Amazon Prime Day Is Set To Boost Q3 Earnings Growth

Due to COVID-19, Amazon Prime Day is arriving later in the year. The pandemic has substantially accelerated the pace and shift to online shopping. In its latest earnings call, Amazon AMZN said “We’ve accelerated the number of — the growth of Prime members, both in the U.S. and internationally. So that’s a good sign that we’re happy about. And we hope that that has long-term ramifications” (Source: Amazon Q2 2020 Earnings Call).

Amazon gained a significant amount of new Prime members, and enough time to analyze the data to discover which types of promotions will entice shoppers to open up their wallets on Prime Day.

The online giant has aggressively been expanding its footprint by opening more fulfillment centers. Amazon is looking to improve its shipping services, offer faster delivery, and attain competitive advantage over Target and Walmart — especially, the latter given Walmart’s proximity to the U.S. consumer.

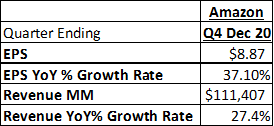

As a result, analysts polled by Refinitiv are already bullish on the company’s performance this quarter. The consensus for Amazon’s Q4 2020 EPS, including Prime sales, is $8.87, which is a 37.1% growth from the $6.47 reported in Q4 2019.

Exhibit 1: Amazon Earnings and Revenue Estimates: Quarter Ending December 2020

(Click on image to enlarge)

Source: Refinitiv I/B/E/S

Moreover, the Refinitiv SmartEstimate data shows investors can expect positive surprises this quarter from Amazon. This quantitative tool has proven to be very valuable and accurate to help forecast financial expectations during the pandemic.

The SmartEstimate is a weighted average of analyst estimates, with more weight given to more recent estimates and more accurate analysts. Our studies have shown that when the SmartEstimate differs from the consensus (I/B/E/S mean) by more than 2%, the company is likely to post subsequent earnings surprises directionally correct 70% of the time. This percentage difference is referred to as Predicted Surprise (PS%).

The Predicted Surprise for Amazon is 3.45%, suggesting the retailer is likely to beat the $8.87 earnings expectations and post a positive surprise.

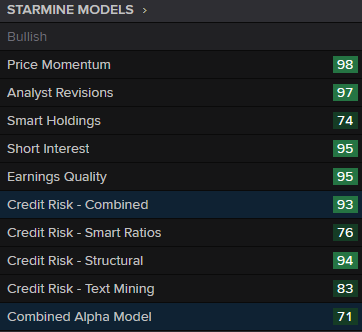

Amazon’s stock price has been up 84% this year and has generally outperformed the S&P 500. StarMine’s Price Momentum Model (Price Mo) shows that Amazon’s performance in this area outranks 98% of its peers (Exhibit 2). It also scores in the top decile with the StarMine Analysts Model, Earnings Quality, and Credit Risk Models suggesting analysts are bullish on the stock and likely to continue revising estimates upwards, earnings are coming from sustainable sources and credit looks healthy

Exhibit 2: Amazon StarMine Models

(Click on image to enlarge)

Source: Refinitiv Eikon

A sea of discounts

In the past, other retailers have sought to piggyback on Amazon’s mega-sale, offering discount deals of their own – on the same day. This year is no exception as retailers are offering promotions to entice shoppers to buy items they didn’t acquire earlier this year, as they traditionally would. Retailers including Asos and Nike are enticing shoppers to download their apps by offering exclusive discounts available on their app.

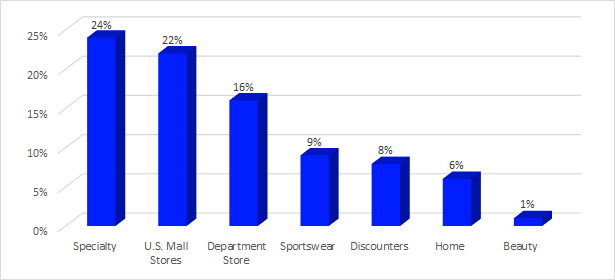

In a collaboration with StyleSage Co, Refinitiv discovered that currently Specialty stores, U.S. Mall Stores, and Department Stores are all offering the highest average discounts to lure shoppers of 16% and higher (Exhibit 3). Additional discounts (taken at checkout) have also been prevalent this week. For example, on the first day of Prime Day, Macy’s added further checkout reductions, as did Adidas and Finish Line.

