AMD: The 50% Revenue Growth Quarter Is Finally Upon Us

AMD (Nasdaq: AMD) reports next Tuesday (Jan. 28) after the close. They guided Q4 to be a huge 50% revenue growth quarter. It sounds like the company's confident enough to hit or beat it. That would set the stage for a big 2020. We recently downgraded AMD to subscribers from Strong Buy to Buy after hitting our price target. That said there's still enough momentum that can potentially drive the stock.

Quick History

The last time we were out publicly on AMD was in October with the stock in the $30s when we went to Strong Buy. The stock's now in the $50s.

In brief, the company sounded very confident then at several investor conferences based on customer acceptance of their products.

Just recently I moved back to a Buy Rating (From Strong Buy Rating) based on AMD stock hitting my price target.

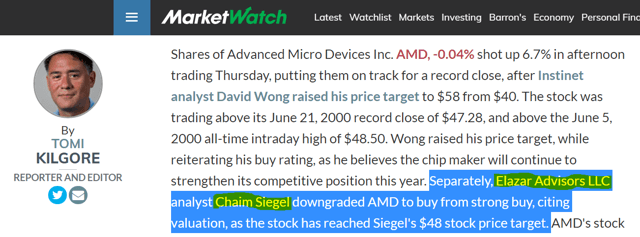

MarketWatch picked up that we downgraded it here to Buy.

One Second, I'm About To Go Off On Sell-Side Analysts. This Won't Take Long

You'll see many sell-side analysts raise their price target chasing a stock higher. As the price goes up they raise their price target. I have no idea what that is.

If you wanted to have a price target it should have been based on your work telling you based on your numbers the stock deserves to trade at $X. It makes no sense to me that pro-sell-side analysts get away with changing their target based on the price of the stock itself. What are they getting paid for? To tell you the stock went up or down? We need them to tell us where it's going, not where the stock went.

I don't believe in the whole sell-side thing, as you can see.

I don't see how sell-siders give an investor conviction.

What I do see is that my subscribers build conviction when they see things like why I think Tesla (Nasdaq: TSLA) can hit $800 or AMD can hit $50. When you see the model, the number progression and the logic behind those numbers you can take ownership that there's a logical reason where a stock can trade.

That helps trading when you have conviction. When you have conviction you ignore the noise and don't sell down on every downgrade or buy upon every upgrade.

Having a price target with sound logic behind the driving numbers supporting that price target helps you ignore all the noise and let earnings get you there to that price target.

It shouldn't be that the target changes based on the price fluctuations.

It should be that the target changes based on the specific company fundamentals.

Doesn't that make sense? Let me know.

So when I downgraded to a Buy Rating it's because it hit my target. That means the price of the stock reflects where I expect my PE X my EPS should be.

I use a historical midpoint PE. That stops me from talking myself into a trade that doesn't exist by making up a high PE number. My EPS numbers are the swing factor.

For AMD it has no recent historical PE so I've been using 35X for a couple of years. I stick with it. It's not an excuse to change my price target, only my EPS numbers change my price target.

To close the loop, so how do I like AMD much more again? If they were to blow out numbers and my EPS need to be much higher, then great, I'll raise my target. But we'll have to see that in the numbers first. Not based on the share price swings.

For now, I think, based on 2020, AMD is fully valued.

I do think that investors are looking out past 2020 because of the exciting taking-share-from-Intel (Nasdaq: INTC) story.

So I keep a Buy Rating (for now) because I agree there's momentum here. But a Buy Rating means a smaller position than a Strong Buy Rating.

50% Revenue Growth Quarter Is Upon Us

Here's what the company expected on Q3,

"Now turning to the outlook for the fourth quarter of 2019. We expect revenue to be approximately $2.1 billion, plus or minus $50 million, an increase of approximately 48% year-over-year and 17% sequentially. The sequential and year-over-year increases I expected to be driven by growth in Ryzen, EPYC and Radeon processor sales, offset by a further softening of Semi Custom processor revenue."

Last year's Q4 was up 59% so Q4s for AMD do have that potential. Plus AMD is further along in multiple product ramps that give them conviction.

They were very bullish at recent conferences as well, which means to me they are confident in the numbers they see printing near term.

At a recent UBS conference they said a few very bullish things:

"We're at about 7% share today Tim, if you look at the IDC TAM of about 20 million units. We also are - it’s our goal over time to get back to the historical levels which was 26%. But before we have credibility in such an aspirational goal, we need to get to double-digit share first. So, our target is to get to 10% share by the second quarter of 2020."

They're talking about more than tripling their server market share now. That's a fairly new number showing their confidence. Again I think that confidence is driven by results they were seeing in Q4 real-time which is about to report next week.

This also says to me business is strong right now,

"The traction in desktop has been exciting. It’s been at the mainstream portion of the market. It’s really important for us if we’re in share gain mode."

When AMD says they are in share-gain mode it means even if the market was weak they'd be growing. That gives you a sense that business is strong despite any potential global macroeconomic concerns.

Here's something else I liked that gives you a sense of how current business is trending:

"We're not only growing our pipeline, but nice customer acquisition in HPC and cloud. We're not seeing any unusual trends as perhaps others in the marketplace might be. We're seeing steady momentum."

All these quotes above are from the company Dec. 9, knee-deep into the Q4. AMD's seeing continued growth in cloud which is such an important end market. They're also seeing momentum in server, in desktop. It sounds like they will do well vs. their expectations.

That's Q4, Big 2020 Also Coming

The Digitimes title above points out that AMD is winning share as Intel can't meet customer demand. More and more customers are turning to AMD which confirms AMD's market share comments.

Another big story for 2020 is the gaming console cycle. Sony (NYSE: SNE) and Microsoft (Nasdaq: MSFT) have announced new consoles for the 2020 holiday. That cycle comes every eight years or so. That's now this year. That's going to crimp sales near term for semi-custom as gamers wait for the new consoles, but will be a big driver for this calendar year which should drive expectations for the back half.

Conclusion

I have upside in our EPS numbers every quarter. But I'm using a 35 PE on our $1.38 for 2020 (see full model: paywall). The Street's at $1.12. If we're right there should be upside to the stock based on the EPS beating. But unless the EPS trajectory proves out to be much higher than I currently expect I think the stock is fully valued. I do think that a core position makes sense based on visibility of gaining share from Intel.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Ready to Nail Tech Earnings? Start your more