Amazon Jumps And Dumps As AWS Growth Slows, Outlook Disappoints

Last quarter, when Amazon reported otherwise respectable earnings, the market hammered the stock after the company guided to the lowest revenue growth since 2001. And, as the company reported moments ago, while its guidance may have been slightly downbeat, it wasn't too far off as Amazon reported Q1 net sales of $59.7BN, just above the $59.68BN consensus estimate, while generating an impressive $7.09 in Q1 EPS, well above the $4.67 expected.

Here are the summary highlights:

- EPS of $7.09, beating estimates of $4.67

- Revenue of $59.7BN, in line with estimates of $59.68BN

- Operating income of $4.42 billion, also beating consensus estimates of $3.10 billion

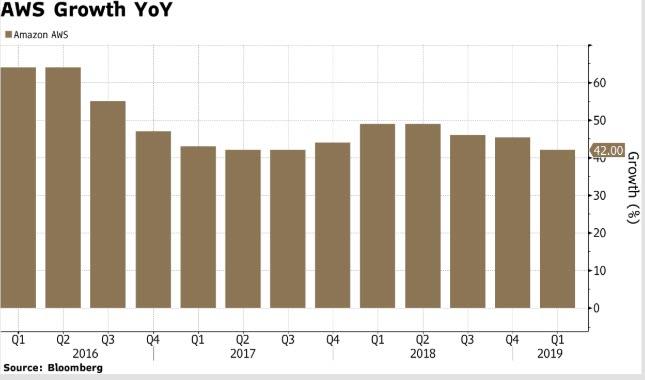

- Amazon Web Services rose 42% to $7.70BN, Exp. $7.67BN; this compares to growth of 45% last quarter and 46% the quarter before.

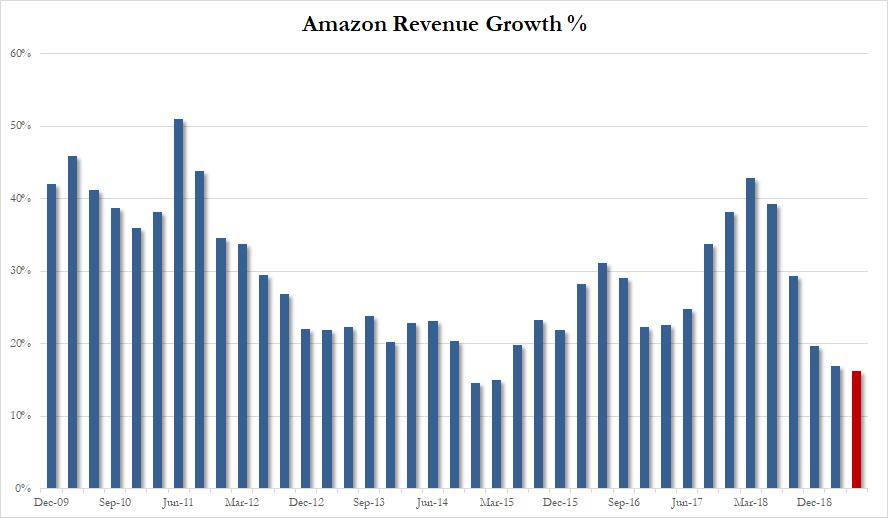

The good news here is that whereas Q1 revenue did come in slightly better than expected, it still showed a significant slowdown, rising 17% in Q1, the slowest growth pace in 4 years. Looking ahead, the slowdown is expected to accelerate, as the company now expects Q2 net sales of $59.5BN to $63.5BN, with the midpoint of $61.5BN coming in below the Wall Street consensus estimate of $62.4BN. If revenue comes in right on the midpoint, it would represent another top-line slowdown of 16.3% in Q2.