Exhibit 3: Average Discount By Sector on Prime Week 2020

(Click on image to enlarge)

Source: StyleSage Co.

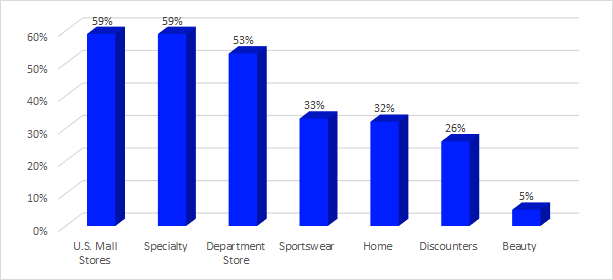

The same can be said for the Average Discount Penetration, which is the percent of merchandise on sale (Exhibit 4). Currently, the same three categories have the most merchandise on sale. Almost 60% of all online merchandise is on sale at U.S. Mall Stores and Specialty stores, followed by 53% at Department Stores. These sectors have also been the weakest performers for some time, thus making it critical to attract consumers to increase sales and earnings.

Exhibit 4: Average Discount Penetration by Sector on Prime Week 2020

Source: StyleSage Co.

Deals consumers want

In a collaboration with StyleSage, Refinitiv discovered that top searches on Amazon Prime Day involve electronics that will improve the stay-at-home experience (Garmin watches, track at home workouts, PC games, Roku, vacuum cleaner, Google Pixel). One of the consequences of the coronavirus pandemic has been a shift to consumers “nesting” at home and gravitating to shopping online.

Other retailers benefiting from Prime Day sales includes Walmart, Target, Best Buy, Crocs with its Justin Bieber Launch, and Nike with its member-exclusive sale driving shoppers to its app. Within the Internet & Catalog Retail sector, Etsy is expected to see the strongest earnings and revenue Q3 growth rates at 386.5%, and 107.9%, respectively. Analysts polled by Refinitiv are very bullish on Crocs for the current quarter.

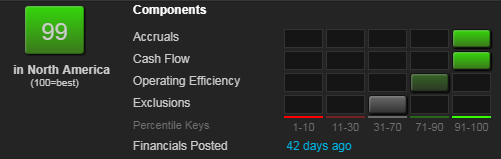

Among these names, Best Buy can boast a StarMine Analysts Revisions Model (ARM) score of 99, which places it at the peak of the top decile of all U.S. companies in this measure of change in the way analysts perceive the outlook for the company. The higher a company’s ARM, the more top-ranked analysts have been boosting their earnings forecasts, and the greater the likelihood that they will continue to do so.

The StarMine ARM is highly predictive of both the direction of future revisions and price movement. Best Buy can boast a 99 out of a possible 100 suggesting that analysts are likely to revise earnings estimates upward.

What’s more, earnings are of good quality. The company scores a 99 of a possible 100 on the StarMine Earnings Quality model, which suggests that profits could be from sustainable sources (Exhibit 5). The company’s cash flow and accruals components also suggest the company is a top performer in these areas. Best Buy said online revenue grew approximately 180% YoY in Q2. And in Q3, domestic online sales were up nearly 175% for the first three weeks of August (Source: Best Buy Q2 2021 Earnings Call).

Exhibit 5: Best Buy StarMine Analyst Model Score

Source: Refinitiv Eikon

E-commerce holiday sales

Total U.S. e-commerce sales for the first half of 2020 were $371.9 billion, an increase of 30 percent from the first half of 2019. E-commerce sales in the first half of 2020 accounted for 13.9% of total U.S. retail sales. The pandemic has substantially accelerated the pace and shift to online shopping. Given this growth, e-commerce is expected to grow in the double digits for 2020.

Exhibit 6: E-Commerce as a Percent of Total U.S. Retail Sales

(Click on image to enlarge)

Source: Refinitiv DataStream

Finally, our research at Refinitiv suggest that the holiday season will still show the strongest retail earnings growth rate of 2020, although it is forecast to be -21.1%. This is an improvement over the first half of the year. Our Refinitiv outlook suggests that retail earnings growth rates will turn positive again in 2021.

Exhibit 7: Refinitiv Retail Earnings Growth Rates for 2020

(Click on image to enlarge)

Source: Refinitiv I/B/E/S

All names and marks owned by Thomson Reuters, including "Thomson", "Reuters" and the Kinesis logo are used under license from Thomson Reuters and its affiliated companies.