Amazon Is Undervalued

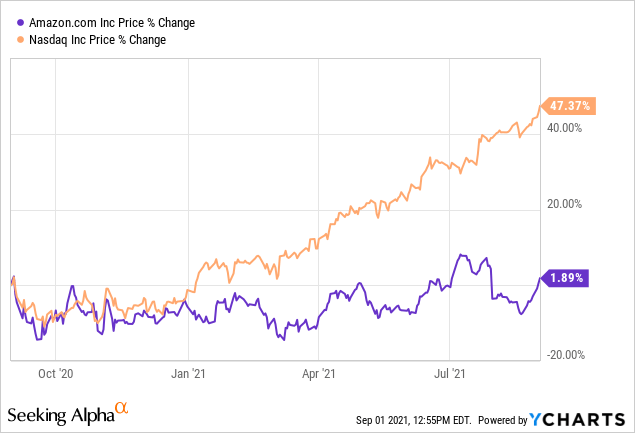

Amazon (Nasdaq: AMZN) stock has been consolidating sideways for a considerable time now, still trading at almost the same levels from 12 months ago. In that period, the stock has significantly underperformed the Nasdaq, so performance has been lackluster on an absolute level and even depressing in comparison to the relevant index. Adding insult to injury, the stock had a sharp selloff after reporting earnings for Q2.

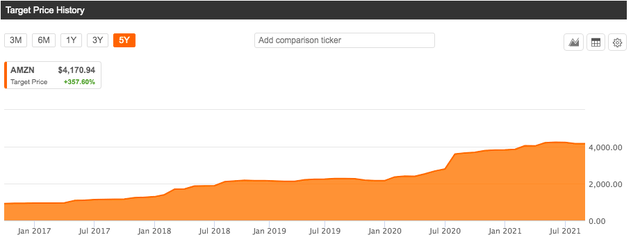

Data by YCharts

There is a time for everything, however, and now looks like a good time to consider buying Amazon stock at current prices.

A Well-Deserved Consolidation

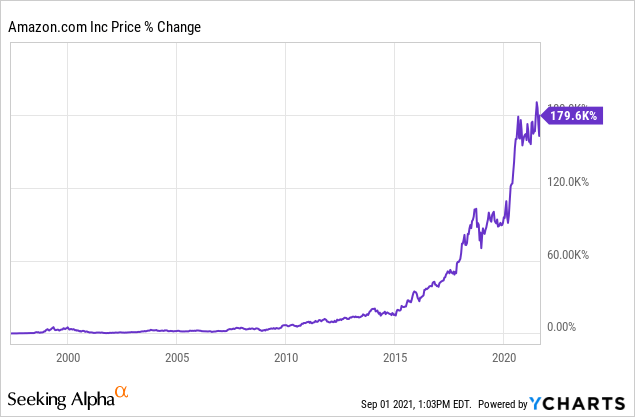

Amazon is one of the most spectacular business success stories in the past few decades, and the stock has delivered massive returns, combined with sharp volatility, over the long term.

Data by YCharts

When a company is so successful, and the stock has a large weight on the big market indexes, it can become "over-owned" in the market, meaning that both institutions and retail investors have already built their positions in Amazon.

This trend was perhaps exacerbated during the lockdowns in 2020, as Amazon became a safe haven for investors looking to own a high-quality business that can also do well in such an uncertain period.

After delivering the kind of spectacular returns that Amazon has produced in the past, it is only natural and even healthy for the stock price to rest for a while and consolidate the gains until it has the energy to make another move higher. High-quality stocks tend to deliver big gains over the years, but no stock can outperform the market each and every year.

