Altice Is An Attractive Short

Dec. 19, 2017, concludes the 180-day lockup period on Altice USA, Inc. (NYSE:ATUS).

When the lockup period ends for ATUS, its pre-IPO shareholders, directors, and executives will have the chance to sell their more than 233.0 million outstanding shares. The potential for a sudden increase in stock available in the open market may cause a significant decrease in the price of Altice USA shares. Currently, just 51.7 million shares of ATUS are trading.

Currently ATUS trades in the $19 to $20 range, significantly below its IPO price of $30 and lower than its first day closing price of $32.71 on June 22, 2017.

Business Overview: Provider of Broadband Communications and Video Services

Altice USA, along with its subsidiaries, operates as a broadband communications and video services provider in the United States. It operates via its Cablevision and Cequel segments. The company delivers broadband, Wi-Fi hotspot access, pay television, telephony services, proprietary content, and advertising services to approximately 4.9 million commercial and residential customers. In addition, the company offers wireless routers and Internet security software; managed desktop and server backup services; managed collaboration services comprising audio and Web conferencing; and pay television services, which include delivery of broadcast stations and cable networks, and advanced digital pay television services, such as high-definition channels, video-on-demand, digital video recorder, and pay-per-view.

In addition, it provides Ethernet, data transport, IP-based virtual private network, and Internet access services; managed services, including business e-mail, hosted private branch exchange, Web space storage, and network security monitoring; data-driven television, digital, and other multi-platform advertising services; and data-driven, audience-based advertising solutions.

Further, the company operates local news channels, in addition to traffic and weather channels; News12.com, an online destination for local news on the Web; and News 12 To Go, a mobile app for phones and tablets. Altice USA operates across 21 states in the U.S. Altice USA, Inc. is headquartered in Bethpage, N.Y. Altice USA, Inc. is a subsidiary of Altice N.V.

Financial Highlights

Altice USA reported its third-quarter financial results for the period ended Sept. 30:

-

Revenue growth of +3.2% year over year in the third quarter 2017 excluding Newsday; reported revenue growth +3.0% year over year in the third quarter 2017.

-

Adjusted EBITDA grew +18.9% year over year for the third quarter 2017; Adjusted EBITDA margin increased 5.8 percentage points to 44.1%.

-

Adjusted EBITDA less capex (operating free cash flow) grew +13.9% year over year for the third quarter of 2017.

Management Team

Chairman and CEO Dexter Goei has served the company since 2009. His previous experience includes positions at JPMorgan, Morgan Stanley, and HOT Mobile Ltd. Mr. Goei holds Degree in Internal Economics from Georgetown University's School of Foreign Service with cum laude honors.

Co-President and CFO Charles Stewart has served Altice since 2015. He previously held positions at Cequel Communications Holdings, Morgan Stanley, Itau BBA International PLC, and Itau Unibanco Holding. He is a Graduate of Yale University.

Competition: Hulu, iTunes, GoogleTalk, and Others

Altice USA faces considerable competition from large enterprises including Vonage (VG), Skype, GoogleTalk (GOOG), WhatsApp, Facetime, magicJack, Sling TV, DirecTV Now, Playstation Vue, YouTube, Netflix, Amazon Prime, iTunes, and Hulu. Morningstar lists the company's peers as AT&T (T), Verizon (VZ), China Mobile, Nippon Telephone and Telegraph, and others.

|

Market Cap (mil) |

Net Income (mil) |

P/B |

P/E |

|

|

Altice USA |

$13,569.0 |

($970.0) |

4.4 |

n/a |

|

ATT |

$222,047.0 |

$12,850.0 |

1.8 |

17.3 |

|

Verizon |

$205,685.0 |

$15,927.0 |

7.7 |

13.0 |

|

China Mobile |

$200,710.0 |

$110,844.0 |

1.3 |

12.2 |

|

Industry Average |

$15,719.0 |

$154,424.0 |

2.0 |

22.1 |

Early Market Performance

Altice USA's IPO priced at $30 per share, close to the high end of its expected price range of $27 to $31. The stock closed on the first day of trading at $32.71. Since then, the stock reached a high of $33.81 on Aug. 1. But it has declined steadily since then reaching a low of $17.85 on Nov. 30. The stock currently trades in the $18 to $19 range.

Summary

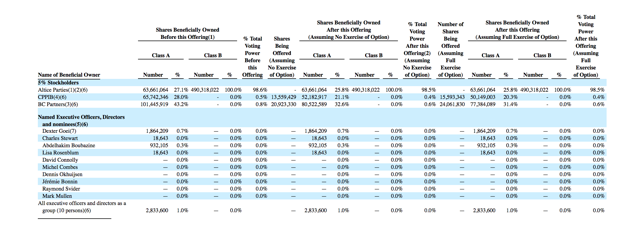

When the IPO lockup expires on Dec. 19th, the company's pre-IPO shareholders and insiders will be able to unload their restricted shares for the first time. This group is made up of three VC firms and 10 individuals.

If just a handful of these restricted shareholders decide to cash in on their positions the marketplace could be flooded with shares. Currently, just 51.7 million shares of ATUS are trading, while more than 233 million shares are restricted.

We suggest that risk tolerant, short-term investors short shares of ATUS ahead of the Dec. 19th lockup expiration. Interested investors should then cover these positions either late in the trading session on Dec. 19th or over the course of the trading day on Dec. 20.

Disclosure: I am/we are short ATUS.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more