Alteryx Stock Crushes: Buying Opportunity

Alteryx (AYX) got downright obliterated last week, the stock collapsed by more than 28% on Friday after the company's earnings report was received with relentless selling by the market. The struggle is real, Alteryx is feeling the impact from the recession and the timing for recovery is unclear at this stage.

However, the slowdown is most probably transitory as opposed to permanent, and short-term weakness in a high-quality business seems to be creating a buying opportunity for investors in Alteryx.

Challenging Environment

Alteryx actually reported both sales and earnings numbers above Wall Street estimates during the second quarter of 2020. But forward guidance was clearly disappointing, and management did not provide many reasons to expect a recovery in demand in the short term.

It is important to understand that Alteryx provides software to make the data analysis process simpler, easier, and more efficient. This is not a company that benefits from specific work from home trends such as those in online communications or cloud computing. Alteryx offers a relatively expensive software solution in times when companies are cutting their spending as much as possible, and this obviously has a negative impact on revenue growth.

Nobody should be too surprised to see Alteryx suffering the impact from the recession, but management comments in the previous quarter may have provided a wrong impression because the company was not yet fully experiencing the deceleration in April.

In the words of Kevin Rubin, Alteryx's CFO:

Last quarter, we highlighted that new business activity in April was consistent with the levels in April, 2019. This gave us some degree of confidence that customers were reengaging after the abrupt slowdown we saw at the end of March. However, we have typical software linearity in our business, meaning the majority of our bookings are generally concentrated in the back half of the customer, changes in customer buying behavior did not become apparent to us until later in the quarter.

Revenue for the second quarter of 2020 was $96.2 million, an increase of 17% versus the same quarter in the prior year. This is a big deceleration in comparison to growth rates in prior quarters, but it is not such a bad number considering the economic environment. The revenue number was actually above analyst estimates by more than $2 million.

However, guidance was a very different story. Alteryx is expecting revenue in the range of $111 million to $115 million in the third quarter, representing a year-over-year growth rate of approximately 7% to 11%. Analysts were on average expecting $119.11 million.

For the full year, 2020 revenue guidance is for $460 million to $465 million or a year-over-year increase of approximately 11%. In comparison, analysts were expecting $505.1 million in revenue 2020, so the guidance number is materially below expectations.

Adding to the concerns, there were no signs of improvements in the trend during the quarter. CEO Dan Stocker said:

Based on what we see today, we do not anticipate a material improvement in business conditions during 2020.

Alteryx stock was trading close to all-time highs leading to the report, and high expectations combined with a material disappointment in guidance can produce significant damage to the stock price.

It was quite obvious when looking at the guidance numbers that this was going to trigger a sharp selloff in the stock, although the magnitude of such a selloff seems to be exaggerated from a long term point of view.

Solid Fundamentals

Accounting revenues can be messy for Alteryx. Due to accounting standards requirements, the company recognizes most of the revenue from a new contract in the quarter in which the contract is signed as opposed to spreading revenue evenly through the duration of such a contract. This means that accounting revenue numbers can be quite noisy, and decelerating growth can have a disproportionately high impact on revenue during a quarter.

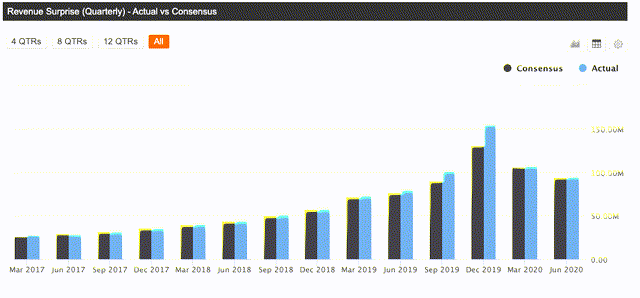

Besides, management is generally quite conservative when it comes to guidance. Alteryx has delivered revenue numbers above expectations in the past 14 quarters in a row, quite an impressive track-record showing that management tends to consistently underpromise and overdeliver.

(Click on image to enlarge)

Source: Seeking Alpha

Other important metrics regarding business fundamentals look much stronger than what the slowdown in revenue would indicate. Alteryx reported a dollar-based net expansion rate of 126%, which is a more than healthy number by industry standards. The company also ended the quarter with $430 million in annual recurring revenue, an increase of over 40% year-over-year.

