Amazon's Acquisitions Create Adverse Reactions

The reality is far more innocuous than the reaction sometimes. When Amazon (AMZN) announced its acquisition of Whole Foods Market (WFM) it sent waves through the retail industry. Waves generally being a natural factor in a relative sea of tranquility that is the ocean doesn’t quite equate contextually on Wall Street. Unfortunately, waves on Wall Street tend to assimilate with context surrounding the aftermath of an earthquake, devastating and demonstrative. The devastation in the retail sector of Wall Street, after the announced acquisition, found retail stocks under immense pressure and not the type of pressure that creates lustrous gemstones. Having said that, some investors will find themselves holding diamonds once the rubble is cleared.

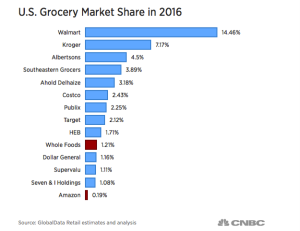

Conjecture and knee-jerk reactions play a large role when trading, but a lesser role when investing. The intelligent investor is able to sift through the conjecture, headlines and knee-jerk stock reactions and see a more vivid picture that disseminates truth and reality. The headlines surrounding Amazon’s acquisition of Whole Foods Market coupled with the broader retail sector adverse sell-off would have one believe Amazon would dominate grocery… starting next week. But that reaction to the news is anything but reality and everything inclusive of hyperbole. The chart by CNBC below is a breakdown of the U.S. Grocery Market share as of 2016:

Combined, Amazon and Whole Foods Market only account for less than 2% of the total U.S. grocery market. What many traders and investors may not fully appreciate for lack of industry knowledge and/or experience is that Whole Foods Market is a very specialized grocery retailer and with a very small retail footprint when compared to its peers. While the once darling of Wall Street for several years found what seemed to be an ever-appreciating share price, in the last couple of years, that performance found itself short lived and with steep declines. Whole Foods Market’s business and total addressable market (TAM) was not what it once claimed it was to be.For years the grocer outlined a path to some 1,200 stores across America only to find itself nearing saturation of the region with fewer than 500 stores and as same-store-sales (SSS) began declining. There comes a point in every business model cycle where newness and low-hanging fruit is all picked cleaned and what you are left with is a mature business that expresses its true demand and value.As such, Whole Foods Market found sales floundering and earnings falling under the pressure of pricing, assortment, competition and generally difficult YOY comps.

It’s a tough business to create let alone to do so with as much success as Whole Foods Market has found. On Wall Street, you are either growing to the moon or you become a value stock. And that is what Amazon believed it found in Whole Foods Market, a valuable entity that could advance its desired grocery expansion. It’s not easy to distribute groceries to the masses solely from a digital marketplace and as such, the Whole Foods niche market offers Amazon a small, but potentially lucrative advancement in the category. Evidencing that mass market scale was unachievable by Whole Foods Market itself, not to mention peers like The Fresh Market and Sprouts, it will take some Amazon tweaking of the Whole Foods business model and many years before the realization of this venture is known for its value. But again, traders have already reacted to headlines despite the logical deductions offered within.

Some analysts are of the opinion that what Amazon has done in other retail categories it will bring to the organic grocery retail business segment, lower prices and forgo profits. I would tend to believe that is a possibility, but it is much lower on the spectrum of possibilities than one would have you believe. Mark Astrachan of Stifel Nicholas states the following with regards to Amazon’s Whole Foods Market acquisition and participation in grocery going forward:

We anticipate Amazon's ownership is likely to result in lower prices at Whole Foods, forcing other grocery participants to follow, negatively impacting category margins.

Here’s what I have to say about Mark Astrachan and with regards to such a forecast: “Remember, Mark Astrachan rated Keurig Green Mountain as a Sell and with a $14 price target when GMCR was trading in the $20 range and before shares rallied over 3 years to above $150 a share”. Certainly, analysts aren’t going to get every call right, but understanding where the opportunity lay for error in a forecast may reveal the true investment or trading opportunity. And that’s what we care about as investors/traders. Mark Astrachan’s reasoning and scrutiny of the GMCR business were all accurate and revealed by 2016, but between 2012 and 2016 GMCR had ample time to grow its customer base and earnings power. This is largely why the Sell rating and price target were found in error.

Moreover and with regards to Astrachan’s forecast for Amazon’s grocery pricing activity, here’s what I would recognize more prominently; Grocery is not hard goods, it is not soft goods and it is not services. There lays the problem with suggesting that Amazon can and will put pricing pressure on its peers in the grocery business segment.It’s largely why Amazon has yet to capture any meaningful share of the grocery segment. Groceries are commodities, consumables and with that already carry little margin. And that is before the actual operating of a grocery business that expresses great logistical and supply line challenges is calculated.

