Actua Announces First Quarter 2017 Financial Results

RADNOR, Pa., May 04, 2017 (GLOBE NEWSWIRE) -- Actua Corporation (Nasdaq:ACTA) (“Actua”) today reported its results for the first quarter ended March 31, 2017.

"2017 is off to a good start," said Walter Buckley, CEO of Actua. “As we anticipated, the strong bookings we saw in the second half of last year resulted in accelerating revenue growth in the first quarter. With a focus on profitable growth, we are well-positioned to continue driving long-term shareholder value."

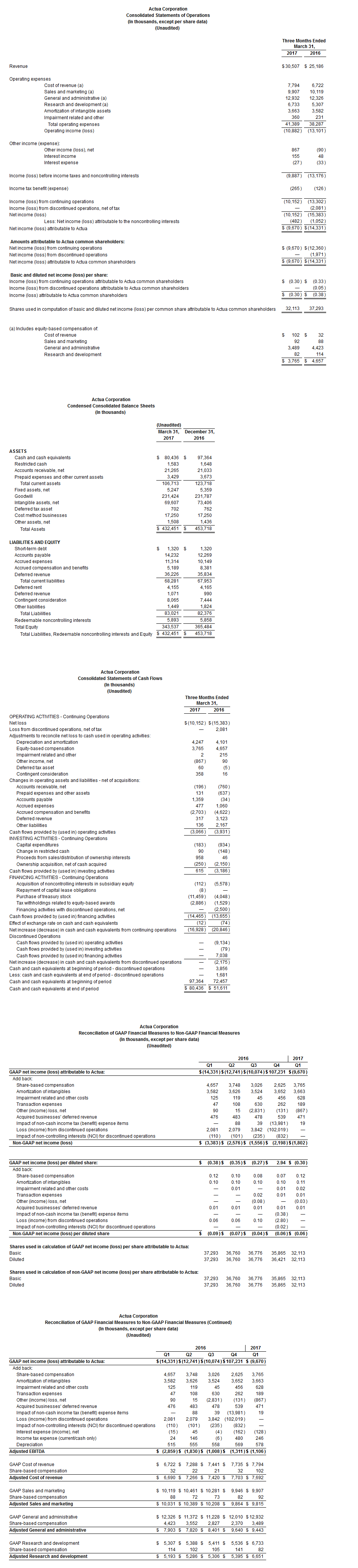

Revenue was $30.5 million for the first quarter of 2017, up from $25.2 million for the first quarter of 2016.Net loss attributable to Actua for the first quarter of 2017 was $(9.7) million, or $(0.30) per diluted share, compared to a net loss attributable to Actua of $(14.3) million, or $(0.38) per diluted share, for the comparable prior year quarter.Non-GAAP net loss for the first quarter of 2017 was $(1.8) million, or $(0.06) per diluted share, as compared to a non-GAAP net loss of $(3.4) million, or $(0.09) per diluted share, for the comparable prior year quarter.Cash flow from operations was a use of $(3.1) million for the first quarter of 2017, compared to a use of $(3.9) million for the first quarter of 2016.

During the three months ended March 31, 2017, Actua deployed $12.5 million to repurchase approximately 895,000 shares.From April 1, 2017 through May 3, 2017, Actua deployed an additional $4.6 million to repurchase approximately 355,000 shares, resulting in year-to-date totals of $17.4 million and approximately 1,250,000 shares.

2017 Guidance

Actua continues to expect 2017 annual GAAP revenue in the range of between $125 million and $130 million, representing a range of between 14% and 19% growth from 2016.Actua continues to expect2017 annual GAAP cash flow from operations in the range of between a use of $(2.0) million and a source of $2.0 million.Actua continues to expect 2017 annual non-GAAP net income (loss) per share to be in the range of between $(0.10) and $(0.15) per diluted share.

A reconciliation of the non-GAAP financial measures used above with the most comparable GAAP financial measures is included with the financial tables at the end of this release.

Please see Actua’s website at www.actua.com for more information on Actua, its businesses and its first quarter 2017 results.

Actua will host a webcast at 10:00 a.m. ET today to discuss its financial results.As part of the live webcast for this call, Actua will post a slide presentation to accompany the prepared remarks.To access the webcast, go to www.actua.com/investors/events-presentations/ and click on the webcast link.Please log on to the website approximately ten minutes prior to the call to register and download any necessary audio software.The conference call is also accessible through listen-only mode by dialing 800.708.4540 or 847.619.6397.The passcode is 44713439.

