Apple's 2Q 2017: Declining Sales Vs. Operational EPS

Apple (AAPL) released 2Q FY2017 earnings that were a slight disappoint, despite the low bar of modest consensus expectations.

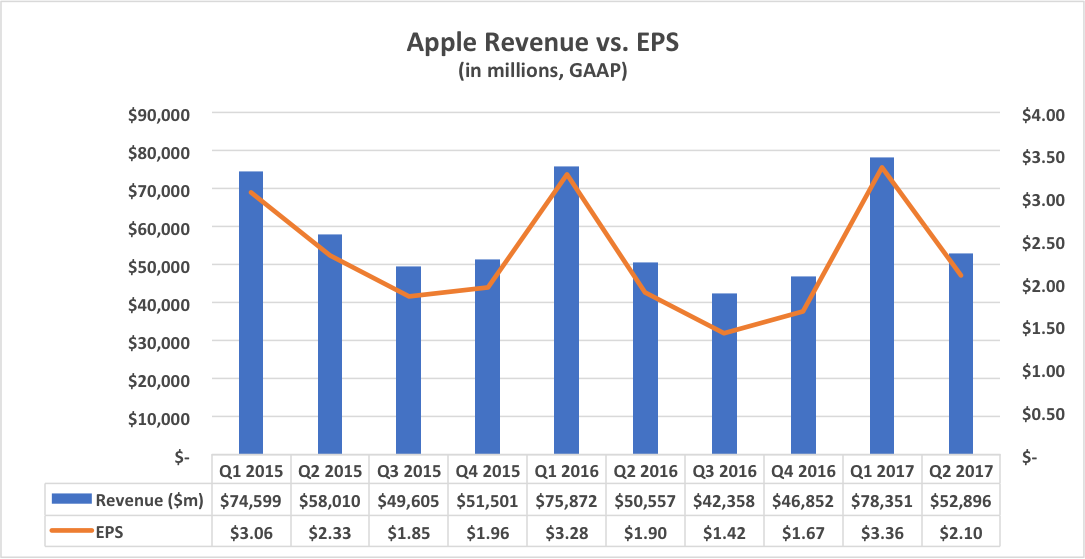

Revenue of $52.9b (+4.6% y/y) missed consensus by $190m, but was countered by better-than-expected EPS of $2.10.

Apple announced a $50b expansion of its buyback program (now $300b by March 2019), and raised its dividend from $0.57/share to $0.63/share.

Apple is now sitting on $256.8b in cash ($239.6b of which, or 93%, is stuck overseas).

______

On 02 May 2017, Apple released 2Q FY2017 earnings that were under top-line, but over bottom-line, consensus expectations. Quarterly revenue was $52.9b (+4/6% y/y, and in-line with Apple's own guidance), and EPS was $2.10 (+$0.08 vs. consensus). Apple's 2Q was pretty much as expected, with no big surprises and no big disappointments.

Earnings Breakdown

Apple's financials track closely to the retail cycle -- peaking around end-of-calendar-year holiday sales, and then dropping through spring into summer -- and this quarter was no exception. The 1Q to 2Q drop was anticipated, and while slightly below consensus, was still within the company's muted guidance. What stands out, however, is the why.

