Amazon: A Growth Monster

Amazon (AMZN) is a growth monster that keeps getting bigger. This year, some 2.1 billion people are expected to buy goods online. That figure was around 1.6 billion in 2016.

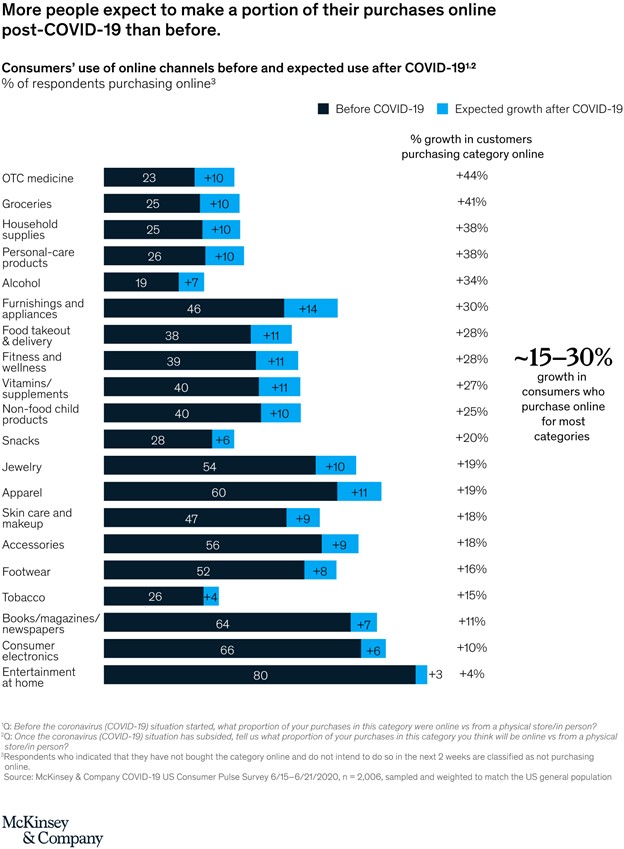

And even though people are tired of being cooped up at home because of the pandemic, they’ve discovered that they like the one-stop online shopping experience. A recent survey by McKinsey & Co. shows the shift to digital purchasing is here to stay.

One-stop shopping is more popular than ever, which is why half of all e-commerce purchases in 2020 were made on mega-marketplaces like Amazon. Ever since the pandemic shifted more consumer spending online, Amazon has done particularly well. Get this: Amazon doubled its profit since the pandemic began.

Granted, Amazon was already dominating before the arrival of COVID-19, but the pandemic shifted its positive momentum into overdrive. Today, Amazon captures more than 25% of all online sales in the U.S. for every category, with the only exceptions being autos and auto parts.

The reason for Amazon’s success is simple. It provides better service than anybody else because of its extensive network of fulfillment centers all over the country. These make it possible for Amazon to deliver orders in a speedy and cost-effective manner.

A typical Amazon fulfillment center is 800,000 square feet — 13 times the size of a football field. It currently has 110 gigantic mega-fulfillment centers in the U.S., and it plans to add 28 more. These would take years and hundreds of millions of dollars for a new competitor to duplicate. And then that would-be competitor would have to figure out how to replicate Jeff Bezos’s multibillion-dollar business.

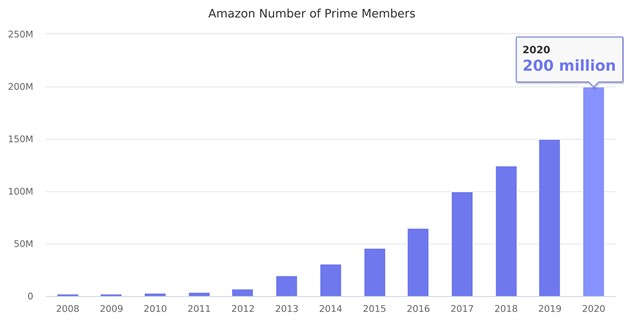

Amazon’s Prime membership service is a keystone of this profitability. Amazon Prime’s annual subscription service has an estimated 200 million members worldwide that pay up to $119 a year for free two-day shipping, online video and music streaming services, photo storage, and more. Chances are you’re one of them: 62% of U.S. households are Prime members.

Two hundred million times $119 a year translates into a staggering $23.8 billion of revenue that shows up on Amazon’s doorstep every year -- before it sells anything. And, boy, are those Amazon customers shopping like crazy. In the last quarter, Amazon pulled in a whopping $125 billion of revenue.

But the real jewel of Amazon’s online kingdom is Amazon Web Services (AWS). AWS is Amazon’s cloud storage division, and it dominates the cloud storage sector. AWS has 10 times the storage capacity as the next 14 cloud competitors combined and controls 40% of the entire cloud storage market.

In 2020, AWS pulled in revenues of $40 billion. And that’s not even the most impressive statistic I can give you right now. However, this is: In just the last 90 days alone, AWS pulled in $12.5 billion of revenue. That’s a staggering 29% year-over-year increase.

I think the large profits AWS generated in 2020 is just the tip of the iceberg. The world continues to create mountains of new data every day, and that data needs to be easily hosted, accessed, and archived. That’s a big reason why I believe the cloud industry is still in its infancy. And it’s just another reason why I believe Amazon shares will continue their ascent.

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.