Anaplan Could Keep Going Lower As IPO Lockup Expires

April 10, 2019, concludes the 180-day lockup period of Anaplan Inc. (PLAN).

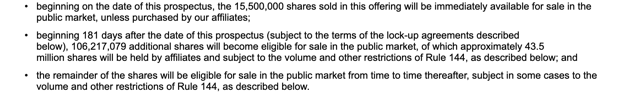

When the lockup period ends for Anaplan, its pre-IPO shareholders and company insiders will have the opportunity to sell more than 106 million currently-restricted shares. With just 15.5 million shares trading pursuant to the IPO, there is a significant chance that sales of this stock could flood the secondary market for PLAN and cause a sudden, sharp downturn in share price.

We believe that pre-IPO shareholders and company insiders will be particularly eager to cash in on some of their gains: PLAN currently trades in the $37 to $38 range, a return from IPO of more than 128%.

Business Overview: Provider of Online Planning Platform

Anaplan is an SaaS company that offers a connected planning platform. Its proprietary technology called Hyperblock powers the platform and was created just for this purpose. The in-memory modeling engine is able to calculate massive quantities of data with its 64 bit, multi-core processors, delivering insights in real time. Anaplan markets its platform as having the ability to unite otherwise disconnected database structures, such as columnar, relational, or analytical processing. Typically, these structures are used in areas like operations, human resources, marketing, finance, and sales.Anaplan sells its products as a subscription service.

Anaplan's platform gives its clients the ability to run alternative scenarios very rapidly. This allows them to assess the impact of proposed or actual changes in business assumptions in real time.

The company's clients include Thomas Cook, LegalZoom, Helly Hansen, Target Australia, Carter's, Satsuma, Booking.com, Sonos, Del Monte, United, HP, Zillow, Pandora, Dish, McAfee, and more. The company operates in the United States, across Europe, Japan, India, Russia, Singapore, and the United Kingdom. Anaplan was founded in 2008, has approximately 1,100 employees, and keeps its headquarters in San Francisco, California.

Company info was sourced from the firm's S-1/A.

Financial Highlights

Anaplan Inc. reported the following financial highlights for the fourth quarter and its fiscal year ended January 31, 2018:

Fourth Quarter

-

Total revenue reached $69.3 million for an increase of 49 percent.

-

GAAP operating loss was 42.7 percent or $32.7 million of total revenue, versus 42.7 percent or $19.8 million in the fourth quarter of fiscal 2018

-

GAAP loss per share was $0.27 versus to $0.97

-

Cash and Cash Equivalents were $326.9 million as of January 31, 2019

Full Year Fiscal 2019

-

Revenue was $240.6 million for an increase of 43 percent

-

Subscription revenue increased 45 percent for $208.6 million

-

GAAP operating loss was 53.3 percent or $128.3 million versus 27.3 percent or $45.9 million

-

GAAP loss per share was $2.46 versus $2.51

Financial highlights were sourced from the company's Investor Relations site.

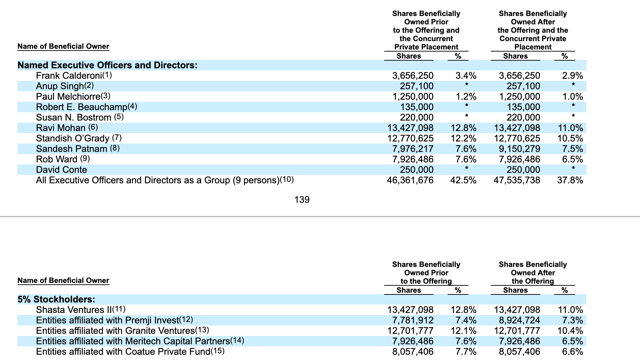

Management

President and CEO Frank Calderoni has served in his position since January 2017. He previously held positions at Red Hat, Cisco Systems, QLogic, SanDisk, and IBM. He earned a BS in Accounting and Business Administration from Fordham University. He earned his MBA from Pace University.

CFO David Morton has served in his position since September 2018. He previously held senior financial positions at Tesla and Seagate Technology. He earned a BS in Business Administration from California State Polytechnic University, Pomona.

Management bios were sourced from the firm's website and S-1/A.

Competition: Legacy Systems, IBM, SAP, and Oracle

As stated in its SEC filings, Anaplan believes that much of its competition comes from conventional, manual processes that are spreadsheet-driven. It also faces competition from legacy vendors like IBM (IBM), SAP (SAP), and Oracle (ORCL).

Early Market Performance

The underwriters priced the IPO at $17 per share. Its expected price range was $13 to $15. The stock closed its first day at $24.30 for an increase of 42.9 percent. The stock reached a low of $21 on November 20. Share prices recovered to reach a high of $40.68 on March 14. Shares of PLAN have a return from IPO of 128.4%.

Conclusion

When PLAN's IPO lockup period expires, more than 106 million currently-restricted shares of PLAN will be eligible for trading. This number dwarfs the 15.5 million shares trading pursuant to the IPO. We believe that there is a significant potential for the secondary market for PLAN to be flooded when the IPO lockup expires. We believe that this will send shares sharply lower in the short term.

The group of company insiders and pre-IPO shareholders who own these shares include numerous executives and five 5% shareholders.

Aggressive, risk-tolerant investors should consider shorting shares of PLAN ahead of the April 10th IPO lockup expiration. Interested investors should cover these short positions during the April 11th and April 12th trading sessions.

Disclosure: I am/we are short PLAN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more