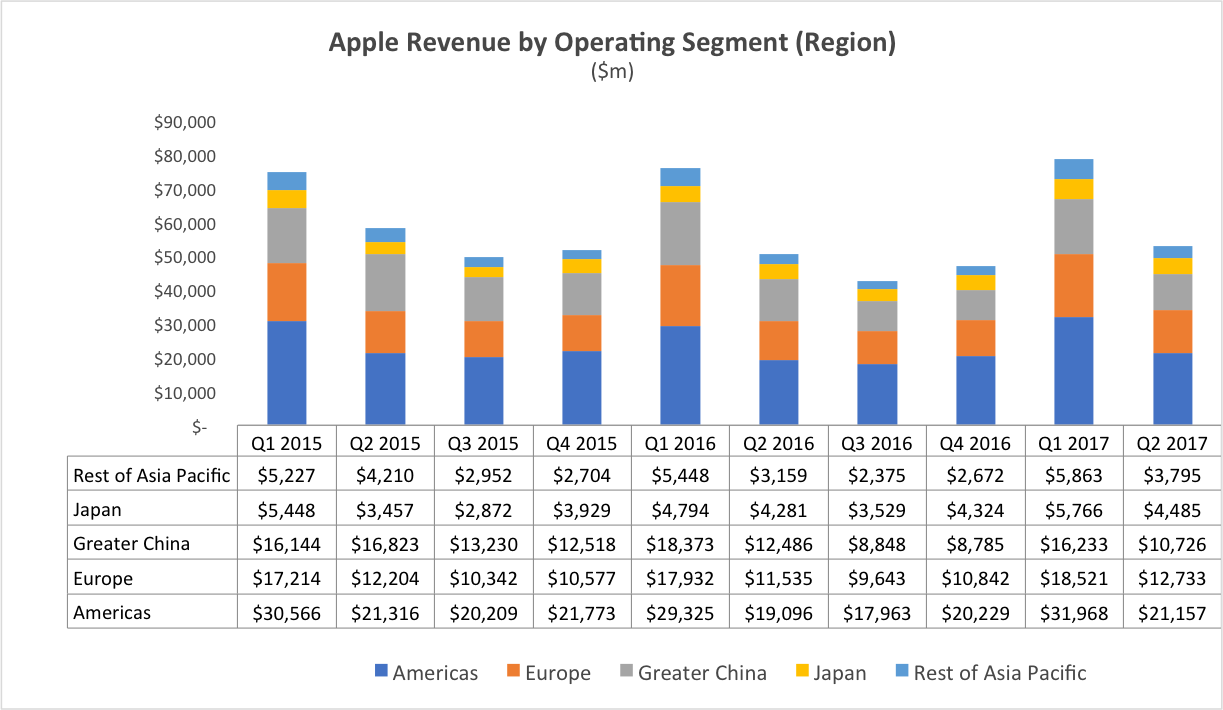

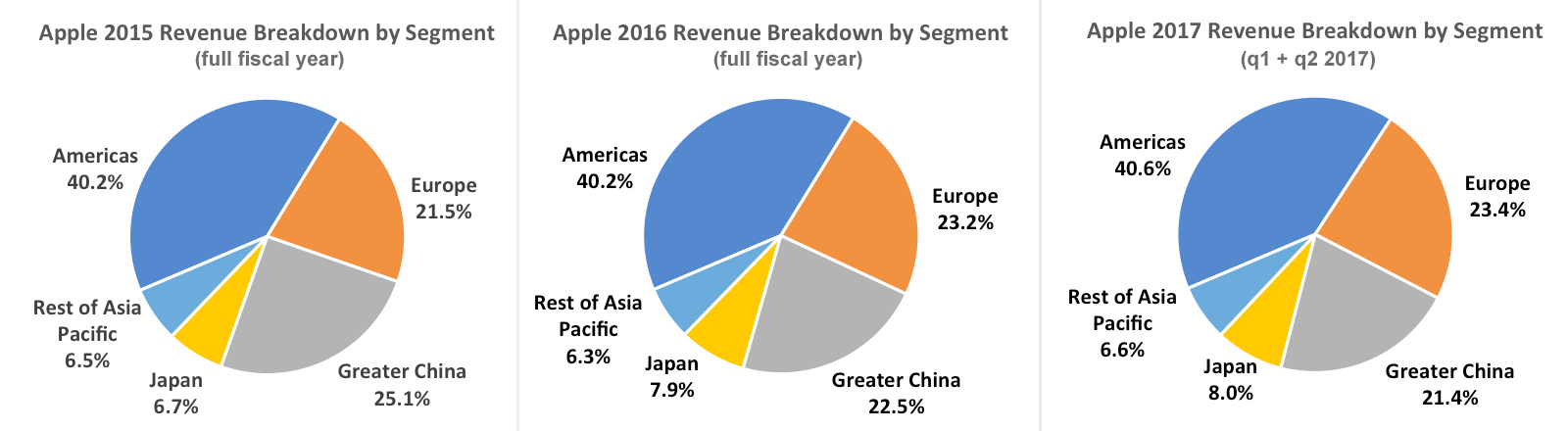

From a regional perspective, only China recorded a y/y decrease in revenue, dropping from $12.49b to $10.73b.

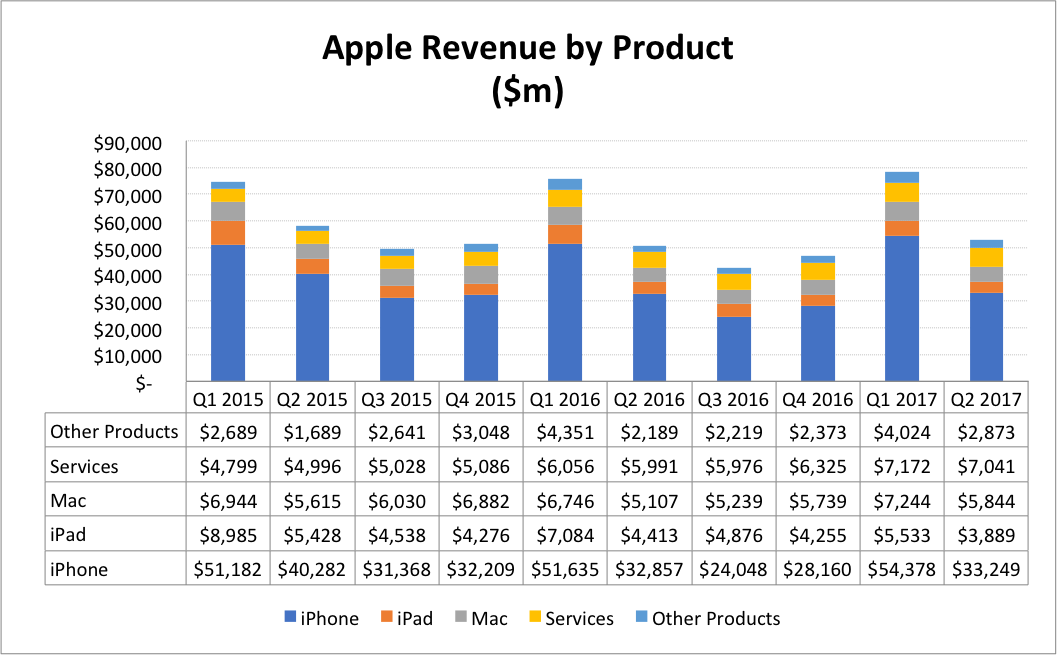

From a product perspective, only iPad sales (predictably) were down y/y. The higher-margin services category showed solid (and increasingly predictable) growth of +17.5% to $7b and represent a truly emerging bright spot. "Other products" (which includes Apple TVs, Apple Watches, Beats, and iPods) over-performed guidance by $400m to grow y/y from $2.18b to $2.87b (+31%), but is still only a little more than a rounding error for practical purposes.