For those unable to participate in the conference call, a replay will be available from May 4, 2017 at 12:30 p.m. ET until May 11, 2017 at 11:59 p.m. ET.To access the replay, dial 888.843.7419 or 630.652.3042.The passcode is 44713439#.The replay and slide presentation also can be accessed in the investor relations section of the Actua website at www.actua.com/investors/events-presentations/.

About Actua

Actua Corporation (Nasdaq:ACTA), the multi-vertical cloud company, brings the power of the cloud to vertical markets and processes.Actua is pioneering the second wave of the SaaS revolution - the vertical wave - by growing cloud businesses that are transforming their markets.With over 700 employees delivering unrivaled domain knowledge, agility and responsiveness to our customers, Actua’s rapidly growing vertical cloud businesses are positioned to lead this wave.For the latest information about Actua and its brands, please go to www.actua.com.

Safe Harbor Statement under Private Securities Litigation Reform Act of 1995

The statements contained in this press release that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.These forward-looking statements involve certain risks and uncertainties, including, but not limited to, risks associated with our ability to compete successfully in highly-competitive, rapidly-developing markets, the valuation of public and private cloud-based businesses by analysts, investors and other market participants, our ability to deploy capital effectively and on acceptable terms, the effect of economic conditions generally, capital spending by our customers, our ability to retain existing customer relationships and revenue streams and secure new ones, developments in the markets in which we operate and our ability to respond to those changes in a timely and effective manner, the availability, performance and security of our cloud-based technology, particularly in light of increased cybersecurity risks and concerns, our ability to retain key personnel, our ability to successfully integrate any acquired business, the impact of any potential acquisitions, dispositions, share repurchases or other strategic transactions, our ability to have continued access to capital and to manage capital resources effectively, and other risks and uncertainties detailed in Actua's filings with the U.S. Securities and Exchange Commission.These and other factors may cause actual results to differ materially from those projected.

About Actua’s Non-GAAP Financial Measures

This release contains non-GAAP financial measures.The tables above reconcile these non-GAAP financial measures to the most directly comparable GAAP financial measures.

Non-GAAP financial measures should not be considered as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP.Actua strongly urges investors and potential investors in our securities to review the reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures that are included in this release.

Actua’s management believes that its non-GAAP financial measures provide useful information to investors because they allow investors to view the business through the eyes of management and provide meaningful supplemental information regarding Actua’s operating results, as they exclude amounts that Actua excludes as part of its monitoring of operating results and assessment of the performance of the business.

Actua presents the following non-GAAP financial measures in this release:(1) non-GAAP net income (loss) (which term may be used interchangeably with adjusted net income (loss) by management during quarterly earnings presentations), (2) non-GAAP net income (loss) per diluted share (which term may be used interchangeably with adjusted net income (loss) per diluted share by management during quarterly earnings presentations), (3) Adjusted EBITDA, (4) Adjusted Cost of revenue, (5) Adjusted Sales and marketing, (6) Adjusted General and administrative and (7) Adjusted Research and development.Actua excludes items from these non-GAAP financial measures as described below.

Non-GAAP net income (loss) excludes from GAAP net income (loss) the following items:

- Share-based compensation.Actua excludes share-based compensation expenses and other expenses associated with equity granted to employees and non-employee directors primarily because they are non-cash expenses that Actua does not consider part of ongoing operating results when assessing the performance of its business, and the exclusion of these expenses facilitates the comparison of results over different time periods and the comparison of Actua’s results with results of other companies.

- Amortization of intangibles.Actua excludes amortization of acquired intangibles, which consists primarily of customer relationships and technology, because they are expenses that Actua does not consider part of ongoing operating results when assessing the performance of its business, and Actua believes that doing so facilitates comparisons to its historical operating results and to the results of other companies.

- Impairment related and other costs.Actua excludes the effect of impairment related and other costs, which primarily include impairment charges, revaluation of contingent consideration, restructuring and severance fees, settlement costs and other one-time costs, because Actua does not consider them part of ongoing operating results when assessing the performance of its business and believes it is useful for investors to understand the effects of these items on Actua’s operations.

- Transaction expenses.Actua excludes the effect of acquisition related expenses because Actua does not consider them part of ongoing operating results when assessing the performance of its business and believes it is useful for investors to understand the effects of these items on Actua’s operations.

- Other income (loss), net.Actua excludes the effect of other income (loss), net, which primarily includes transaction-driven gains and losses, as well as certain foreign currency impacts, because Actua does not consider them part of ongoing operating results when assessing the performance of its business and believes it is useful for investors to understand the effects of these items on Actua’s operations.

- Acquired businesses’ deferred revenue.Actua includes acquired businesses’ previously deferred revenues that are not recognized under GAAP because Actua considers them a part of ongoing operating results when assessing the performance of its business and believes it is useful for investors to understand the effects of these items on its operations.

