Alphabet's Path To $5,000 By 2025

400tmax/iStock Unreleased via Getty Images

Alphabet (GOOG) (GOOGL) has grown into one of the most powerful enterprises in the world. While the company operates numerous businesses and controls many products and services, most of Google's profits still come from search and advertising. Google should continue to dominate the global search segment, but the company's secondary businesses should become more profitable in future years. We have been long Google for a long time, and holding the company's shares should continue to pay off going forward.

More Business, More Profits

Source: about.google

Alphabet has many businesses, as Google is now present in just about every corner of the internet. Of course, it's not just the internet, as Google is increasingly involved with hardware and other non-internet-centered businesses. However, the company continues to generate the lion's share of its revenues and profits through its search segment. Over 71% of Google's advertising revenues came in through its search business in Q1 2021. Moreover, Google search accounted for roughly 58% of the company's total revenues last quarter.

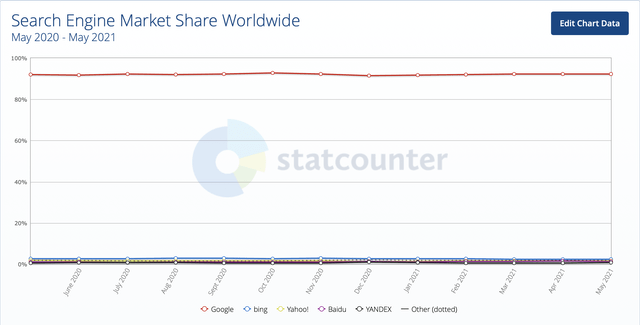

Search Market Share - All Platforms

Source: statcounter.com

With over 90% market share across all platforms, Google remains the dominant force in global search. The company has a powerful, market-leading position in this space, and it is not likely going to give up market share. Also, Alphabet has numerous expanding businesses that are likely to produce substantially more revenue in the future.

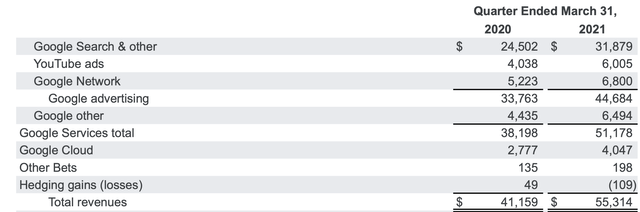

For instance, YouTube's revenues continue to increase at a robust pace. The segment's revenues surged by 77.5%, from $11.1 billion to $19.7 billion (2018-2020). In Q1 2021, YouTube ads sales came in at a staggering $6 billion, a 49% YoY surge. Google's cloud business also continues to expand rapidly. The cloud business delivered $4.05 billion in sales last quarter, a 46% YoY increase.

Q1 2021 Revenue Highlights

Source: abc.xyz

While cloud and YouTube delivered nearly 50% YoY revenue growth, search also did quite well with a 30% YoY increase. However, these are only three segments, and Alphabet has a significant number of growing businesses. Under Aplphabet's umbrella are companies like Verily, Sidewalk Labs, Calico, GV, Google Capital, DeepMind, X, Waymo, Project Wing, Titan Aerospace, and more. Alphabet also has numerous products and services. Some of Google's best-known products include Android OS, Chrome, Earth, Drive, Finance, Gmail, Google Play, Maps, News, and much more.

Alphabet may have the best-diversified portfolio of businesses out of any company in the world right now. Many of these segments are essentially growth companies. These businesses are attracting users, gaining momentum, building revenue streams, improving monetization, and should become increasingly profitable over time. Therefore, Alphabet's stock price should continue to grow accordingly.

Price Projections

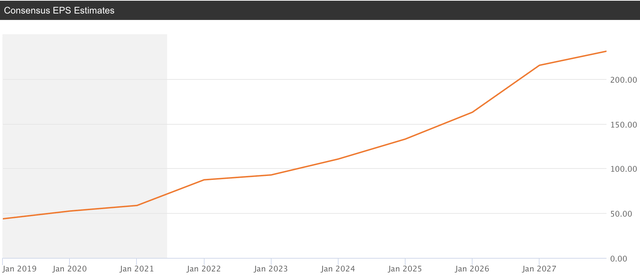

Alphabet's Consensus EPS Estimates

Source: seekingalpha.com

Right now, Alphabet trades at around 28.8 times consensus forward EPS estimates. Analysts expect the company to increase revenues by 16% this year. Moreover, analysts expect robust earnings and revenue growth to continue. Therefore, in 2025 Alphabet should earn approximately $165 per share. I don't see why Google should be valued any differently than it is now. Thus, if we put a 30x multiple on $165 in EPS, we arrive at a stock price of around $5,000. As the market typically prices companies ahead of time, Alphabet should achieve this price level by 2024.

Some Potential Challenges

While I don't see any immediate risks to the business, it is always good to discuss some potential challenges. For instance, regulatory issues are a concern. Due to its monopolistic style business structure, Google has faced regulatory scrutiny and fines in the past. Penalties have affected the company's bottom line, and similar issues could impact future earnings. Additionally, as Alphabet continues to grow, there could be calls to break up the company. However, a breakup of Alphabet's enterprises will likely unlock shareholder value instead of destroying it. In addition, higher taxes are a concern. As the White House pushes for higher corporate tax rates, Google's and corporate America's bottom line, in general, could get impacted. Finally, a broader slowdown in the economy or a recession would likely weigh down Alphabet's earnings and put pressure on my $5,000 price projection.

The Bottom Line

We've owned shares in Alphabet throughout much of the time since the company went public back in 2004. The stock has done well, as it's up by nearly 3,000% since Google's public debut. Moreover, the company's stock continues to shine, as shares are up by roughly 78% over the past year. While Alphabet is trading around 28 times this year's EPS expectations, the company should deliver substantially more income in future years. Google remains a dominant force in search, and the company's numerous businesses are likely to grow more profitable over time. As a result, Alphabet has strong earnings growth potential, as the company could deliver approximately $165 in EPS in 2025. Also, due to its robust earnings growth, the company could maintain around a 30 times earnings valuation in future years. Therefore, as Google continues to expand its earnings, its stock price should also continue to appreciate. Alphabet could roughly double to around $5,000 by 2025.

Disclosure: I am/we are long GOOG.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any ...

more