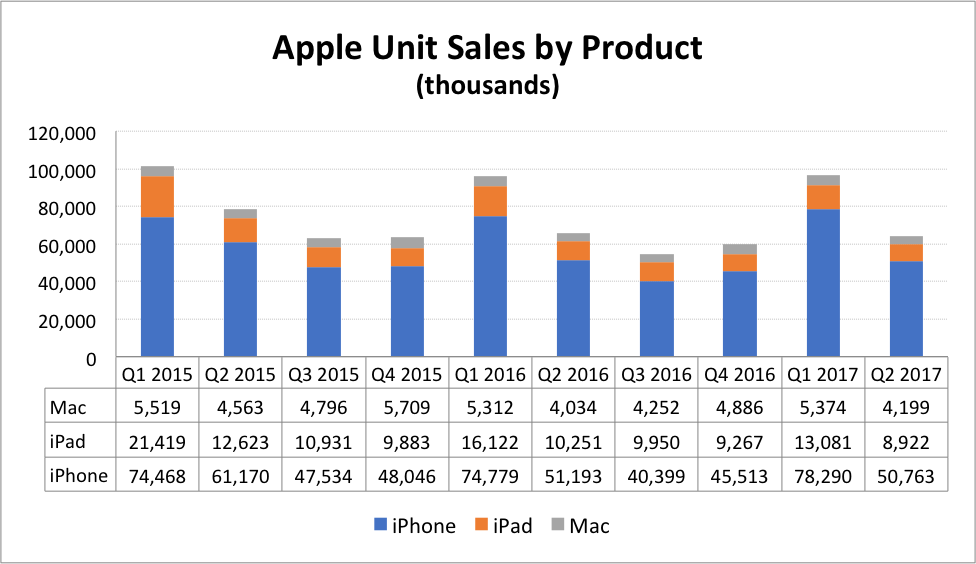

From a unit/volume perspective, Apple continues to face declining sales on its mobile products -- the iPhone (unexpected) and iPad (expected) shipments were both below consensus expectations and are trending downward y/y.

Top Positives from the Results/Call

1. Earnings. Tim Cook knows how to drive EPS and shareholder value in the face of declining revenue, though there is a limit to his ability to continue doing so without reaccelerating revenue growth. While y/y revenue only increased slightly, from $50.56b to $52.90b (a 4.62% y/y increase, but below consensus estimates), Apple managed to drive EPS upward from $1.90 to $2.10 (a 10.5% increase y/y, and above consensus estimates). Apple continues to demonstrate operational efficiency.

2. Apple Watch. Cook touted the Watch's performance during the Q&A. Sales have doubled in six of its top ten markets, cementing Apple's move into the wearable market. Cook described Apple's wearable line (which includes Beats headphones and AirPods, both of which sounds like a bit of stretch as "wearables") as a Fortune 500 company based on size. That said, we're still waiting for additional ecosystem build-out (such as in the medical field), in order to believe that this category can become a material driver of revenue growth.

3. Services. Cook suggested listeners think of Apple's services business (support, iTunes, Apps, etc.) as a Fortune 100 company due to its $7,041m of quarterly revenue - clearly a positive for this line, especially as the profitability is higher than its iPhone line (which dominates revenue). Total subscriptions across all services now sit at 165m, of which there is some overlap (as individual users can consume multiple services).

4. Cash. As we discussed on this morning's Cheddar NYSE Opening Bell (below), Apple generated $12.5b in cash during the quarter ($10b of which was returned to investors), and is now sitting on $256.8b total (although $239.6b, or 93%, is overseas awaiting repatriation).

5. Dividends. Apple announced a 10.5% increase in its quarterly dividend, from $0.57 to $0.63 per share (note: this translates to roughly $13.2b paid out annually, which would be greater than half of Iceland's forecasted 2017 GDP).

Top Concerns from the Results/Call

1. Uninspiring iPhone Sales. Apple brought in $33.25b from its iPhone product line, a modest +1% y/y increase on declining (y/y) sales of 50.8 million units, missing consensus expectations of 52 million. iPhone ASP (average selling price) increased slightly y/y from $642 to $655 (+2%), primarily as a result of increased demand for the larger 7 plus. We're also concerned with ongoing shortages/price increases of memory, which could erode margins in the near term.

