Antero Midstream GP LP Set Terms For IPO; We Remain Cautious

Antero Midstream GP LP (AMGP) filed an S-1/A with the Securities and Exchange Commission for its upcoming initial public offering. The company intends to sell 37,250,000 shares at a marketed price range of $22 to $25. It has an additional 5,587,500 shares as an overallotment option for its underwriters. Assuming it prices at the mid-point of its price range, and underwriters exercise their option to purchase additional shares, it would have a market cap value of $3.37B. The company is expected to make its debut on Thursday (5.4).

All the common shares being offered in the IPO are from selling shareholders and the company will not receive net proceeds from the IPO. Upon completion of the IPO, selling shareholders will own 80% of common shares.

The underwriters for the IPO are Morgan Stanley, Barclays, J.P. Morgan, Baird, Citigroup, Goldman, Sachs & Co., Wells Fargo Securities, Credit Suisse, Scotia Howard Weil, Tudor, Pickering, Holt & Co., Evercore ISI, Raymond James, D.A. Davidson & Co., Janney Montgomery Scott, Ladenburg Thalmann and MUFG.

Business summary

Source: anteromidstream.com

Antero Midstream GP LP is based in Denver, Colorado. The company owns the general partner of Antero Midstream Partners LP (NYSE: AM) and all of its incentive distribution rights (IDRs). Based on its production volumes during the fourth quarter of 2016, the company reports that Antero Resources is the eighth biggest natural gas producer in America and the second largest producer in Appalachia.

As of Dec. 31, 2016, the company held 616,000 productive acres in the Marcellus Shale in northwestern West Virginia and southwestern Pennsylvania and in the Utica Shale in Ohio.

Executive management team

Paul M. Rady is the chief executive officer of Antero Resource's general partner and has served in that position since Jan. 2017 and as chairman of the board of directors of it since April 2017. He has also served as the chairman and CEO of the general partner of Antero Midstream since Feb. 2014. Rady co-founded Antero Resources in 2004 and its predecessor in 2002 and served as its CEO from its founding. Previously he held multiple progressively responsible roles for other gas and oil companies dating back to 1990. He holds a Bachelor of Arts in geology from Western State College of Colorado and a Master of Science in geology from Western Washington University.

Glen C. Warren, Jr. is the president and secretary of Antero Resource's general partner, serving in those roles since Jan. 2017. He previously served as the chief financial officer, president and secretary of Antero Midstream's general partner starting in Feb. 2014. He was the chief financial officer, secretary, president and a co-founder of Antero Resources and its predecessor in 2002. Before Antero Resources, Warren served as an executive vice president and the CFO of Pennaco Energy from 1998 until 2001. He previously worked for 10 years as a natural resources investment banker. He holds a Bachelor of Arts from the University of Mississippi, a Master of Business Administration from the University of California, Los Angeles and a Juris Doctor from the University of Mississippi School of Law.

Financial highlights and risks

The Antero Midstream GP LP cash flow is completely dependent on the ability of Antero Midstream to make distributions on its IDRs. Nearly all of Antero Midstream's revenue is derived from Antero Resources (99.86% in 2016). The company generated $590.2M in revenue in 2016, versus $387.3M in 2016. The increase in revenue was driven by an increase in E&P activity. Direct operating expenses doubled, due to significant increase in spending on fluid handling services, a service which did not begin until the end of 2016, and expanded as part of the business in 2016 and 2017.

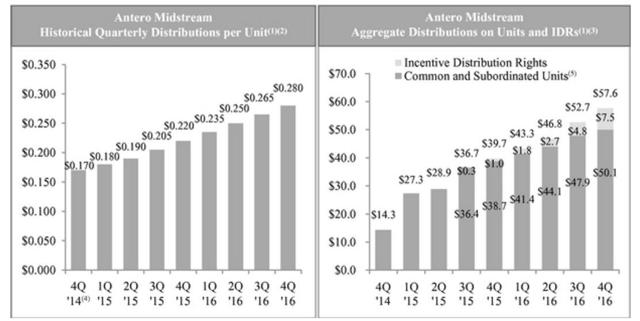

Antero Midstream has a history of increasing its cash distributions, growing from $0.17 per unit ($0.68 on an annualized basis) in Q42014 to $0.30 per unit ($1.20 on an annualized basis) in the most recent quarter. It expects a 28% to 30% for 2017 distributions, compared to 2016. In 2016, the company had $16.94M in equity a net income of $9.7M and $1,2M and net income of $781,000 in 2015.

(S-1/A)

As of December 31, 2016, it had cash and cash equivalents of $6.8M, total assets of 1.98B, and total liabilities of $897.2M.

Conclusion: Consider Caution

Despite increased performance we are wary about the oil and gas industry more broadly and whether current trend will continue. The company's complete reliance on Antero Resources for revenue also gives us pause.

With interest rates expected to rise this year, we worry this could depress the value of Antero Resource's shares.

We recommend avoiding this IPO unless comfortable with the volatility of the oil and gas industry.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in AMGP over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more