AMD: Bullish On Earnings

AMD (NASDAQ:AMD) reports after the close on Tuesday. I had previously thought the Q4 guide could be a stretch implying growth of 50%. I now think it's doable. There's margin upside but the real EPS upside still comes in 2020.

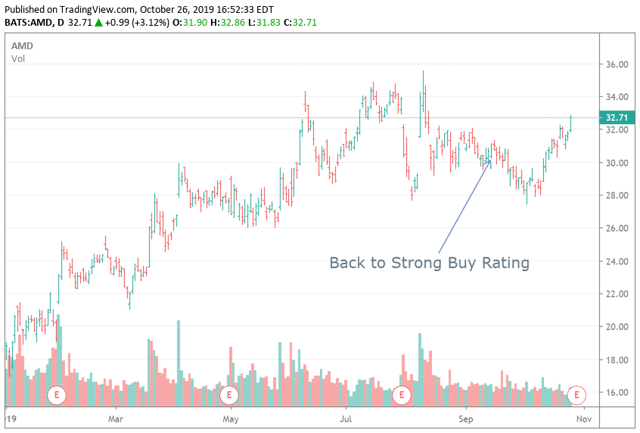

Back To Strong Buy Rating

After hearing AMD speak at Deutsche Bank Tech Conference (NYSE:DB) September 10th we realized the company had strong confidence in their guide. Their full-year guide implied the need for a 50%+ revenue growth rate in Q4. When hearing that on their Q2 earnings call, we were cautious. That was a huge jump to expect.

But after hearing them speak at the recent investor conference the company exuded confidence. They were also, by the way, more than two-thirds of the way through Q3. They pretty much knew the numbers and the server ramp and still exuded confidence.

We upgraded our rating to subscribers soon after from Buy Rating to Strong Buy Rating (paywall) soon after hearing them speak.

After that and a little math, reviewing the company, I felt more comfortable that Q4 was achievable.

Still the upside really comes in 2020. So if they make Q3 and Q4 then investors will quickly swivel to a big earnings year next year.

50%+ Revenue Growth Implied For Q4

They gave Q3 revenue guidance of $1.8B in Q3 and "mid-singles" revenue growth for the 2019 year. If you back into Q4 that means you need 50%+ revenue growth.

Here're the numbers.

|

Sourced From Elazar Advisors Models, Data Sourced From AMD Earnings Reports

You can see above that when you assume their Q3 guide you need a 50+% Q4 to hit their annual target.

But listening to them speaking at Deutsche Bank, they sounded confident in hitting those targets.

For Rome they said "confidence is high." They said "reception is good." They also said that cloud customers would be the driver. Both Intel (NASDAQ:INTC) and Micron (NASDAQ:MU) have since talked about cloud strength. Since AMD is dependent on cloud strength, it sounds like they'll get it with confirmation of cloud spending trends being strong at their peers.

Intel said last week that "continued cloud recovery" was driving their data center Q4 outlook.

Micron said on their late-September earnings call, "solid sequential demand growth for server solutions in both cloud and enterprise markets."

AMD has said cloud is key to hit their targets. The cloud customer segment is apparently doing well which can potentially give investors confidence in AMD as well.

What Else We Heard That We Liked

At that conference we also liked a couple of other things we heard.

The company gave market share targets for server of 25-27% which was much higher than their previous double-digits implying around 10%.

They also categorized GPU as a "lumpy contributor." The term "lumpy" does not always have a positive connotation. It can mean that revenues come one quarter, then they may not show up the next quarter.

But hearing them say it's a "lumpy contributor" meant to me that it's contributing in a bigger way than normal. In my career I never heard "lumpy" used with "contributor." Wrapped around all their other bullish commentary I took it as another bullish comment.

For the company to hit their targets in Q4 they need server and GPU growth rates more than their other segments.

So hearing confidence from the company in those two segments helped me feel more bullish.

But It's All About 2020

Assuming AMD does okay in Q3 and Q4 we'll have more conviction that 2020 is their big year.

The gaming console segment goes in about 7-8 year cycles. It's about that long since there are big major new consoles out of Microsoft (NASDAQ:MSFT) and Sony (NYSE:SNE). Both have announced new gaming consoles coming in 2020.

AMD announced that they will be in both Microsoft and Sony's next-gen boxes.

So in 2020 you not only have their continued server penetration and other new product cycles, but you also have a potential spike in gaming consoles coming later in 2020. It adds one more material driver to the story.

Gross Margins

The company has been very bullish about gross margins and this is what gets us big numbers for 2020.

Listen to what they said about gross margins on their earnings call. They were very bullish,

"I think what I would say is we are very pleased with the progress we have made on the margin in 2019. The product mix continues to get richer and we'll see as we get closer to 2020 in terms of the specifics, but you are right, the product mix does get better, so -- and even in the other businesses, including the client business the product mix being richer benefits the margin."

|

Sourced From Elazar Advisors Models, Data Sourced From AMD Earnings Reports

Semi-custom is their lower-margin business. That starts ramping in the second half of 2020. Until then AMD has higher margin new products driving their margins as you heard on Q2.

They were very bullish about margins at Deutsche's conference along with being bullish on their Q2 call. So in a way, their Deutsche call was an update confirming what they said in Q2.

Gross margins should be strong in Q4 by getting fixed cost leverage on servers as they hit higher volumes. Also, their new product mix has higher margins, driving the numbers.

I look at 2-year run rates. The 2-year adds up this year's change plus last year's same-quarter change. It helps you smooth out for one-timers to spot underlying trends.

The company has said that Q4 will be higher margins than Q3. If you start doing the 2-year math and flow that into 2020 you start getting some big numbers.

I use higher gross margins in the first half of 2020 because semi-custom doesn't come until the second half. Semi-custom will lower the margins. You see it reflected in the model grid just above.

Conclusion

The Street's at $1.06 for 2020. We're at over $1.30 (full model:paywall). AMD needs an okay Q3 and Q4, nothing different than their guide. Their guide is already pretty big. If they can hit it there will be a lot of excitement about the potential for 2020. That's how we can get a big stock move.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Ready to Nail Tech Earnings? Start your more