"An Inability To Turn Around": Deutsche Bank Slides After Reporting Dismal Earnings

That merger between Deutsche Bank and Commerzbank, which is contingent on the biggest German lender's inability to turn operations around, is looking increasingly likely, because earlier today Deutsche Bank reported earnings which confirmed that, well, it is simply unable to make said much-needed turn.

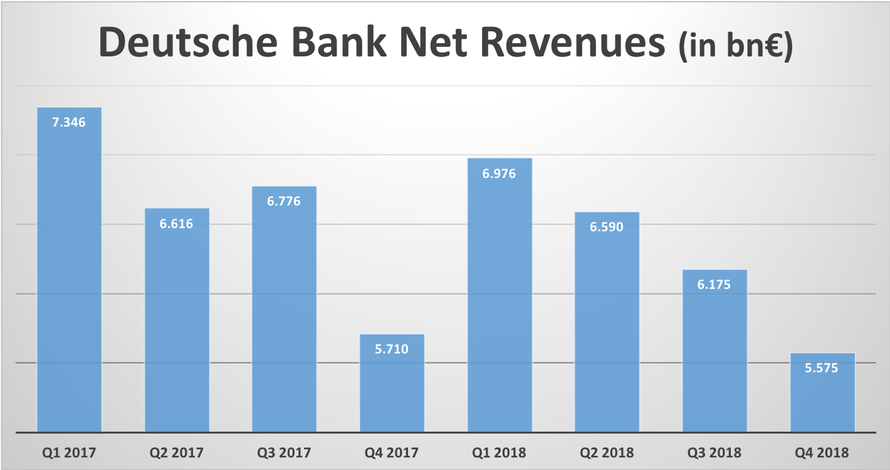

Deutsche Bank reported Q4 net revenue of €5.58BN - the lowest quarterly print in years - and 2.6% below the average analyst estimate of €5.73, led by another decline in trading revenue, resulting in a pretax loss of €319 million in line with estimates of a €331.0 million loss.

And as the bank shrank for an eighth straight quarter in the final months of last year, CEO Christian Sewing pledged, even more, cost cuts although it is clear by now that cost-cutting has starting to eat into profits.

To wit, in the volatile fourth quarter, in which market gyrations were supposed to help the company's trading desk (despite images of police raiding the bank’s headquarters in November) revenue shrank another 2.4%, led by a slump in the key fixed-income trading business that did even worse than peers. The key bank's securities unit slumped, losing market share particularly in fixed income trading, where revenue slumped 23%, but also in equities, which declined 0.8%; both missed consensus estimates. The bank's U.S. peers on average reported a 17% drop in FICC and 4% higher equities revenue.

Here are the key results in a nutshell:

- 4Q FICC sales & trading revenue €786 million, missing the est. €992.0 million

- 4Q equities sales & trading revenue €379 million, missing the est. €372.0 million

- 4Q sales and trading revenue €1.17 billion, missing the est. €1.34 billion

- 4Q Investment Bank revenue €2.60 billion, missing the est. €2.72 billion

And so clearly unable to rightsize the company's revenues, the bank focused on cutting even more costs instead. To appease angry shareholders, CEO Sewing boosted his target for adjusted costs, promising to keep them below 21.8 billion euros this year, compared with the 22 billion euros previously announced, and affirmed a plan to return at least 4% on tangible equity “despite a challenging market environment.”

Sewing also said the bank would return to “controlled” growth, a promise that eluded his predecessor, and said if revenue keeps disappointing, he’ll find more savings. At some point, though, even he will have to admit that at this point DB has cut out all the fat and is increasingly chopping away muscle, with any new terminations resulting in direct hits to the bottom line.

“Management has delivered on what is in their control in the medium term: cost, capital and liability optimization,” JPMorgan Chase analyst Kian Abouhossein said. "However, for now, we remain concerned about Deutsche Bank’s inability to turn around fixed-income trading."

