Analysts Weigh In Lululemon Athletica Following Meeting With New CFO

Analysts recently met with Lululemon Athletica Inc’s (NASDAQ: LULU) new CFO, Stuart Haselden, to discuss the future of the company. He is replacing John Currie, who was with Lululemon for 7 years and announced his retirement in June.

The transition comes as Lululemon is working to restore its reputation. In March 2013, Lululemon recalled a series of yoga pants after they were found to be transparent. In February, founder and CEO Chip Wilson stepped down from the board, after already stepping down as CEO, claiming that he had achieved his goals as a board member. Wilson came under fire for responding to the transparent pants recall by saying that the pants “don’t work for some women’s bodies” due to different body shapes.

Recently, Lululemon has been trying to expand its menswear options. In addition to opening its first store for men in New York City in November, the athletic retailer released the ABC pants for men. The ABC pants, or “anti-ball crushing” pants, are built for men’s comfort. The pants retail for $128.

On April 8, Sam Poser of Sterne Agee upgraded Lululemon from Neutral to Buy with a price target of $77. Upon meeting with the new CFO who will be replacing John Currie, Poser is “becoming confident that ongoing margin and sales growth is in the offing” after being “wary” of the retailers long-term growth opportunities. Poser remains concerned that international growth is “spread too thin” but overall believes that Lululemon is investing in its brand, which will pay off in late 2015 and 2016.

Sam Poser has a 72% overall success rate recommending stocks and a +16.8% average return per recommendation.

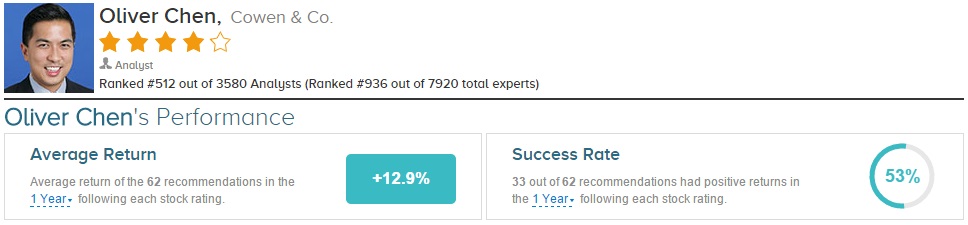

Separately on April 8, analyst Oliver Chen of Cowen & Co. reiterated an Outperform rating on Lululemon and raised his price target from $72 to $74. After meeting with the new CFO, Chen commented that he remains “impressed w/continued healthy momentum, driven by high degree of product newness, solid inventory control & full-px focus.” He believes first quarter and “LSD comp guide is achievable & accelerating momentum likely as new spring product flows into stores.” Chen’s three main focuses are “L-T margin drivers, tank/pant wall upgrades, & robust men’s [opportunity].”

Oliver Chen has a 56% overall success rate recommending stocks with a +13.4% average return per rating.

On average, the top analyst consensus for TipRanks is Hold.

Disclosure: To see more ratings for Lululemon, visit more