Apple Is A Short Into Earnings

It was reported by Japan's Nikkei that Apple has warned suppliers that they need 20% fewer components for its upcoming IPhones suggesting that demand is weaker than anticipated in the maturing smartphone market. This only makes sense as smartphone prices have escalated and there have been only minor upgrades to the specs in recent years, i.e., a couple more megapixels doesn't really move the needle anymore. All smartphones can make calls, take pictures, watch movies, text and send files. Only very small incremental changes that most people don't even require are what separates phones from 3 years ago to the latest product offerings.

Consumers are going to hold onto their expensive smartphones for longer than ever before in the decade plus evolution of the smartphone device. This is bad news for companies like Apple who is so reliant on one device for the majority of its earnings profits and margins. Last year Apple told suppliers to plan on 100 million IPhone 8, IPhone 8 Plus, IPhone X device shipments which contrasts sharply to this year where Apple is telling suppliers to prepare for 80 million iPhones, that is quite a 20 million haircut, for what analysts were labeling the game changing IPhone refresh cycle. Remember all that analyst talk and hype that led up to the release of the IPhone 8? No wonder there are all those buy one get one free deals going on at the cell phone carriers lately.

We have been getting these supply chain reports for a couple of months now, when in late April the CFO of a key Apple chip supplier -- Taiwan Semiconductor warned of "mobile softness" and "continued weak demand" when it reported earnings. We have also been getting a pattern of reports from the semiconductor companies that make processors used in iPhones that demand for new smartphones is weaker than expected, which is even more telling of the nature of the smartphone market given the robust economy overall. Remember that supply chains have a lag effect, and we started to get these reports in late April, and they are continuing as recently as last Friday for the fall forecasts for IPhone demand. It seems things are deteriorating in this market, and are only going to get worse from here. I have a feeling Apple is going to miss their earnings report in early August, and miss rather significantly for the first time in a long time on these IPhone numbers.

This is the fundamental reality of a slowing and declining smartphone market what we refer to as the end of the Smartphone supercycle where we think smartphone prices and margins are only going to come down from here and keep going down year after year going forward for the next decade. The fact is that a $50 smartphone and a $1000 smartphone have more in common than they have differentiating features, and this trend will only continue going forward is very bearish for high end margins.

The next frontier battleground for market share at the high end segment will be the price wars between Samsung and Apple just like we saw in the carrier segment of the market. All smartphones will be completely commoditized in two years if it hasn't already reached that point today. Consumers will buy a smartphone for $250 at most, slap a protective case on it, and call it a day. The days of waiting in lines, paying $800-$1,000 for a ubiquitous rectangular device that makes calls and takes pictures, or serving as status symbols are over for the smartphone Supercycle.

This is juxtaposed with a stock that had a decade plus of everyone and their uncle piling into Apple stock in the most crowded trade in financial markets setting up quite an avalanche of disappointed investors who thought Apple would realize these fat and obviously unsustainable margins for the rest of eternity. Product cycles mature just like business cycles, and IPhones have more in common with the Commodity Supercycle than many analysts and investors realize, and that ended poorly as China stopped building a new city every month which negatively affected iron ore, oil, and many other industrial commodity input prices and components. What makes it even worse for smartphones, is that we still use Oil everyday, but Smartphones have replacement cycles these days from three to five years.

Now perpetual bulls like Warren Buffett will have you believe that "Obsessing over iPhone sales misses the whole point of Apple stock" or some other trite cliche investing wisdom that Warren routinely spouts off every time he is interviewed regarding negative economic or company specific news. Remember his ‘market wisdom’ regarding IBM`s dismal quarter after quarter declining revenue numbers, it's called a market rationalization.

When a company has been valued and run up for a decade on IPhone sales, gets the majority of its revenue and profit margins from IPhone sales, has cash reserves to buy back shares solely due to robust IPhone sales, has been hyped and oversubscribed by investors based upon future IPhone sales in the US and China it is bigtime news when this market and product dynamic appears to be changing and slowing down.

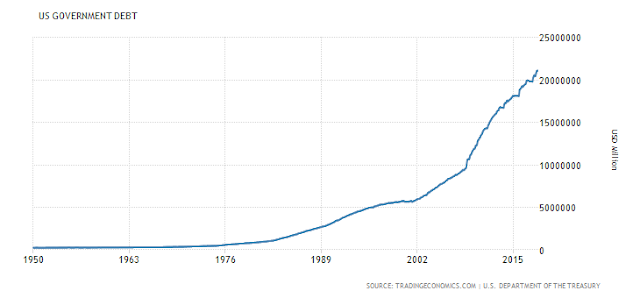

Has Warren Buffet ever made a statement to sell stocks that he has owned ever? It is ironic that he has always been negative regarding bond market valuations, and fails to realize that the same liquidity responsible for “unnatural bond market valuations” is also responsible for historically overpriced and unnatural stock price valuations, namely central bank QE stimulus.

Warren Buffett was talking up stocks all the way down during the Financial Crisis of 2007, lucky for him he was bailed out by Central Banks, talked up IBM all the way down to finally throwing in the towel, and will be defending Apple`s declining revenue numbers probably for years before he realizes he came far too late to the Apple Stock Party, and will always be the perpetual ultimate bagholder of last resort for stocks. However, Warren there is no Central Bank or Government bailout this time around, all those tools are gone, used up as the overwhelming debt levels and historically low global interest rates are clearly illustrating right now. Thus you will have no market savior this time around for your bagholder strategy of just buying and holding through the financial market and inevitable stock market crash.

If Warren Buffet knew anything about investing in Technology he would have bought Apple 20 years ago, even 10 years ago, even five years ago, not at the very end of the 10-year business cycle, 10-year Global Central Bank QE Era, and the end of the 10-year Smartphone Supercycle.

Apple stock is a sell into this earnings release in early August with its stock currently trading at all time highs, and it is a medium term short over the next two years, and is a longer term short over the next ten years as the most crowded trade on the street for the last decade unwinds. Apple`s stock decline will be Warren Buffett`s clue to retire from financial markets, as he has lost an investing step.

Comments on Warren Buffer aside. I agree with the analysis on $aapl. I wrote a similar article regarding slowing iphone sales back in October. Since then Apple has rallied but not as much as it should have given the size of Buffets buying and stock buybacks. Will make a good short one day.