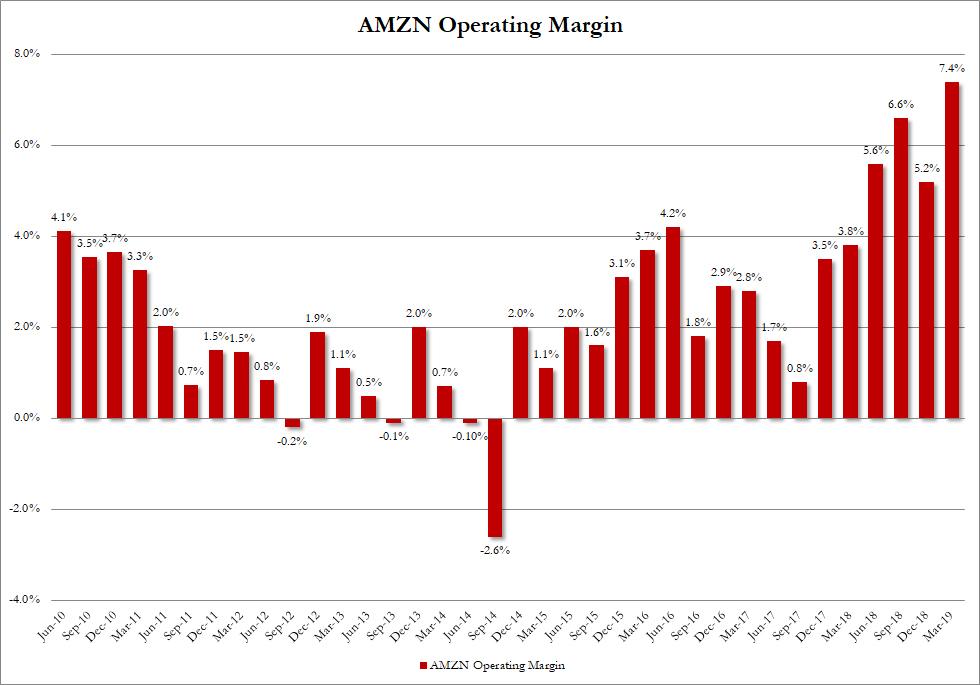

That said, the company's profit margin nearly doubled, from 3.8% last year to an impressive 7.4% in Q1 2019, largely thanks to the increasing contribution from AWS.

On the other hand, Amazon's operating income outlook disappointed, with the company now expecting it to come in between $2.6 billion and $3.6 billion, compared with $3.0 billion in second quarter 2018, but well below the Wall Street consensus estimate of $4.2 billion.

One notable improvement was the sharp drop in the international loss, which shrank to just $90MM in Q1 2018, down sharply from the $622MM loss a year prior.

As noted above, the all important Amazon Web Services was once again responsible for more than half of Amazon's entire profit, with the division generating $7.7BN in revenue and $2.22BN in operating income, a 28.9% margin, down from the 29.3% in Q4, and responsible for 50.2% of Amazon's total operating income of $4.42BN. Slightly more concerning was the slowdown in AWS revenue, which rose 42%, down from 45% last quarter.

Meanwhile, Amazon's other revenue, which includes Amazon's advertising business, grew only 36%, a sharp drop from the 97% growth in Q4 and the 132% growth it had a year ago. One possible reason for the slowdown is that Kroger, Walmart, Target and other big retailers are building out their own in-house digital advertising businesses. And, as Bloomberg notes, with about 300 million shoppers visiting its stores each month, and millions more on its websites, Walmart draws in more people than Google, Facebook or Amazon, according to Forrester Research. "That audience is catnip for big advertisers like Coca-Cola and Kraft Heinz."

Looking at Amazon's Bricks and Mortar presence, the price cuts implemented by Whole Foods appear to have helped overall sales in the "physical stores'' segment, which rose 1% to $4.3 billion compared with the year-ago period, reversing a 3% decline in the fourth quarter.

In the broader quarterly comments, Amazon provided the following chilling update on where Jeff Bezos and Alexa are secretly eavesdropping now, such as Canada, Brazil and pretty much everywhere else:

Amazon expanded Alexa features internationally: Echo Show launched in India, France, Italy, and Spain; Echo Input, which allows customers to add Alexa to an existing speaker, launched in India, Japan, France, Italy, Spain, and Australia. Alexa can now understand French in Canada, with a new experience built from the ground up for French Canadian customers. Amazon announced plans to bringAlexa to Brazil later this year. Developers can start building skills using the Brazilian Portuguese voice model.

