An Underestimated Chinese Commodities Service Provider

Summaries:

- The market has undervalued China's commodity supply chain which those leading companies with a tendency to digitize and connection of the upstream and downstream chains should enjoy higher valuations.

- TD Holdings is a still-growing Chinese commodity supplier company whose valuation is expected to move all the way up as its performance is turning around.

Significant earnings growth in the second quarter

TD Holdings (Nasdaq: GLG) achieved total revenue of $59,839,600 in the second quarter of 2021, compared to $1,942,400 in the same quarter last year, an increase of nearly 30 times year-over-year. Viewing the performance over the previous few quarters, TD Holdings has seen visible growth in income. In total, it achieved annual revenue of $89,421,900 for the year ended June 2021, up 2,714% year-over-year, and gained net income of $357,800, a turnaround that compared to a loss of $5,462,400 for the same period last year.

The cost of purchasing non-ferrous metal products covered a big part of the company’s cost of revenue. For the three months ended June 30, 2021, it bought $57.93 million of non-ferrous metal products from 15 third-party suppliers and $1.53 million from five related party suppliers.

According to the announcement, the increase in the company’s revenue in the second quarter was primarily the result of the booming global commodities market that had propelled the price to rise and the demand to increase.

The undervalued commodity supply chain industry

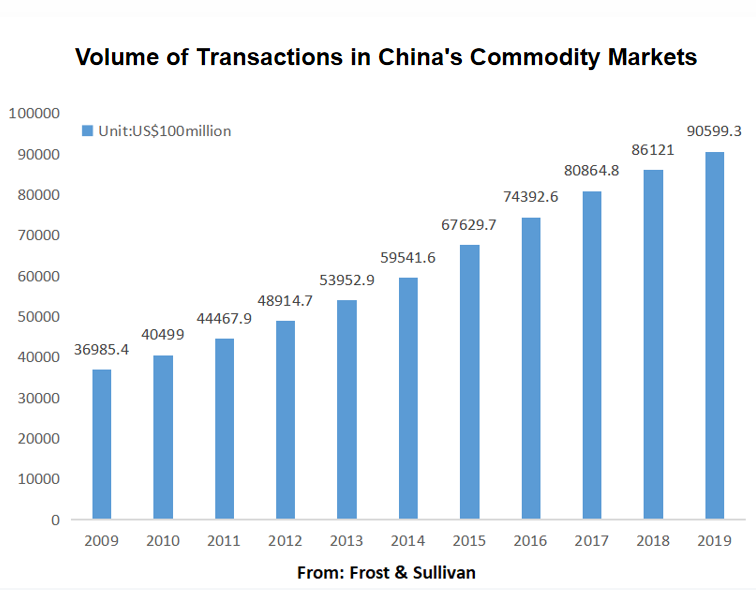

According to Frost & Sullivan's data, China’s commodities market transactions grew from $3.7 trillion to $9.05 trillion from 2009-2019. The actual market size will be even larger as commodities trade from upstream to downstream theoretically includes a variety of businesses such as commodity procurement, sales, logistics, and finance. According to the China Federation of Logistics and Purchasing (CFLP), the total sales of commodities in China reaches around $12.356 trillion in 2020, with an average growth rate of 5.9% over five years.

(Click on image to enlarge)

The demand for commodities in China’s manufacturing sector is huge, and the transaction volume is sizeable. However, owing to different commodities have different reserves and outputs, there could have appeared supply-demand mismatch like undersupply or oversupply for some commodities, and it takes time for this imbalance to be reflected in the market, which makes the existence of an effective commodity trading platform very necessary.

Acting as a “lubricant” between the buyers and sellers, commodity trading platforms provided by companies can facilitate the flow of commodities. However, traditional commodity providers are trapped in troubles like low-profit margins, poor cash flow, high leverage, and a lack of uniform standards for warehousing data and operations, as well as inefficient use of corporate resources.

In recent years, TD Holdings and many other Chinese companies have launched digital transformation campaigns to fix their dilemma. They have built digital platforms focused on the commodity industry chain, making transactions between upstream suppliers and downstream buyers simpler and trading more efficient. The initiative provides solutions to end-to-end integrated bulk commodity logistics, which help companies to gain steady logistics service fees.

The out-of-date image of Chinese commodity service providers remains among the current market. Instead, the dominant have cleaned out the barriers between the upstream and downstream through the establishment of digital platforms, expanding their industrial chains by acquisitions and other means to strive to build a one-stop chain that integrates purchasing and marketing, logistics and finance. As the enterprises that lead the way to grow with better performance, they would catch more attention from the market and will have a greater promising future.

TD Holdings’ development awaits market test

Through mergers and acquisitions, TD Holdings is gradually transforming itself into an entity manufacturer that takes control over the source of commodities. As a segment of its globalization strategy, it has stretched out its business to global mineral resource development which plans to gradually acquire non-ferrous metal mining rights around the world in the next 5-10 years to enrich the company’s commodities category and strengthen its pricing power over global commodities.

In addition, TD Holdings has successfully entered the unmanned logistics and new energy automobiles industries through the acquisition of two Chinese new energy vehicle companies, Guangdong Jinbochuang Special Purpose Vehicle Co., Ltd and Hunan Jinmeike New Material Co., Ltd. It is also about to strengthen its presence in the logistics sector with the launch of GLG brand driverless light-weight trucks for bulk commodities.

Apart from the efforts to continue its basic commodity supply chain services, TD Holdings also expands new businesses through mergers and acquisitions and other means, which is expected to bring sustainable revenue and net profit improvement to the company. As such, the company’s performance over the next 12-24 months is worthy of attention because it has the potential to become the giant of China’s commodity supplier in the next generation.

Disclaimer: This article is prepared by Mentor Finance (the "Company") and by certain qualified investors (such as professional investors). By reading this article, you agree to keep ...

more