Algos And ETFs Might Give Stock Pickers A New Life

Algos and ETFs became a significant part of the market infrastructure. That has changed the market rhythm, and it has amplified certain behaviors. Those changes might be the opening that stock pickers needed to be back on the action.

Picture: DocChewbacca

Algorithms have been responsible for changing the market rhythm. We have become accustomed to 10% plus after-earnings swings, which wear-off two days later. Presently, it seems like the algos take the lead by reacting to the news, and then, as they turn their attention away, the market seems to normalize. The impact is so big that even very experienced and skilled market participants, like Stanley Druckenmiller, are mesmerized by the impact that it is having on the market.

Another market sophistication that is affecting the rhythm of the beast is the ETF. We might argue that the ETF has brought us the fast-food of macro investment. Pick a sector, and, boom, it’s done, there is no need for deep research. It suffices that the whole targeted market is growing. As a result, when a company has caught the eye of money managers, the whole sector tends to go up.

Both have brought advantages to the market. Liquidity is one of them. Another is facilitating capital to move from one sector to the other. Adjustments are much faster. That also means that speculative flows are likely to increase volatility.

That brings us to the point. For starters, going forward value investors will need to add one more skill: algorithm mechanics. Right now, algos seem to be weighing earnings’ data and reacting to it aggressively. That tends to provoke short term self-reinforcing directional moves. Sometimes, in the wrong direction. And, that will be an opportunity for value investors.

Graph 1 – Adobe stock price from December 13 to January 17

(Click on image to enlarge)

(Source: Yahoo Finance)

The case in point is Adobe stock price, from December 13, until January 17. Adobe presented earnings on the 13th of December. The results were considered a beat. However, the next day, shares dropped more than 6%. In the 15th of December, the losses continued. On the next day, there was a small rebound, and then, the downward movement resumed until Christmas Eve. By that point, the total losses, since December 13, were 16.45%. Then, without any significant development, the stock started a comeback. By January 17, the stock was back to ground zero.

That was just an example, and, obviously, several other causes might have contributed to this outcome. But looking carefully, you can find a myriad of similar examples throughout the market. In itself that is nothing new, the market is full of stories of overdone movements, be it panics or euphorias. However, my argument is that algos are making them more frequent and rapid. Wrapping-up, stock pickers should have a better chance of spotting these exaggerated moves and trade them.

ETFs are changing the market rhythm

Another interesting development is the fact that ETFs tend to lift entire sectors very rapidly. And, then, they also tend to drop at the same speed. Basically, they are causing boom-and-bust sequences, at a faster pace than was the norm. Because those are also self-reinforcing movements, sometimes, we end up with industries with better fundamentals than the pre-boom period. However, when a soft landing comes, the money vaporizes from the ETF, and we end with companies at pre-boom price levels, but better fundamentals.

The ETF’s mechanics are very interesting. Since ETFs trade like stocks, they tend to replicate the stocks in their portfolio. However, there is a huge degree of reflexivity underneath. If a sector, represented by an ETF, falls out of favor, it will be sold by investors. A negative flow, coming out of an ETF, will weigh negatively in every stock present in the ETF. A good example is what happened to financial ETFs after the Presidential election. According to analysts from Keefe, Bruyette & Woods, $9 billion flowed into financial ETFs. On average, shares of stocks in ETFs rose more than shares of companies that weren’t. That speaks volumes about the inefficiencies that ETFs are provoking.

