Ameresco - Chart Of The Day

Summary

- 100% technical buy signals.

- 15 new highs and up 17.03% in the last month.

- 26.74% gain in the last year.

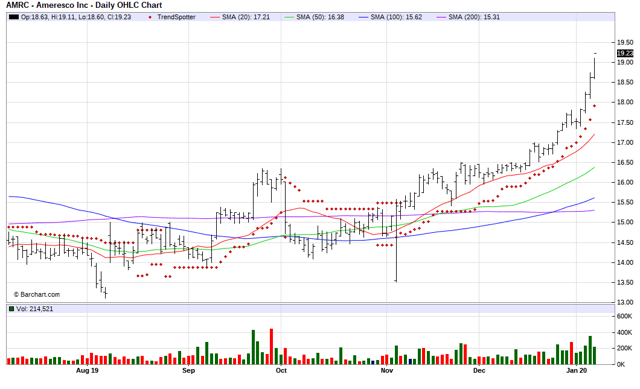

The Barchart Chart of the Day belongs to the energy efficiency contractor Ameresco (AMRC). I found the stock by using Barchart to sort it's list of New All-Time High stocks first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 11/7 the stock gained 23.62%.

Ameresco, Inc. provides comprehensive energy services for businesses and organizations in North America and Europe. It offers energy efficiency, infrastructure upgrades, energy security and resilience, asset sustainability, and renewable energy solutions. The company operates through U.S. Regions, U.S. Federal, Canada, and Non-Solar Distributed Generation segments. It designs, develops, engineers, and installs projects that reduce the energy, as well as operations and maintenance costs of customers' facilities. The company's projects primarily include various measures customized for the facility and designed to enhance the efficiency of building systems, such as heating, ventilation, cooling, and lighting systems. It also offers renewable energy products and services, such as the construction of small-scale plants for customers that produce electricity, gas, heat, or cooling from renewable sources of energy; and sells electricity and processed renewable gas fuel, heat, or cooling. In addition, the company provides enterprise energy management and consulting services; and sells solar photovoltaic (PV) energy products and systems. It serves federal, state, and local governments, as well as healthcare and educational institutions, housing authorities, and commercial and industrial customers. As of December 31, 2018, the company owned and operated 87 small-scale renewable energy plants and solar PV installations. Ameresco, Inc. was founded in 2000 and is headquartered in Framingham, Massachusetts.

(Click on image to enlarge)

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can, therefore, change during the day as the market fluctuates. The indicator numbers shown below, therefore, may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 35.45+ Weighted Alpha

- 26.74% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 17.03% in the last month

- Relative Strength Index 85.19%

- Technical support level at 18.23

- Recently traded at 19.21 with a 50 day moving average of 16.38

Fundamental factors:

- Market Cap $876 million

- P/E 29.85

- Revenue expected to grow 8.30% this year and another 6.30% next year

- Earnings estimated to decrease by 6.20% this year but increase again by 26.30% next year and continue to compound at an annual rate of 25.00% for the next 5 years

- Wall Street analysts issued 4 strong buy recommendations on the stock

- The individual investors following the stock on Motley Fool voted 361 to 13 that the stock will beat the market

- 2,819 investors are monitoring the stock on Seeking Alpha

Disclosure: None.