Alphabet Stock By The Numbers

Alphabet (GOOG) (GOOGL) has attracted a lot of attention due to the data privacy concerns surrounding the company in recent months. When this happens it can be easy to miss the forest for the trees. Investors typically focus too much on the short-term news flow, and they tend to lose sight of the long term fundamentals in the business.

Quantitative analysis can be remarkably valuable in these cases, since the numbers provide a clear and objective view of an investment, leaving subjective opinions and emotions aside. With this in mind, let's take a look at Alphabet stock from a quantitative perspective.

Outstanding Growth And Profitability

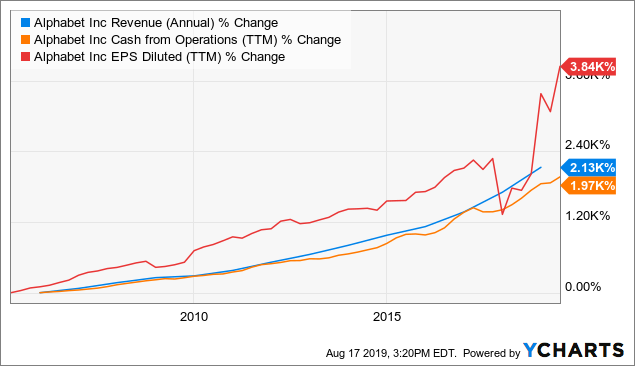

Online advertising is a high growth industry, and Alphabet is the top player in such a promising market. This leadership position in a compelling industry has allowed Alphabet to produce outstanding performance in terms of key metrics such as revenue, operating cash flow, and earnings per share over the long term.

(Click on image to enlarge)

Data by YCharts

The company is consolidating its competitive strengths with Google and expanding into different areas with abundant room for sustained growth over the long term. Google owns 8 different services with over 1 billion users each: Google Search, YouTube, Android, Gmail, Maps, Chrome, Google Play, and Drive.

YouTube is a particularly promising growth engine over the years ahead. Management said in the most recent earnings conference call that thousands of channels have doubled their total monthly revenue by using new monetization products like Super Chat and Channel Memberships. YouTube channels with more than 1 million subscribers grew by 75% year-over-year last quarter. In addition to this, YouTube Music and YouTube Premium now available in over 60 countries, up from five markets at the start of 2018.

Google is actively integrating augmented reality into search. For example, when users are searching for new shoes online, they can view the shoes in 3D or even superimpose those shoes to their wardrobe to see if they match.

The company is capitalizing on Artificial Intelligence technologies to make big improvements to the Google Assistant. According to management, the next-generation Assistant can process requests up to 10 times faster, making it easier to multi-task, compose e-mails, and even work offline.

Growth tends to naturally slow down as companies gain size over time, but Alphabet is still growing at full speed and even accelerating. The company reported a 19% increase in revenue last quarter, with performance accelerating versus a 17% increase in the prior quarter.

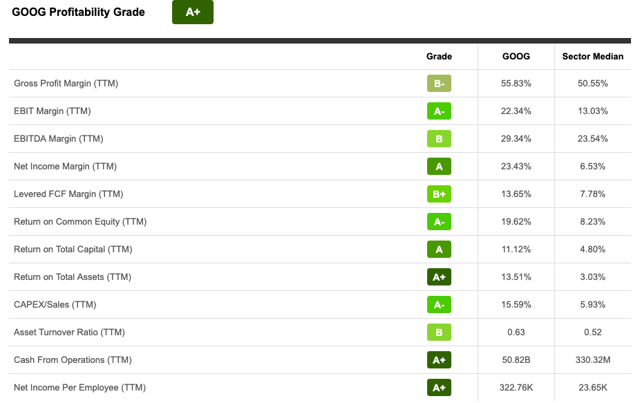

Alphabet has aggressively increased its investments in all kinds of ambitious projects over the past several years, and this has a negative impact on margins, but the business is still producing spectacular profitability levels.

The table below compares a wide variety of metrics for Alphabet versus the sector median, and the company is widely superior across all kinds of profitability indicators.