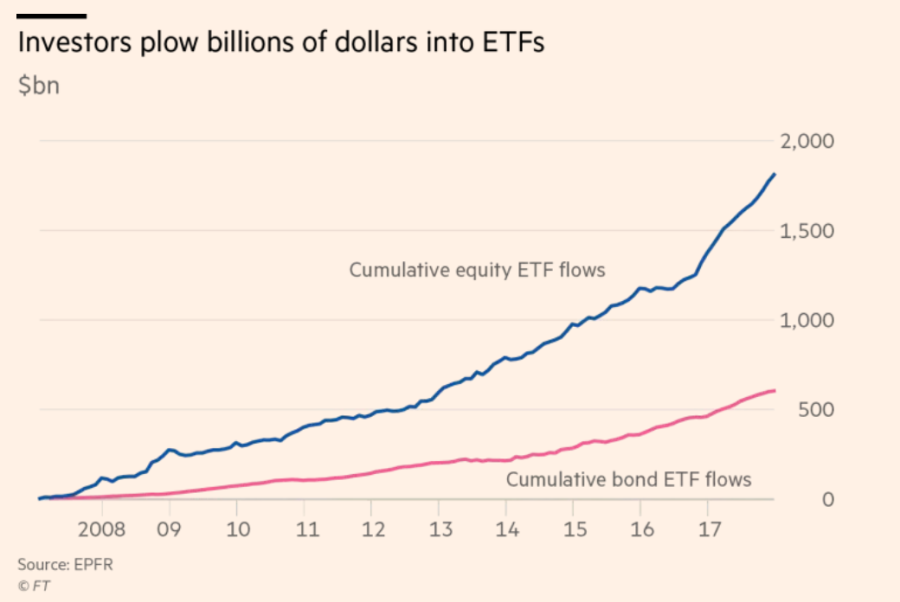

Graph 2 – Funds flowing to ETFs

(Click on image to enlarge)

(Source: Financial Times)

One good illustration of the ETF effect is the semiconductor sector. From June 2016 until June 2018, Micron in particular, and the semiconductors, in general, rode the Trump trade magnificently.

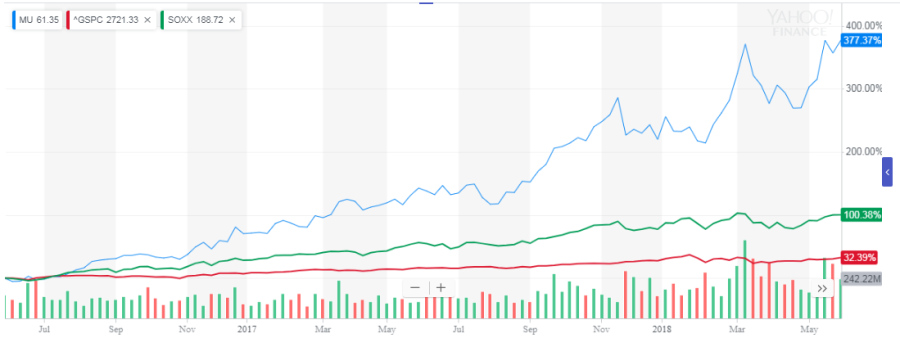

Graph 3 – Micron stock price (from June 2016 to June 2018)

(Click on image to enlarge)

(Source: Yahoo Finance)

In the 2nd half of 2018, when it became apparent that the Fed and the trade war were impacting the economy, traders started ditching cyclical companies. And, one good way to do it is by shorting semis. They have always been very sensitive to economic cycles, and now you can easily short them by shorting an ETF.

Graph 4 – Micron stock price (from June 2016 to December 2018)

(Click on image to enlarge)

(Source: Yahoo Finance)

Basically, we were back to the 1st half of 2017 price levels. However, for Micron, the fundamentals were significantly better.

Conclusions

Once seen as a threat by traders and portfolio managers, algos and ETFs might be creating pockets of opportunities for stock pickers. The extreme and fast moves provoked by those tools, allied to the herd effect, seem to be creating huge divergences in the value/price relation.

Actually, algos might help stock pickers timing the market, by creating discontinuities. Released data, read by algos, tends generates trades that close value/price gaps or, sometimes, does the opposite. Stock pickers just have to do their research and wait for an opening to buy or sell.

On the other hand, ETFs create extreme herd effects. Sometimes, it works as a tide that lifts all boats. Again, that is an opportunity for stock pickers to separate the wheat from the shaft.