Despite the latest dismal results, Sewing did deliver on one pledge: to post the first annual profit in four years, with Deutsche Bank reporting net income after minority interests of 267 million euros for 2018, despite a bigger-than-expected loss in the final three months. The bank also achieved a target of keeping costs, adjusted for one-time items, to below 23 billion euros.

Looking ahead, however, there was little clarity, with the company merely focusing on more cost-cutting instead of providing a roadmap to higher revenues: “If the revenue environment does not develop as we expect, we will seek additional savings,” Sewing said. “Beyond 2019, we are still committed to further reducing our costs and improving our cost-income ratio.”

As Bloomberg notes, the prolonged revenue contraction is adding pressure on the CEO and Chairman Paul Achleitner to explore alternative fixes for Germany’s largest lender. Sewing, who only took over last year, has pleaded for patience with his strategy of expense controls and a scaled-back investment bank, but the government is worried he may not succeed before the next economic slowdown.

To be sure, DB's CFO tried his best to spin the results in a favorable light: "We feel we are in control of our destiny, we’re executing against our plans,” James von Moltke, the bank's chief financial officer, said in an interview on Bloomberg TV. Still, "there’s a lot of talk in the sector overall, that over time mergers, consolidation in the European banking sector would be sensible for a variety of reasons. We’ve tended to agree with that."

Von Moltke also said that the recent police raid “absolutely impacted” business in December. A group of about 170 law-enforcement officials searched the bank’s headquarters and other offices in late November, in a case tied to the Panama Papers, fueling market concern about potential legal fines. Sewing said at the time that the bank had considered the case closed, having examined it in 2016 when news about the Panama Papers first broke.

“Clearly being in the headlines in that way is unhelpful for client confidence,” von Moltke said. “We’ve gone some way to restoring that. There’s more work to do to communicate the nature of these issues.”

The bigger problem than money laundering, however, is that Germany’s largest bank has been facing declining revenue for four years, turning the shrinkage, especially in the most profitable investment banking division, into the top concern among investors and analysts alike and sparking speculation it may ultimately seek a merger with Commerzbank which may come as soon as this summer.

While a deal is viewed by some as an imperfect solution, the German government -- which on Wednesday slashed its economic growth forecast for this year -- has said it wants strong international banks to support Germany’s export-oriented companies. The country still owns a large stake in Commerzbank after a bailout. It doesn’t own a stake in Deutsche Bank.

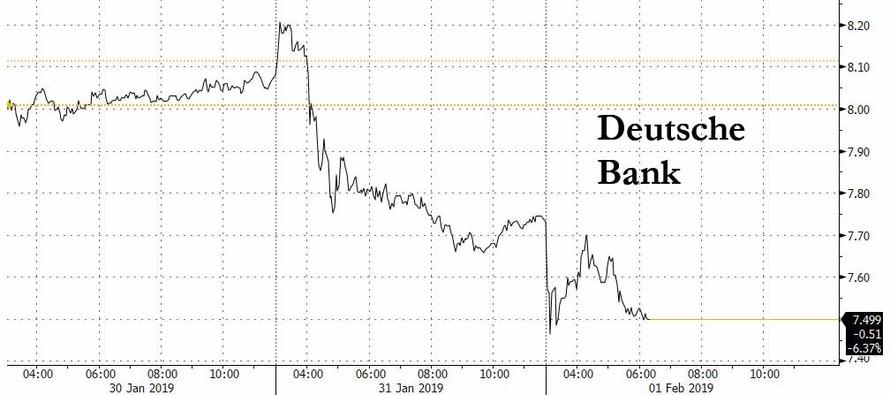

For now, however, investors appear to have thrown in the towel, with DB stock initially jumping then sliding 3.4% after the results.

The good news is that for now at least, DB, which was the worst performing Stoxx 600 member in 2018, is still up on the year. We don't expect this to hold, especially if the yield on longer-dated European yields keeps sliding and there is no rebound in Germany's economy, which after today's terrible German Mfg PMI is not looking likely.