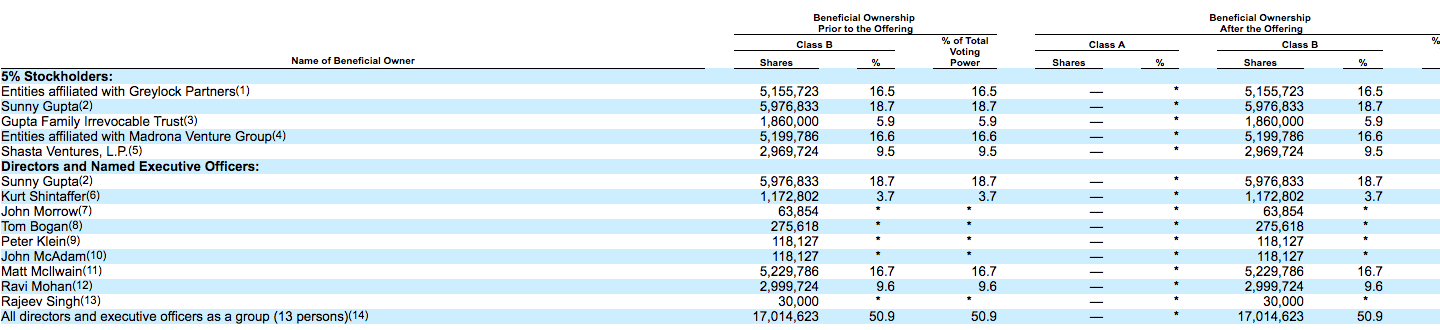

In particular, (see below) could be eager to move onto other investment opportunities and return gains to investors. If event some insiders sell, it could push APTI down considerably.

(Click on image to enlarge)

(Source: SEC Filings/Principal Shareholders)

As we've highlighted previously, we have observed abnormal negative returns in the two weeks surrounding many lockup expirations.

We therefore recommend investors sell their position or consider shorting APTI shares before March 22.

Disclosure: I am/we are short APTI.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not ...

more