Adobe Stock Forecast: Why Adobe Deserves A Price Target Of $730

Summary:

- Adobe’s stock has risen +36.7% since my December 15, 2020 buy recommendation. Adobe’s stock is now trading above my old PT of $600.

- I am still endorsing ADBE as a buy because it is clearly a momentum stock that’s been rising for the past 9 months. My new PT for ADBE is $730.

- Adobe still persists as a pseudo-monopoly in 2D content creation software. The recent release of the $49.99 Substance 3D Collection is a promising growth driver

- Adding 3D content creation software to its Creative Cloud subscription service is commendable. The 2D/3D graphics software industry is growing at 5.2% CAGR.

- Adobe’s stock touts the highest Piotroski score of 9. The Piotroski Score is a priority barometer in my investing analysis.

I reiterate the buy rating I gave Adobe (ADBE) last December 15, 2020. ADBE has had a price return of +36.7% since that previous article. My takeaway now is that ADBE is still a buy. Yes, you may take your profits now but the bullish one-year forecast score of I Know First for Adobe tells me it is justified to average up on ADBE. The AI algorithm of I Know First gave ADBE a 1-year forecast score of 458.20 with a predictability rating of 0.35. Any stock that receives a forecast score higher than 100 is a buy signal from I Know First.

Compare the said chart above to the December 15, 2020 chart below. ADBE right now has a much higher 1-year forecast score than on the day I gave ADBE a price target of $600. Due to the very high forecast score of ADBE, I am giving it a new price target of $730.

I Know First is very bullish on ADBE because the stock market momentum is on the side of Adobe. Momentum investing tenets applies to Adobe’s stock right now.

Why I Know First AI Algorithm Is Bullish

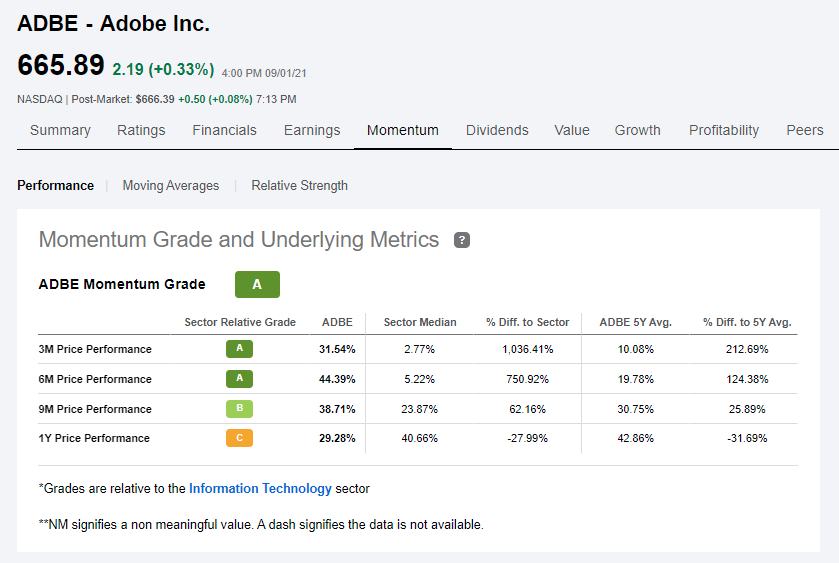

ADBE has been on a roll for the past nine months. The chart below illustrates well why ADBE is an upward momentum buy. The 3-month, 6-month, and 9-month price-performance stats are all positive growth. ADBE’s upward trend has not been disrupted by adverse events or short-selling actions. There’s a strong bull run for ADBE.

(Click on image to enlarge)

Trend analysis is usually used to evaluate the momentum strength of a stock. Trend analysis uses linear regression on short-term (20 days), medium-term (60 days), and long-term 120-days patterns of a particular stock’s high and low price movements. Common sense will tell us that the chart below says ADBE has been on an upward slope since early June.

(Click on image to enlarge)