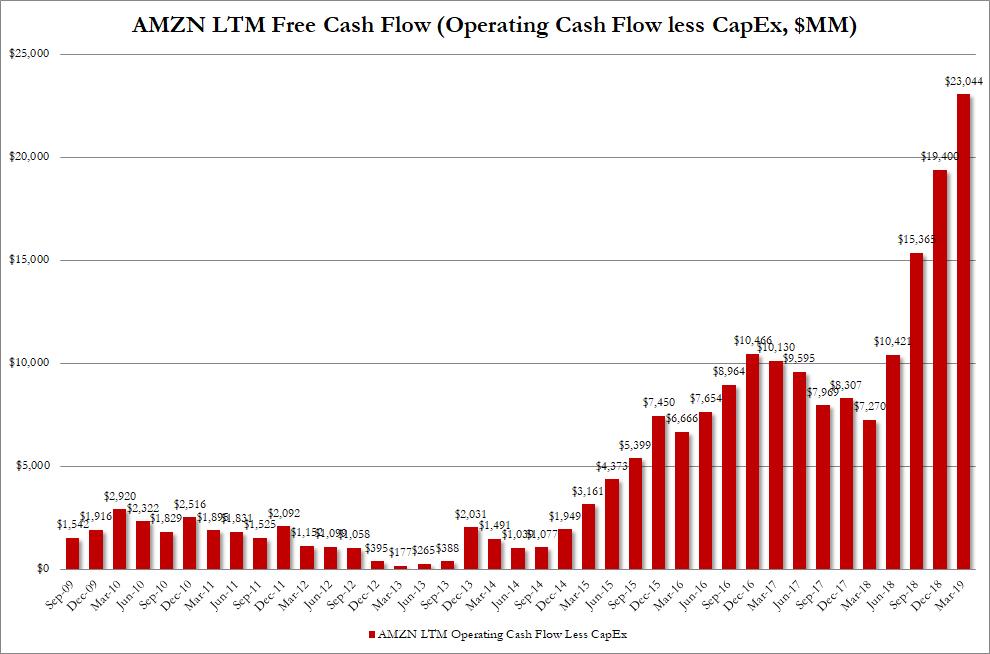

And before Amazon's army of underemployed workers hears you complain about the company's less than stellar numbers, for those still concerned about AMZN's cash burn, here is an update on the company's reported LTM Free Cash Flow in Q1 of $23.04 billion, a new all time high.

