Amazon: Why We Think There's Earnings Upside

Summary

- Guidance might be too conservative.

- COVID-19 pandemic brought new customers in the door that wouldn’t have come in otherwise.

- Risk of a second wave could further fuel Amazon's numbers.

A month from now Amazon (NASDAQ:AMZN) is set to report Q2 earnings. Based on their last earnings call their guidance may be too conservative. Revenue growth could show a nice beat.

The pandemic negatively affected many companies while benefiting Amazon in several ways: Increased online spending, increased use of Amazon services like Prime Video, Prime Music, Alexa, etc.

Amazon is capitalizing on the new customer flow to cross sell them to drive repeat business and revenue growth. Many of those new customers previously avoided online shopping.

If there’s further pandemic risk, demand for Amazon products and services could further accelerate.

This revenue acceleration is driving flow through earnings upside in our earnings model (paywall). Stocks trade on earnings potential. This revenue burst is giving us nice stock price upside potential in our model even with the stock being up.

We currently have it recommended as a Buy and it’s one of the companies in our model portfolio (paywall).

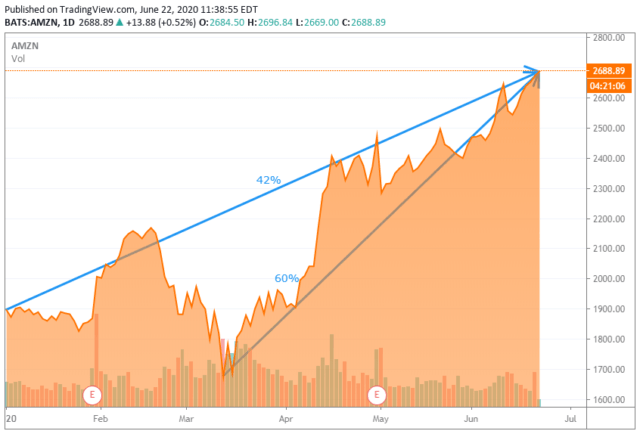

Source: Amazon.com, Inc. (AMZN) Stock Analysis & News

No doubt the stock is up but we’ll show you that based on our 2021 EPS X a 65 PE we still get nice stock price upside potential.

Why We Think Guidance Is Conservative

Last week we wrote (paywall) to subscribers why Amazon's guidance for Q2 might be too conservative. We looked at the company's North American Retail business revenues. They were averaging around 22% revenue growth from Q2 to Q4 in 2019, but managed to increase revenues by 28.8% in Q1.

If you think about it though, the big upside in revenue growth came in March, not January or February.

When you start to assume that January and February revenue growth was probably similar to the trend in 2019, then you start to back into a big March revenue number.

Assuming they maintained a similar growth for the first two months of 2020 as in Q2-Q4 2019, we can back into how much revenues grew in March 2020. Here's how:

0.66 x 22% + 0.33 x March Growth = 28.8% growth reported for the quarter.

That gives us March having around 43% growth for their retail division to reach 28.8% for the quarter, assuming equal weightings for each month. If you assume January was a bigger seasonal month then you have to assume that March was up more than 43%.

Let’s assume March is the trend. When we plug that faster March growth rate for retail in our model for Q2 and Q3 we get higher numbers than the company’s guide.

E-Commerce Surge

Amazon rules e-commerce globally. The stay-at-home trends that the pandemic created have increased the demand for online sales across the board. E-commerce had previously been growing at a fast clip, and the pandemic is likely to increase that growth. A lot of consumers likely changed their purchasing habits permanently, which Amazon can capitalize on.

High risk parts of the population like elders, which might have avoided online shopping, are forced to change their habits. After understanding online, they may not return to traditional channels.

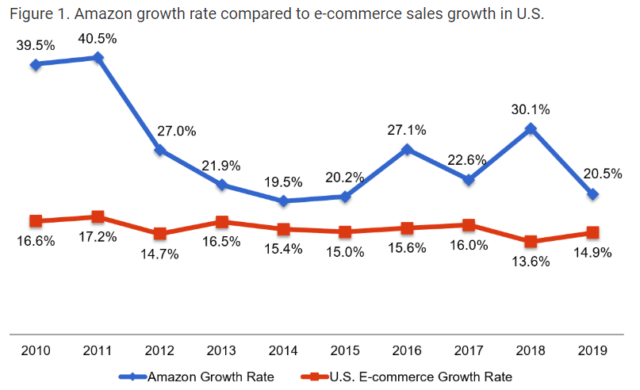

E-commerce sales grew around 16% a year for the past decade, and Amazon has been able to capture a large part of that growth. In the chart below we can see that their growth rate has been of course higher than the growth rate of the total market, which means Amazon has been consistently gaining share.

Source: Amazon SWOT Analysis (5 Key Strengths in 2020)

It looks like the chart is showing Amazon’s moving more inline with the rest of the market. This pandemic probably causes Amazon to re-accelerate vs. the market.

Amazon Web Services (AWS)

AWS is probably Amazon’s most important business and can benefit as many businesses shift to the cloud due to the pandemic. AWS offers compute, storage, database, and other service offerings for start-ups, enterprises, government agencies, and academic institutions.

Last quarter, AWS accounted for 13.5% of Amazon sales, but was 77% of the company’s total operating income.