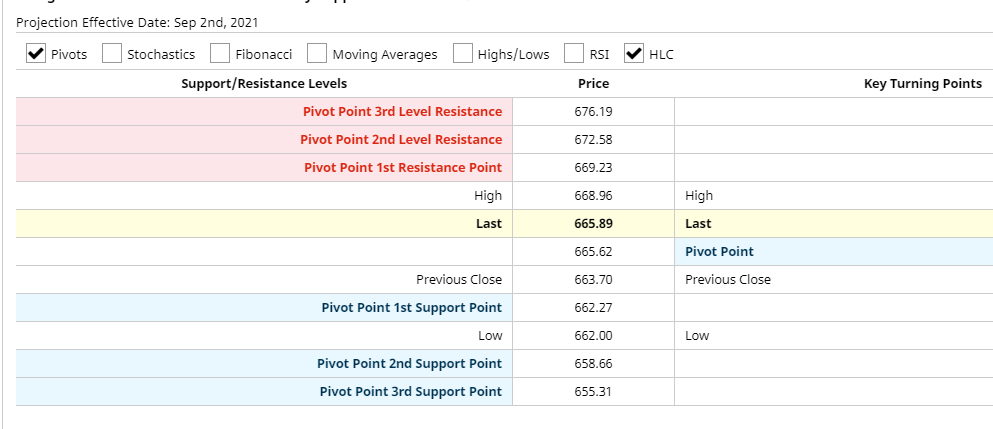

My new $730 1-year price target for ADBE is highly feasible. The 1st Support Pivot Point is already at $663.70 and the 3d level resistance pivot point is $676.19. Converging pivot points of resistance and support lines could mean there’s a very low chance of ADBE dropping below $650.

(Click on image to enlarge)

A strong upward momentum indicates that the majority of investors are emotionally very optimistic for ADBE. The level of investor optimism or pessimism can easily be determined by checking the stock’s Exponential Moving Average or EMA chart. For those who are not yet adept in technical analysis, ADBE is a buy because its 5-day EMA of $661.89 is higher than its 13-day EMA of 652.63. The 13-day EMA is higher than the 20-day EMA of 645.64. The 20-day EMA is higher than the 50-day of $616.94.

(Click on image to enlarge)

The logical high positivism of investors for ADBE has made it an expensive stock to own. However, you can just console yourselves that ADBE’s forward GAAP P/E valuation is only 69.58. This is notably lower than ADSK’s 125.09x.

(Click on image to enlarge)

The very high valuation ratios of ADBE are acceptable because its robust balance sheet, hefty cash flow, strong revenue growth, and consistent high profitability counteract them. Prima facie evidence of this is that Adobe’s stock still touts a Piotroski score of 9 – which is the highest rating.

(Click on image to enlarge)

ADBE is a pricey stock to own but it is a very safe long-term investment. Adobe does not pay dividends. However, Adobe has a $15 billion stock repurchase program.

Why Investors Are Very Optimistic

The recent release of the $49.99/month Substance 3D software suite is a strong tailwind for Adobe. Investors are bullish (they are the ones who gave ADBE a 6-month price return of +44.39%) because Adobe is growing out of its 2D content creation software business. Adobe is basically starting to compete against the $2,365/year 3D media entertainment software products of Autodesk (ADSK). The five Substance 3D software products tout seamless integration with other Adobe products like After Effects, Dimension, Photoshop, and Illustrator.

Going forward, investors are bullish on ADBE because Adobe can now start monetizing from 3D artists of the growing computer graphics software industry. This niche industry has a CAGR of 5.2% and it will be worth $40.25 billion by 2025. Prior to Substance 3D, 99% of Adobe’s subscription revenue comes from its 2D suite of content creation software programs.

The Substance 3D Stager program is capable of high-quality composition for 3D video games, TV/movie content, and Augmented Reality/Virtual Reality visualization. The global AR and VR software and hardware industry is growing at 73.7% CAGR. It will be worth $766 billion by 2025. The recent surge in ADBE’s valuation ratios is partly because Adobe is now accepted as a future leader in AR/VR content creation.

Adobe Stock Forecast: Conclusion

You should act on the very bullish signal from I Know First for Adobe’s stock. ADBE is an upward momentum stock that deserves your attention. Competing against the 3D modeling/animation software products of Autodesk could contribute $500 million to $1 billion to Adobe’s topline for the next two years. As per the chart below, Adobe’s forward revenue CAGR is only 17.17%. This is notably lower than its 5-year average revenue CAGR of 22.08%.

(Click on image to enlarge)

My fearless forecast is that the $49.99/month Substance 3D software suite can help Adobe achieve a 2021 EPS of $12.5, 2022 EPS of $14.50, and 2023 EPS of $16.50. Adobe will remain a monopoly on 2D content creation software. It could also become a dominant 3D content creation software provider for video games developers, TV/Movie producers, and AR/VR content creators.

Past Success With Adobe Stock Forecast

I Know First has been bullish on ADBE’s shares in past forecasts. On our June 14, 2020 premium article, the I Know First algorithm issued a bullish Adobe stock forecast. The algorithm successfully forecasted the movement of ADBE’s shares on the 1 year time horizons. ADBE’s shares rose by 39.62% in line with the I Know First algorithm’s forecast.

Disclosure: This article originally appeared on Iknowfirst.com, a financial services firm that utilizes an advanced ...

more