2. The Not Our Fault Explanations. Weak iPhone 7 sales were attributed to a reduced channel inventory issue, missed estimates on demand, and too much hype about the pending iPhone 8 release, all of which Apple has the ability to anticipate and manage.

3. Underperformance in China. China is a difficult market for Apple. While it cited increased retail-store sales of 27% y/y and an increase in Mac sales of over 20%, total revenue in the region plummeted by 14% y/y from $12.5b to $10.7b, continuing a downward trend from 2Q 2015 when it accounted for $16.8b of total revenue. Note that approximately 30% of the q/q decline in revenue was attributed to foreign exchange issues.

4. Underperformance in India. Although management commented that revenue increased by double digits y/y, no further specifics were given and it is not clear that Apple is keeping pace with the competition. Apple will likely have to put in additional efforts to grow this market, and indicated it is actively working to do so, including efforts to open a developer center and additional retail stores. However, we are not optimistic the market can support Apple's higher price point, even on its lower-end SE models.

5. Qualcomm. This is less of a concern and more of an unknown. Apple is withholding royalty payments it considers unfair (as Qualcomm is charging royalties based on a percent of the overall value of the final iPhone product, not the actual technology being used). In response to Apple's withholding, Qualcomm has lowered its 3Q 2017 guidance by $500m and is rumored to be seeking a court-ordered ban on the import of internationally manufactured iPhones into the US.

We'll have to wait and see how this plays out, but for now, it's an unknown with a low probability of major impact (Apple is accruing payments).

Bottom Line

As we expected before the earnings release and call, Apple is all about the iPhone 8 at this point, using it to downplay its iPhone 7 underperformance (too much hype on the iPhone 8, resulting in delayed purchasing behavior), while betting on significant interest (and pent up demand) boosting 1Q 2018 at calendar-year end. But competition in the mobile phone market is only increasing internationally, and Samsung may be returning a bit stronger than anticipated.

Apple is clearly in transition, and it knows it. We've spoken in the past about the company's shift from an innovation-driven to an operations-driven focus, and now Apple must execute a market transition from iPhone-dominant value to a blend of iPhone and services-driven profitability.

As the iPhone (and other hardware) becomes increasingly commoditized, we're still looking for how Apple will differentiate itself long-term from its increasingly proficient competitors, including how it will expand its wearable ecosystem.

We're also looking for guidance on the fruits of Apple's labors in other areas, such as Project Titan, its autonomous driving project (which we believe will be primarily software-based, and not a Tesla-type competitor), and what it might be planning with the new satellite/imagery team it is building out (which could be part of a larger infrastructure play). We're also interested to see how Apple moves into the entertainment/content market, given its recent moves and desire to drive more renewable content subscriptions and services revenue.

Yes, we're positive on Cook's operational excellence, but it's unclear what this new 2018+ Apple will look like at this point. While Cook stated during the call "we're investing a ton in machine learning and autonomous systems," there has been little guidance regarding how this will fit into the larger portfolio (in contrast to Facebook, which has been increasingly open about its 10-year moonshot plan).

But perhaps most of all, we're very interested to see what it does with its cash, should it have the opportunity to repatriate. One option is to continue its smallish-acquisition strategy (nine acquisitions since Jan 2016, involving machine learning, automation, security, augmented reality software, mapping/navigation, and facial recognition). But we're also concerned about major acquisitions, such as the recent Apple-Disney rumor, or the slightly less discussed connections linking Apple (at the board level) to Boeing and its broadband satellite effort.

Moving into 3Q 2017, we anticipate seasonal softness may be compounded by additional declines in iPhone sales (pending the iPhone 8) and in China (due, to both increased competition as well as the growth of all-in-one apps, like WeChat, that negate much of the Apple app/value proposition). We'll also be looking to see how quickly Apple can increase sales in the Wearable and Services categories.

Disclosure: I am/we are short AAPL (with puts)

For more insights, check out this free trial of Samadhi's more