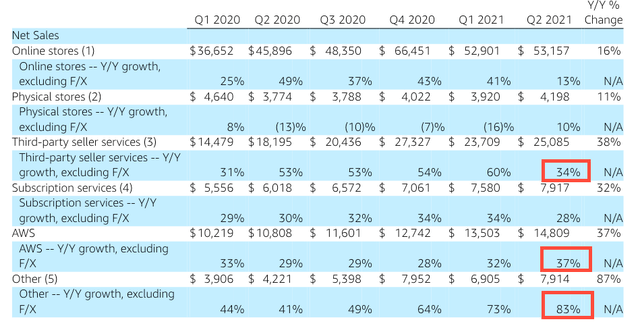

There is also the fact that revenue for Q2 2021 came in below expectations, creating some uncertainty around a company that typically smashes expectations. However, this weakness is mostly concentrated in first-party sales, which increased 13% and decelerated substantially versus prior quarters.

However, this deceleration is mostly due to the pulling forward of demand during the lockdowns, and it is only affecting the less profitable revenue source, meaning first-party e-commerce sales. Other segments such as third-party sales, Amazon Web Services, and Other - which includes the much promising advertising business - look as strong as ever, if not more.

Importantly, these outperforming segments are becoming a much larger share of the overall revenue mix. If this trend continues, it will have positive implications in terms of margins and top-line growth for Amazon going forward.

Attractive Valuation

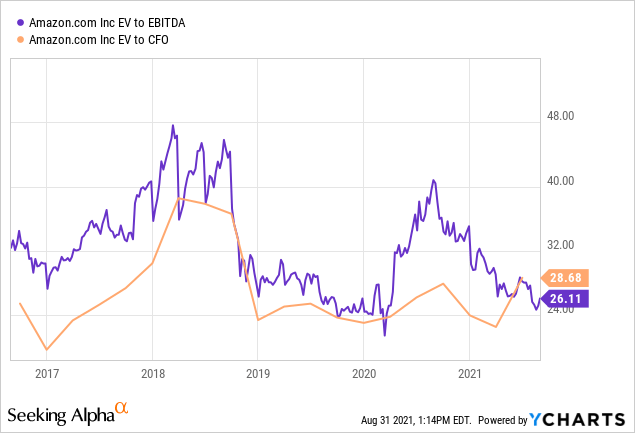

Amazon is attractively valued right now, if not downright undervalued. The stock is trading at an EV to EBITDA ratio of 26 and an EV to CFO ratio of 29. Both valuation ratios are near the low end of the valuation ranges for Amazon over recent years.

Data by YCharts

Wall Street analysts have an average price target of $4171 per share for Amazon, which implies an upside potential of 21% versus current levels.

I would never make a decision to buy or sell a stock based on Wall Street targets, but it doesn't hurt to see that the stock is conservatively priced in comparison to consensus earnings estimates and the price targets derived from those estimates.

Source: Seeking Alpha

Even better, those estimates are rather conservative, as the analysts are expecting a significant deceleration in sales growth over the years ahead. Revenue growth is expected to slow down from 18% next year to below 10% as 2030 approaches.

| Fiscal Period Ending | Revenue Estimate | YoY Growth | FWD Price/Sales |

| Dec 2021 | 476.05B | 23.31% | 3.69 |

| Dec 2022 | 562.44B | 18.15% | 3.13 |

| Dec 2023 | 655.36B | 16.52% | 2.68 |

| Dec 2024 | 741.04B | 13.07% | 2.37 |

| Dec 2025 | 839.79B | 13.33% | 2.09 |

| Dec 2026 | 972.28B | 15.78% | 1.81 |

| Dec 2027 | 1,018.86B | 4.79% | 1.73 |

| Dec 2028 | 1,123.73B | 10.29% | 1.56 |

| Dec 2029 | 1,232.41B | 9.67% | 1.43 |

| Dec 2030 | 1,333.99B | 8.24% | 1.32 |

Source: Seeking Alpha

It obviously makes sense to expect growth to slow down for such a large business. But Wall Street has consistently underestimated Amazon in the past, and it wouldn't surprise me to learn that they are underestimating Amazon's growth prospects once again.

This could be a powerful driver for the stock. Market prices reflect expectations, if the company can outperform expectations, this also means that the stock price is ultimately undervalued.