There very simply isn’t a lot of profit to be made in grocery for which is largely evidenced by the revolving door of grocery business liquidations that seem never ending, decade after decade and brand name after brand name. It’s why Costco (COST) doesn’t really make its monies and profits off its grocery business, but rather its membership business and fees. Take a look at Costco’s gross margin percentage for goods sold; it’s an eye-opener for sure. Costco is fortunate if it captures a gross profit margin of 13% on goods sold as a total assortment in its storefronts, much of which is the result of its grocery assortment dragging down the total gross profit margin that includes jewelry, hard goods and apparel. To offer a comparison with regards to how little profit exists in grocery, apparel or clothing, especially fashion can offer upwards of 75% profit margin. So from the potential of 75% profit margin and the inclusion of groceries in a product mix, Costco largely generates less than 14% gross profit margins annually. Kroger (KR), Albertson’s and Safeway (SW), simply name the grocer and you’ll understand the struggles in the business segment that align with capturing a profit exist in perpetuity. Target (TGT) and Wal-Mart (WMT) are no strangers to the struggles of grocery but achieve a greater profit margin due to an even assortment mix and the expansiveness of their retail footprint across the United States and abroad. Having said greater profit margin, understand it isn’t by much and when compared to those retailers that choose not to sell groceries.

It’s been a difficult week for retail stocks in the face of the Amazon/Whole Foods Market news and I’m sure when retailers report the Q2 results much will be discussed on conference calls by members of respective management teams. So with the offered rendering and better understanding as to why the news may not be as damaging to retailers in the near-term as stock valuations would have one belief, I’ll leave readers/investors/traders with my more focused thoughts and analysis as follows:

The Final Thought

Retailers, be they in the grocery, department store or other segments, have been experiencing difficulty growing sales and profits prior to the Amazon headlines. In part, retailers have found themselves in this unenviable position because of the seismic shift in consumption initiated and grown by Amazon’s e-commerce expertise as well as generational consumption changes. As such, brick and mortar retail consumption has seemingly peaked.When a peak has been reached and sales siphon into other sales channels like e-commerce, any potential and additional pressures are magnified. This is especially the case when a dominant party like Amazon is stimulating those pressures yet again and possibly more deeply.

Reactions to the fearful impact are swift and alarming even if the reality of the situation may not be realized for years. Such overreaction can find with it opportunity. However, opportunities are not always equal, but traders/investors should value the potential opportunity equally. For some, they may have found an opportunity to pick up a retail name near the floor of a trading range and profit from a swing trade. For others, the opportunity may come from an inevitable retail sector upswing whereby the long-term investor can lighten holdings.

Many retail stocks have found themselves devalued by 30,40,50 percent and more.The devaluation is warranted as the fundamentals for such stocks represent their diminishing metric performance. Brick and mortar retailers can’t “put the genie back in the bottle”, e-commerce is here to stay as technology simply has and will dictate future outcomes that align with the growth of this retail segment and at the expense of brick and mortar retail sales. The devaluing of retail brick and mortar businesses validate the previous comment. But brick and mortar businesses can find stabilization of its business model through curtailment and alignment that is on-trend with e-commerce. That is what many retailers have enacted today. Don’t let that be a point of solace as it will be with Amazon/Whole Foods Market, such stabilization will take years and has proven as such and through the most recent, pain-filled years. So while stabilization and share price appreciation can be found once again for many retail names, it may be found short lived and/or still underperforming opportunities elsewhere in the marketplace.

I’m not of the opinion that any traditional brick and mortar retailers are investible at this time. That does not mean they are not tradable for months or even a year at a time as I’m forced to recognize the term investment is largely subjective. The end game for retail is likely a foregone conclusion: There will always be storefronts just as there will always be e-commerce. Let’s face it, nearly 20 years into the e-commerce era the retail segment still only accounts for less than 10% of total retail sales. How long will it take to capture the next 10% of retail sales and is there a limit to the total addressable market for e-commerce sales that largely never, never gets discussed. When we look at how long it has taken to capture less than 10% of retail sales by the e-commerce segment, I would think this is more a red flag for the segment than analysts and the media have considered to date. So how much market share each segment will capture or maintain remains undetermined at present. For now, however, investors would be wise to exercise caution when investing or trading the major retail names.

Disclosure: I am long TGT and COST.

Good comment thread. Another good thread to read with a similar discussion is here: www.talkmarkets.com/.../winner--losers-from-amazons-proposed-purchase-of-whole-foods

#Walmart acquired #Jet to compete with #Amazon. Now Amazon wants to acquire #WholeFoods to compete with Walmart. I don't think Walmart's acquisition did a think for them. Hopefully Amazon's will work out better for them $WMT $AMZN $WFM

That acquisition was only completed in late September of last year. I think it will take time for results to really show for Walmart, so I wouldn't write off that acquisition yet... Not to mention that Walmart payed approximately 20% of what Amazon paid.

Walmart acquired Jet to get a very much needed technological edge over Amazon. But have you ever shopped at Jet? I have. It pales in comparison to Amazon's technical knowhow and breadth of features/reach. There is no comparison. In fact overall I found Jet's website to be buggy, boring and confusing. And shipping is as slow as Walmart. I saw no advantage to the acquisition.

Do you see it differently?

I definitely agree, i think that $AMZN is just so much better at what they do that it is sort of insulting to compare them to Walmart. I always say that Amazon is sort of like $APPL in the sense that they may not be the first to do something, but they are always the ones to make it better, and this will definitely be the case.

