AcuityAds Holdings: Unknown SaaS Play With >100% Upside

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Article highlights:

- AcuityAds Holdings is an undiscovered SaaS play on the Toronto Venture Exchange that commercialises a next-gen digital advertising platform.

- They rank among the fastest growing tech companies in North America, and a streak of new contract wins this year will ensure the high ranking.

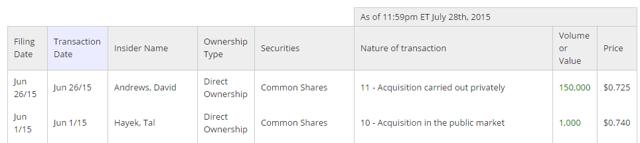

- Their CFO recently bought 150k common shares in the open market.

- Their low market cap, solid balance sheet and clean share structure solidify downside protection.

- I expect shares to soar 100% in a relative short time-frame.

Full article starts here:

Upfront note: this company only trades on the Toronto Venture Exchange, ticker = AT.V. The currency amounts in this article represent Canadian dollars.

Not many investors somehow have the Toronto Venture Exchange on their radar, but I argue more investors should. This exchange sports almost 2000 stocks of which many of them fly under the radar. The trick is finding the 'hidden gem', the unknown venture that offers a surprisingly compelling risk/reward opportunity. I think AcuityAds Holdings (AT.V) is such a hidden gem. This company sports the ideal features: multi-year revenue growth, 100% undiscovered, insider buying, etc. This article will tell you more.

Brief business overview

AcuityAds is a tech company that has developed the so called SaaS-based 'Programmatic Marketing Platform', a solution that uses artificial intelligence to connect digital advertisers to consumers across many media channels. This technology uses 'Big Data' algorithms, a term you probably have heard about, and machine learning, the branch of artificial intelligence involving systems that learn from data. Their self-service business unit is highly scalable, which means 1 client that licenses their technology could automatically make many of their clients also indirectly clients for AcuityAds; a very interesting business model.

Industry experts point out that programmatic marketing is the fastest growing and most disruptive area in digital advertising. AcuityAds is one of the few pure-plays operating in this space with Fortune 500 enterprises and small to mid-sized businesses as customers in Canada and the United States.

Nobody knows about this stock

As said, not many investors eye the Toronto Venture Exchange. AcuityAds is a completely unknown stock. I could not find any coverage on investment platforms, social media or anywhere else. Management is non-promotional (maybe they should to some degree), a trait I often see in Canadian management teams. A total absence of coverage partially explains the current undervaluation in my view.

Rapid growth

Late 2014, Deloitte released the 2014 Technology Fast 500, an annual ranking of the fastest growing North American companies in technology. AcuityAds Holding holds the 26th position, based on the company's total five year revenue growth rate of 6589%. The latest earnings reports consistently showed record revenue numbers. Management's goal is to become a major force in the United States, a much larger addressable market than Canada.

The advertising business is a bit seasonal, so comparing to Q1 2014, this year's Q1 showed a 10% revenue bump to $3 million. Ttm annual revenue stands at $14 million. Their flagship product, the programmatic marketing platform, generated an impressive >150% revenue growth, making clear why management is focused on commercialising this product. But Q1 is typically a slow season, so Q2 and Q3 should reveal (much) stronger (sticky) revenue growth.

If we look at developments in Q2, we can see that contract wins are beginning to add up:

April 30th: AcuityAds acquires over $500k from leading North American Automotive dealer

June 4th: AcuityAds receives a $200k order from a global pharmaceutical company

June 10th: AcuityAds awarded over $500k commitment from a leading North American Advertising Agency

June 23th: AcuityAds receives a $500k order from a global appliance company

July 9th: AcuityAds receives follow-up order of $340k from the Automotive dealer

Also potentially boosting revenue from now on is that AcuityAds formed a partnership with SlimCut Media. Launching in Canada initially, the AcuityAds and SlimCut partnership will be expanding into the US market starting in Q2 of this current fiscal year with the launch of a new network of US premium publishers.