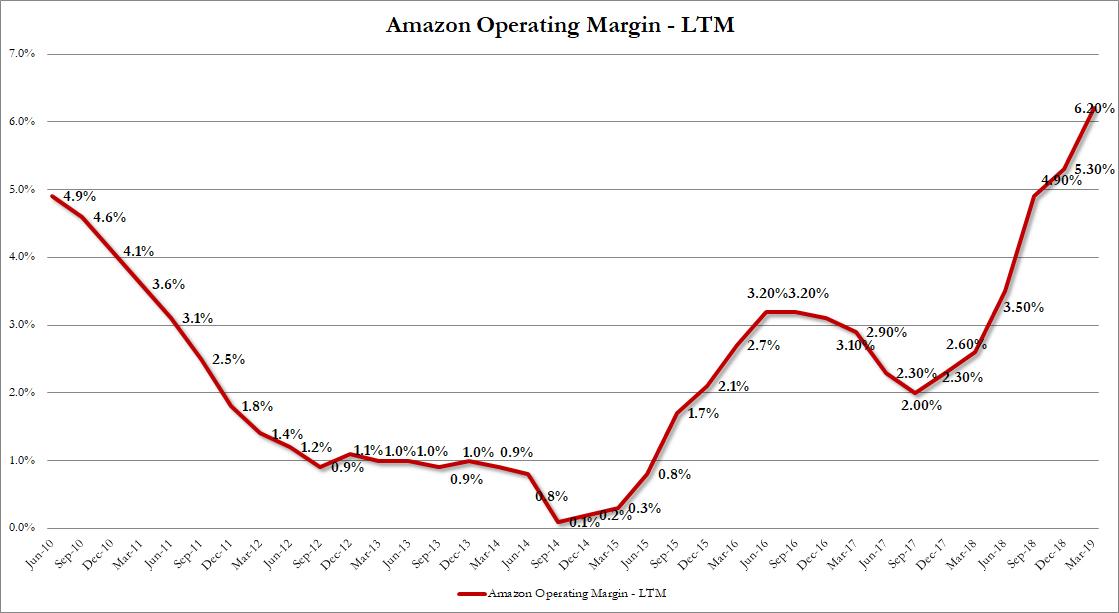

Just as notable is that after sliding in early 2017, Amazon's operating margin has soared in the past three quarters, largely as a result of AWS, and in Q1 hit a new all time high of 7.4%

Clearly, this means that the company's LTM operating margin is soaring, after dropping modestly in early/mid 2017:

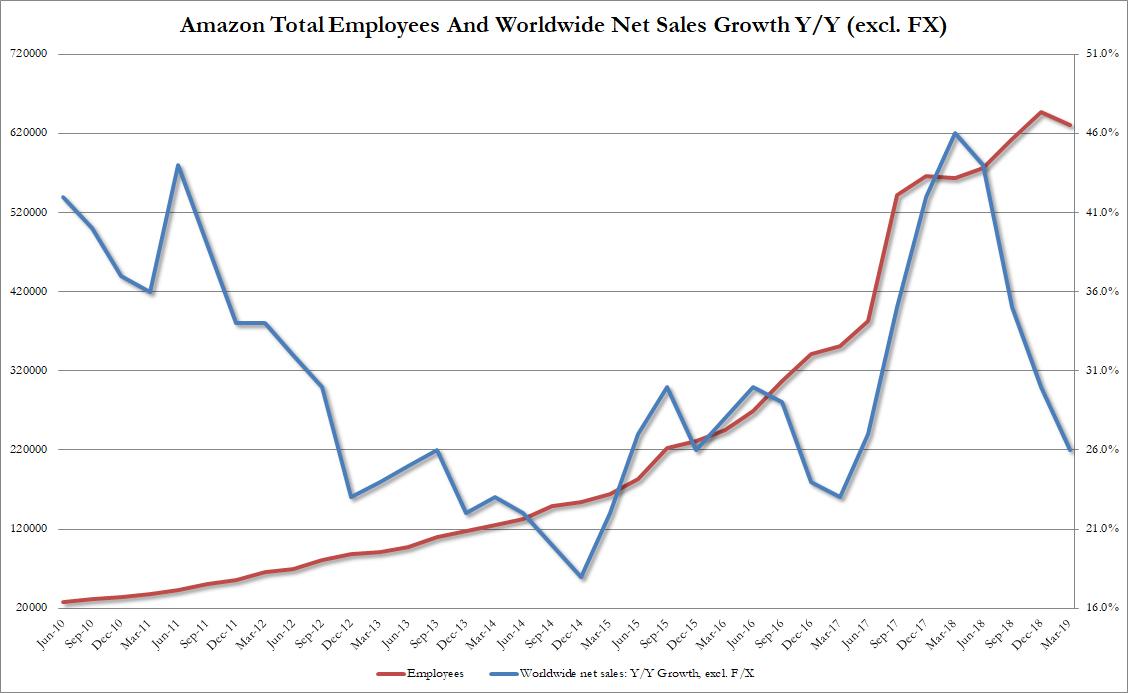

Meanwhile, as noted above, after the company consistently grew its global net sales in past years, in Q1 this number dipped further, from 35% in Q3 to 30% in Q4 and now to 26% in Q1, while total headcount did something it hasn't done in years: it decreased from 648K to 631K. As a reference, at the beginning of 2017, Amazon employed around 350,000 full- and part-time workers. It is nearly double this number less than two years later.

The stock initially spiked on the big EPS beat, but has since retraced all gains as investors focused on the slowdown in AWS and the disappointing operating income guidance.