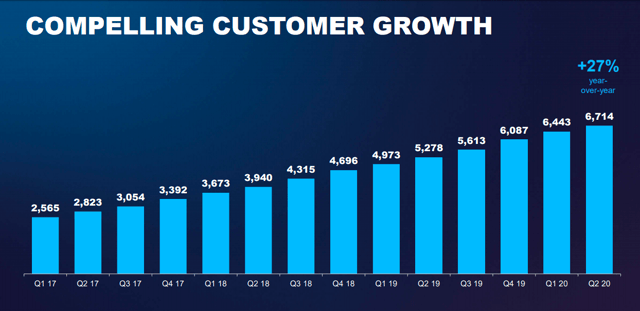

Alteryx added 271 net new customers during the quarter, including six of the Global 2000. The company currently has more than 6,700 customers around the world including 37% of the Global 2000. Engagement levels are at record levels, so customers are clearly finding in Alteryx a valuable tool to make decisions in times of uncertainty.

(Click on image to enlarge)

Source: Alteryx

Management expects to exit the year 2020 with approximately $500 million in annual recurring revenue, representing an increase of 30% year over year. These numbers do not reflect a declining business, quite on the contrary.

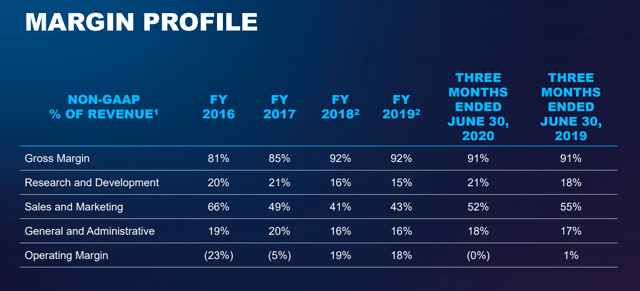

The company also delivered solid cost discipline during the quarter, with gross profit margin remaining resiliently high in spite of the slowdown in growth.

(Click on image to enlarge)

Source: Alteryx

Yes, revenue guidance was materially below expectations and there is no way around that. However, there is a huge difference between a company that is facing a slowdown in growth due to challenging economic conditions and one that is facing a permanent deterioration in fundamentals.

When it comes to Alteryx, the company is delivering a level of performance that most other companies in the world can only envy during a recession, and the business fundamentals look as healthy as ever.

The Most Important Thing To Consider

Alteryx is implementing a series of initiatives focused on jumpstarting revenue growth. Adoption licenses are short term contracts, generally for 6 months, allowing customers to test the platform without a large commitment in time or money. These licenses are obviously easier to sell when customers are on a tight budget.

Adoption agreements grew 60% year over year and more than 100% sequentially last quarter. If the company manages to retain a large share of these customers going forward, the overall impact on revenue could be attractive over the middle term.

Alteryx is increasingly focusing on strengthening and expanding its ecosystem. The company announced a global elite partnership with PWC in the first quarter and new tech partnerships with Adobe (ADBE) and UiPath in the second quarter.

New hires among sales reps have underperformed other historical cohorts recently because it has been harder for them to get the right training and learn the sales playbooks in a work from home environment. Alteryx is building new learning platforms and adjusting its sales playbooks in order to restore sales and marketing efficiency to historical levels.

It is hard to know what kind of impact these initiatives are going to have in the short term, but one thing looks quite clear: based on the evidence currently available, the company's problems seem to be temporary and due to external factors as opposed to internal and permanent.

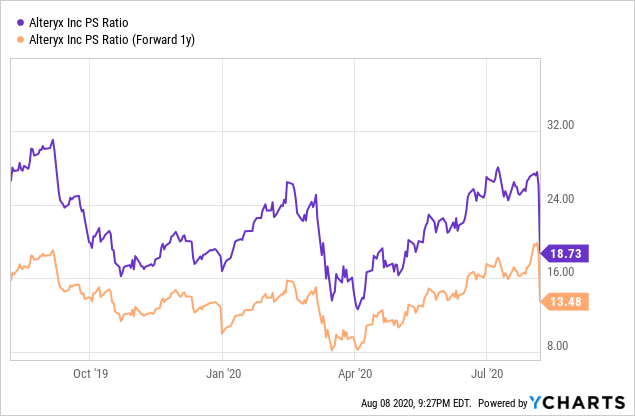

The stock was priced for perfection before the report, and now valuation is accounting for a much tougher reality. A forward price to sales ratio of 13.5 looks fairly reasonable for such a high-quality business.

(Click on image to enlarge)

Data by YCharts

The most important thing to consider is that the fundamentals are intact and Alteryx is well-positioned for much better performance when the economy recovers from the recession. Markets are forward-looking, so I wouldn't be surprised to see the stock moving in the right direction if the prospects for the economy start to improve over the middle term.

Market expectations for Alteryx have now been reset to much more modest levels, and potential returns for long term investors look clearly attractive at these price levels.

Disclosure: I am/we are long AYX.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more