(Click on image to enlarge)

Source: Seeking Alpha Essential

Reasonable Valuation

Alphabet stock is trading at a price to earnings ratio below 24, which is more than reasonable for a company that is producing outstanding revenue growth and massive profitability. Looking at historical valuation levels, the stock is also valued near the low end of its valuation range over the past several years.

(Click on image to enlarge)

Data by YCharts

Importantly, looking at the earnings numbers in aggregate does not tell the whole story. Google is a cash-generating machine, while the other bets division is losing money at the operating level. The company is also giving the first steps in terms of YouTube monetization, so the current earnings numbers don't really show the true economic and strategic value of Alphabet's different businesses.

In other words, if Alphabet theoretically decided to retain its search business and sell all of the other businesses, the company would have much higher margins than today and still make a lot of money from selling properties such as YouTube, Waymo, Maps, and many others.

Alphabet is very reasonably priced when looking at current earnings, and the stock could be deeply undervalued when considering that current earnings are not really reflecting its true fundamental value of the business.

Fundamental Momentum

Stock prices are not driven by the business fundamentals in isolation, but the fundamentals in comparison to expectations. The current price of a stock is incorporating a particular set of expectations about the future. If the company can outperform those expectations, then the stock price will need to increase in order for the valuation to remain stable.

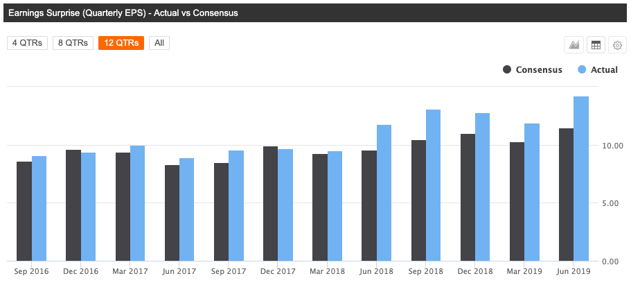

Alphabet has delivered earnings numbers above Wall Street expectations in 10 of the past 12 quarters, and the company has surpassed those expectations by a considerable margin over the past several quarters.

(Click on image to enlarge)

Source: Seeking Alpha Essential

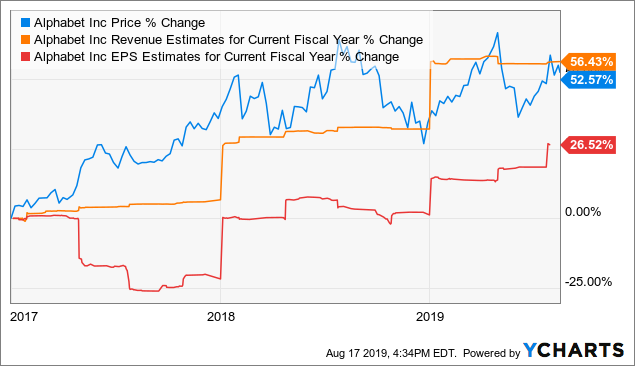

The chart shows how Alphabet stock has evolved in comparison to earnings and sales expectations for the business. Like usually happens, rising sales and earnings expectations are pushing the stock price higher too.

(Click on image to enlarge)

Data by YCharts

Moving Forward

Considering factors such as growth, profitability, value, and momentum, Alphabet looks like a strong investment proposition. We can now evaluate different return drivers in combination by evaluating the PowerFactors system for Alphabet stock. This is a quantitative algorithm that ranks companies in a particular universe according to a combination of factors: financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and Alphabet has a PowerFactors ranking around 97. This means that the stock is in the top 3% of stocks in the US market when looking at multiple return factors together.

Regulatory uncertainty can be an important source of volatility around the stock, but hardly a game-changer in terms of business fundamentals. The most likely scenario is that new regulations will be focused on areas such as data privacy and competitive behavior. The probabilities are that Google will remain a dominant player in its key markets and a massively profitable business in the years ahead, so short-term volatility could create buying opportunities for long term investors in the company.

Alphabet is a top-quality stock to buy and hold for the long term, and any price pullback down the road could present a buying opportunity for investors to purchase a world-class company for an attractive price.

Disclosure: I am/we are long GOOG.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more