The food and logistics supply chain is dry complicated, cumbersome and wildly expensive. I like the comparison offered, but it's highly unlikely that in this particular case, "better" is going to be the outcome.

I personally found Jet to be relatively easy to use and visually pleasing, but that is more personal opinion I suppose.

My point was more about how it's too early to tell at this stage. Anything could happen with Walmart and Jet, or Amazon and Whole Foods, so I don't think it's prudent to write off one of their acquisitions

It's been a while since I shopped at Jet. But I found their process of getting extra savings by buying items from similar warehouses to be very confusing. Overall it was difficult to understand how much I was paying for each item. And I found those numbers often changed. For instance, if I added an item to my cart it would list thousands of items that I could get cheaper. But wanted they didn't mention is that the savings would only apply if I added ONE item, I would not get more savings by adding more than one item. Also, if purchasing many items, it was hard to keep track of which item was linked to savings on which items. So if you deleted an item from your cart later, you might lose the extra discount on something else which may have been the only reason you added it to your cart in the first place.

Without the additional savings, every item I looked at was cheaper on Amazon. Just a very confusing model over all. And that was the only technological enhancement I even saw. Otherwise the website was extremely basic. The search function was dismal and their item selection was pretty limited and ever changing. So there were many times I bought an item I liked and wanted to re-order it, but when I tried, I found they no longer carried it.

I will say they had very good customer service though. Something Walmart could benefit from but which I fear might work the other way around. At least Walmart's customer service is as poor as ever. Personally, I wouldn't mind if Amazon put Walmart out of business with the exception that competition is good for the consumer.

Don't forget the logistics network that $AMZN is bringing to Whole Foods! That being shared between the two companies could reduce costs for both of them.

Grocery logistics is far different than what Amazon understands or has experienced proficiency with. That is what they are actually acqui omg in the deal, not bringing to the table. On a mass scale Amazon doesn't have scaled expiry, chargeback and DSD experience as they don't have those busines relationships or operations.

"Grocery logistics is far different than what #Amazon understands or has experienced proficiency with." = Hitting the nail on the head. $AMZN $WFM

@[Seth Golden](user:34522) is exactly right. This is uncharted territory for Amazon. I'm not saying they will fail, but I think they are going to have a harder time of it then they expect.

Amazon does sell food online, so I would argue that they do have a lot of experience. And they certainly have the $$ to hire more people with more direct experience.

selling food online and doing so successfully are two different indicators. Their market share clearly indicates they don't have good experience and know how or likely the right skill sets and personnel.

I agree with Knoth, they have started #AmazonFresh, and their partnerships with shipping companies can help them expand with less growing pains. That, and they have some of the greatest minds in the field of supply chain! Who knows what other knowledge and experience those minds hold.

Actually Amazon started their own shipping company. But I would think super markets use their own workers as delivery men rather than using UPS.

But look at their same day shipping roll outs: the distribution network is already very promising!

The grocery business is highly complex and complicated to maintain, nonetheless maintain profitably over extended periods of time. It's one thing to sell groceries that are dry goods as Amazon has and will continue to do, it's an entirely different thing to sell cold, frozen and dairy foods. Expirations, shelve lives and the necessity of sourcing locally is NOT in any way shape or form something Amazon has done on scale or with any proficiency along the lines of what I've noted within. Moreover, there is a profound reason as to why the major beverage companies have a dominant position within the grocery supply chain inclusive of DSD operations. Again, this is not something that is available to Amazon and obviously as such Amazon has NO experience with this such aspect of the grocery business. The beverage and snack business make the grocery business profitable, most everything else outside of meats is considered minimal profit to losses. Amazon likely understands this as it has been trying for many years now to expand its grocery business to include greater sales volumes, but without a DSD, high volume business it has been extremely difficult. So you buy Whole Foods with local sourcing DSD operations and all that comes with the business of selling cold, frozen dairy goods. Having said all of that, Amazon will still likely not be successful without large scale modifications to the Whole Foods business model as Whole Foods has a very finite consumer base. Again, Amazon likely understands this but most importantly...and here is the biggest takeaway as we share this experience going forward: Amazon doesn't care. Amazon doesn't care because its shareholders don't care. We're talking about a company that went unprofitable were over a decade and with the stock price doing nothing but appreciating over that time period. So while we banter and rationalize this acquisition whichever way we choose to do so, no matter what the outcome, shareholders will likely continue not to care as the core Amazon business has proven disruptive and, now, more profitable than ever. Maybe the real question is can Amazon do no wrong? Thank you all for the comments and sharing!

I can't agree that Amazon and it's stockholders do not care. Amazon has had those long periods of operating on losses in order to innovate and expand, which has shown tangible success! As for the DSD operations, you have a great point, and much more experience looking into this industry than I, however looking back at amazon's expansions into new fields, I find historical precidence to back up my feeling that they will successfully find a way to set up those local DSD connections, or work around their lack of them.

I have to thank you for responding to my comments as well Seth, this has been a great discussion!