Amazon is the market leader in e-commerce and cloud computing infrastructure, two industries that still offer abundant room for growth in the years ahead. International expansion is barely getting started, and Amazon has plenty of opportunities for growth in advertising and digital entertainment, among other areas.

The opportunities are there, and Amazon has a competitive strength, the strategic resources, and the proven management team to successfully go after those opportunities.

Scale is a crucial advantage in online commerce because it allows the company to spread fixed costs on a large number of items. No other company can beat Amazon in terms of scale and cost efficiency in online retail. The same dynamic is at play in Amazon Web Services, more scale produces more efficiency and cost advantages as revenue grows.

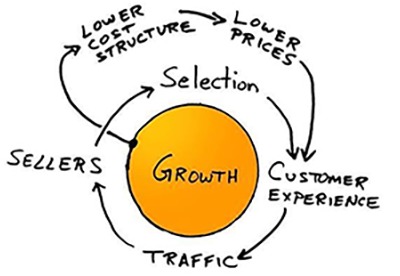

The network effect is at play in third-party sales. More customers attract more sellers to the platform, which creates a greater selection and a bigger scale to reduce costs and prices. This keeps attracting more customers and sellers to Amazon over time.

This dynamic creates a flywheel effect that creates a virtuous cycle of growth and increased competitive advantages for Amazon over the long term.

Source: Amazon.

With a forward price to sales ratio of 3.7 for 2021 and 3.3 for 2022, the current entry price is not too demanding at all, and it even looks quite cheap based on current sales estimates. Furthermore, there is a good chance that Amazon will outperform those relatively shy growth estimates from Wall Street in the years ahead.

Risk And Reward Going Forward

The most recent factor hurting the stock is the deceleration in growth after the reopening. However, this is just a transitory thing due to challenging year-over-year comparisons and the fact that consumers have more interesting alternatives than just hoarding toilet paper and canned food via Amazon. Besides, when we look at the report from a broader perspective, Amazon is still performing very well across its multiple segments.

Regulatory risk is always an issue for Amazon and other big tech players. The probabilities are that regulatory pressure will not kill the bullish thesis on Amazon. After all, consumers love the company, as it strives very hard to offer low prices, wide selection, and world-class service.

Ironically enough, if the government ever splits Amazon into its different segments, there is a good chance that the different parts will get a higher valuation than the company as a whole is getting now.

To provide some perspective, AWS produced $14.8 billion in revenue with an operating margin of 28% last quarter. Revenue increased 37% year over year. A price to sales ratio of 20 gives you a value estimate of $1.05 billion for AWS and a price to sales ratio of 30 gives you a value estimate o $1.58 billion for AWS alone.

That being said, even if Amazon the business is strong enough to continue thriving in the face of regulatory pressure, Amazon the stock can still be affected by negative headlines in the short term. Investors in Amazon need to be prepared for noise and volatility coming from regulatory risks.

I would say that Shopify (SHOP) is perhaps the biggest risk for Amazon these days. Shopify allows merchants to have full control of the customer experience and the data, which is a big advantage. Shopify is also making smart inroads in social commerce via partnerships with the leading social networks like TikTok, while permanently expanding its platform of services to consolidate its competitive position.

The main negative with Shopify as an investment is valuation, as the stock trades at aggressively demanding multiples. However, it is also executing at a high level, and owning both Amazon and Shopify allows an investor to own two high-quality leaders in e-commerce while also diversifying the competitive risk away.

Some Amazon bulls tend to consider the stock a bulletproof investment with almost no risk. While I do agree that the upside potential more than compensates the risks by a large margin, but it is important to always keep in mind that all investments always carry risks, and they can even have some future risks that are not visible right now.

That being clarified, investing is always a game of probabilities, and you want to put those probabilities on your side. Amazon is a high-quality business with rock-solid competitive strength, plenty of growth opportunities, and trading at an attractive valuation. The bullish thesis for Amazon stock looks quite strong at these levels.

Disclosure: I/we have a beneficial long position in the shares of AMZN, SHOP either through stock ownership, options, or other derivatives.

Disclaimer: I wrote this article myself, ...

more