IDG Communications recently said the average IT Department will allocate 32% of their total IT budget to cloud computing within the next year.

Cloud services allow remote collaboration on a massive scale. As businesses are forced to rethink their work from home strategy they shift spending to cloud, where AWS is the largest in the space. The shift toward cloud computing should accelerate with current events.

Gaming could also be huge for cloud demand. This report says that Microsoft (NASDAQ:MSFT) estimates there are two billion gamers in the world. And the advancements in 5G, Wifi 6E and cloud computing will allow gamers to stream video games. Instead of paying upfront the cost of equipment and games, they could pay a subscription fee to stream them. This could help bring gaming to a broader base and also create a steady cash flow from subscriptions. AWS will likely benefit from this rising demand, even if they don't directly host games.

Amazon’s biggest profit driver should benefit from the pandemic.

This isn’t our near-term driver to our earnings model upside but it helps build conviction on the overall story.

Amazon Prime and Other Services

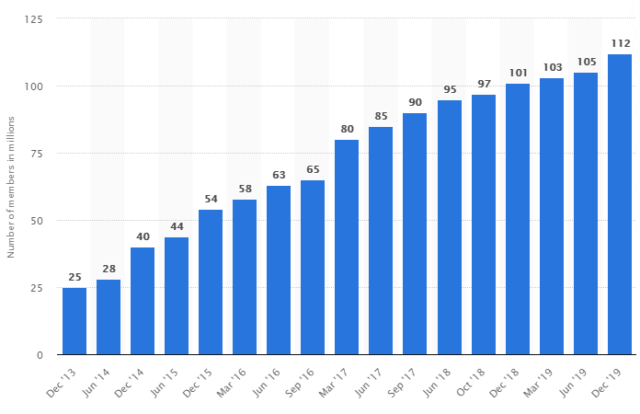

Prime subscribers in the US grew 28.4% a year over the last six years. The surge in online business, plus the growing number of offerings on the service, can accelerate adoption.

While they did not reveal their subscriber numbers for Q1, they said the following:

We see our prime customers are shopping more often and they have larger basket sizes. We're also seeing a lot more use of our video benefits and our digital benefits.

So in March, for the first time viewers nearly doubled, which is I think a good time for people to when they're, a lot of them are staying at home to stay entertained.

Amazon clearly hinted that usage is up huge. That keeps people in their ecosystem and gives us visibility of continued growth.

Source: U.S. Amazon Prime subscribers 2019 | Statista

The chart above shows the number of Amazon Prime users. You see last year jumped. This year should really jump.

In 2019, subscription services revenue for Amazon were $19,210 million, or 6.8% of total revenues. We can assume most of this comes from Amazon Prime Subscriptions. For comparison, in 2017 and 2018 revenues from subscriptions were $9,721 and $14,168. This also is a high margin so a nice add to earnings and conviction to the numbers.

As people stay home this business benefits.

They also are making moves in sports. The NFL is the most watched league in the US, and Amazon struck a deal to air Fox’s Thursday football broadcast, and also the rights for an exclusive national regular season game.

Second Wave Risk

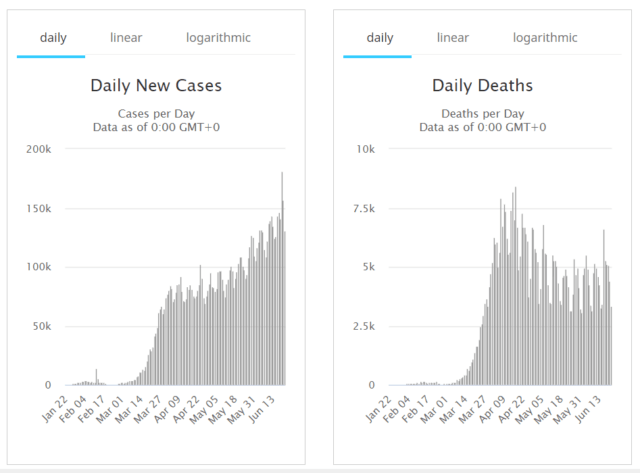

The number of global coronavirus cases are growing.

If there’s further shutdowns and stay at home orders, Amazon benefits. They took a margin hit to adjust to the change this quarter and will probably have less of a hit going forward. That should drive earnings leverage in the back half. If there’s another lockdown, Amazon is positioned to benefit on revenues and margins.

Source: Coronavirus Cases:

Above you have global case counts hitting new highs and death declines stalling. We hope these trends get better of course. For now though these are the type of numbers that risk extending the pandemic. As we reviewed above this can continue to be a driver to Amazon.

Model and Price Targets

Our Amazon earnings model (see full model: paywall) predicts 2021 EPS at around $52 per share vs. the Street at around $37 in earnings for next year. To value the company we’re using a PE of 65. We tend to use the median PE for the company, but Amazon’s PE is way too high for us, 65x is the max PE we allow ourselves for any company. With our EPS and a 65 PE, our 2021 price target is around $3,400. With a current price of around $2,700, this gives us 26% upside potential.

Conclusion

Amazon has been on a great run since March. But we think the stock can keep going. Our earnings model gives us conviction there’s more stock price upside despite the run. The pandemic is driving several of Amazon's core business segments. Amazon’s capitalizing on winning new customers which they can keep for a lifetime.