Also, the company is launching innovative stuff to stay ahead of the competition. Take for instance their weather targeting solution, a cool software feature marketers can use to real-time target their campaigns based on a range of weather conditions, current temperature, wind speeds and humidity. They just hired an extra sales executive to boost revenue growth.

Trend-wise, the addressable market of digital advertising 2.0 using artificial intelligence and Big Data is very large and growing. TheStreet reported back in May that this market is very hot. Here's an estimate that clearly signals how big this market is; the size will grow to USD 15 billion in 2015, up 50% from last year.

Adding all this information up, I expect the next earnings report on August 18th to again show record revenue numbers.

Balance sheet

In order to strengthen the balance sheet, management completed a warrant-free capital raise last May by selling 4.3 million common shares at $0.70, a 25% discount to the stock price prior the raise.

Taking this into account, the balance sheet now contains:

- $3.5 million in pure cash

- Slightly positive working capital

- Low-interest $300k long-term debt, which is being reduced each quarter

Overall, the balance is pretty solid, so no red flags here. Working capital is a bit tight, but I expect a positive cash flow later this year. AcuityAds currently still burns cash ($400k in Q1), but that was primarily caused by management's strategic choice to significantly expanded the sales workforce. Management intends to leverage these investments in order to realize revenue growth in future quarters. What also didn't help was the weakening Canadian dollar, which increased financing costs with approximately $120k.

Share structure

Outstanding are:

- 25 million common stock (includes the recent raise)

- 2 million options average @$1.05

- 300k warrants @$0.70

- No debentures or convertibles

AcuityAds Holdings has a clean share structure for a venture stock. There are some derivatives in the money, but no big deal compared to market cap.

Big insider buy

Very bullish is that the CFO bought 150k common shares in the open market recently. The CEO was also buying, but in chump change amounts. Either way, I think that key insiders like the CEO and CFO buying is the most bullish insider transaction you can have. Further, insiders have been adding shares earlier on.

Valuation

The current ttm price/sales ratio is 1.5, very low for such a fast-growing tech company in such a fast-growing space. A price/sales ratio of at least 3 seems much fairer. Many peer companies trade at such multiples, although they aren't pure plays like AcuityAds is (which actually warrants a higher multiple for AcuityAds). The company still burns cash, albeit low, so that could explain some discount, but that won't hold up anymore the moment they turn profitable (probably in Q4). EV/Ebitda is a bit hard to estimate, but once they turn Ebitda positive, a ratio of 25 should warrant a share price double today's level roughly.

Will AcuityAds be acquired?

It's speculative, but I think the odds are there. TheStreet recently reported how active M&A is in this space. The competition is namely not sitting still: AOL struck a multibillion dollar deal lately, and other well-known big shots in the world of advertising (TubeMogul, Millenial Media) have all been raising guidance's because of the simple fact that the programmatic advertising market is red-hot. They probably are keen on growing-by-acquisition too; undervalued little pure plays are known to be popular take-over targets.

What's more, I talked to their CEO last week, and he told me that they put down an offer last year, because he genuinely believes AcuityAds could become a $200 million company in time, equivalent to almost a 10-bagger increase. He has personally invested more than a million dollars, and he wants a multi-bagger ROI.

Risks section

The recent financing reduces near-term dilution risk to almost 0, but longer-term, dilution risk remains on the table. Management is working hard to generate a profit, but the company might need more cash for growth opportunities.

Customer reliance wise, losing a customer will have a low impact. Almost half of the total revenue is generated by at least 10 customers, and this reliance will diminish by each quarter the company is growing. But losing a customer is of course still a risk.

This is a thinly traded micro-cap, that bears the typical risks associated with micro-caps. Be aware of these and due your own due diligence.

Conclusion

Today is a good day to add AcuityAds to your portfolio. This is a undiscovered and undervalued micro-cap that operates in a red-hot market, is growing and about to turn a loss into a profit. Downside risk is limited, thanks to the undervaluation, a solid balance sheet and a clean share structure. The upside is on the other hand not limited, but very big. I expect at least a double from here. The bonus kicker there is that a big name in the world of advertising makes a bid, which undoubtedly will reward shareholders with a hefty premium.

Disclosure: The author is long AT.V.

Click more