- Impact of non-cash income tax benefit items.Actua excludes the impact of any non-cash income tax benefit items as Actua believes it is useful for investors to understand the effect of this item and does not consider them a part of ongoing operating results when assessing the performance of its business.

- Loss (income) from discontinued operations.Actua excludes the loss (income) from discontinued operations as Actua believes it is useful for investors to understand the effect of these items for all periods presented and does not consider them a part of ongoing operating results when assessing the performance of its business.

- Impact of non-controlling interests (NCI) for discontinued operations.Actua did not own 100% of the discontinued operations presented.Therefore, Actua excludes the impact of the NCI on discontinued operations as Actua believes it is useful for investors to understand the effect of this item for all periods presented as compared to what has historically been provided as Actua does not consider them a part of ongoing operating results when assessing the performance of its business.

Non-GAAP net income (loss) per diluted share is calculated as follows:

- Non-GAAP net income (loss) (as defined above) is the numerator.

- Shares used in calculation of non-GAAP net income (loss) per diluted share.For periods where GAAP and non-GAAP net income (loss) are both losses, Actua uses the same number of shares used to calculate GAAP and non-GAAP net loss per share.For periods where GAAP and non-GAAP net income (loss) are both income, Actua uses the same number of shares used to calculate GAAP and non-GAAP net income per diluted share.For periods where GAAP net income (loss) is a loss but non-GAAP net income (loss) is income, Actua includes the impact of incremental dilutive securities for the period to determine non-GAAP net income per diluted share.For periods where GAAP net income (loss) is income but non-GAAP net income (loss) is a loss, Actua excludes the impact of incremental dilutive securities for the period to determine non-GAAP net loss per diluted share.

Adjusted EBITDA excludes from GAAP net income (loss) the following items:

- Share-based compensation.Actua excludes share-based compensation expenses and other expenses associated with equity granted to employees and non-employee directors primarily because they are non-cash expenses that Actua does not consider part of ongoing operating results when assessing the performance of its business, and the exclusion of these expenses facilitates the comparison of results over different time periods and the comparison of Actua’s results with results of other companies.

- Amortization of intangibles.Actua excludes amortization of acquired intangibles, which consists primarily of customer relationships and technology, because they are expenses that Actua does not consider part of ongoing operating results when assessing the performance of its business, and Actua believes that doing so facilitates comparisons to its historical operating results and to the results of other companies.

- Impairment related and other costs.Actua excludes the effect of impairment related and other costs, which primarily include impairment charges, restructuring and severance fees, settlement costs and other one-time costs, because Actua does not consider them part of ongoing operating results when assessing the performance of its business and believes it is useful for investors to understand the effects of these items on Actua’s operations.

- Transaction expenses.Actua excludes the effect of acquisition related expenses because Actua does not consider them part of ongoing operating results when assessing the performance of its business and believes it is useful for investors to understand the effects of these items on Actua’s operations.

- Other income (loss), net.Actua excludes the effect of other income (loss), net, which primarily includes transaction-driven gains and losses and revaluation of contingent consideration, as well as certain foreign currency impacts because Actua does not consider them part of ongoing operating results when assessing the performance of its business and believes it is useful for investors to understand the effects of these items on Actua’s operations.

- Acquired businesses’ deferred revenue.Actua includes acquired businesses’ previously deferred revenues that are not recognized under GAAP because Actua considers them a part of ongoing operating results when assessing the performance of its business and believes it is useful for investors to understand the effects of these items on its operations.

- Impact of non-cash income tax benefit items.Actua excludes the impact of any non-cash income tax benefit items as Actua believes it is useful for investors to understand the effect of this item and Actua does not consider them a part of ongoing operating results when assessing the performance of its business.

- Loss (income) from discontinued operations.Actua excludes the loss (income) from discontinued operations as Actua believes it is useful for investors to understand the effect of these items for all periods presented and does not consider them a part of ongoing operating results when assessing the performance of its business.

- Impact of non-controlling interests (NCI) for discontinued operations.Actua did not own 100% of the discontinued operations presented.Therefore, Actua excludes the impact of the NCI on discontinued operations as Actua believes it is useful for investors to understand the effect of this item for all periods presented as compared to what has historically been provided as Actua does not consider them a part of ongoing operating results when assessing the performance of its business.

- Interest expense (income), net.Actua excludes income and expense from interest as Actua believes it is useful for investors to understand the effect of these items for all periods presented and does not consider them a part of ongoing operating results when assessing the performance of its business.

- Income tax expense (current/cash only).Actua excludes the impact of any current, cash income tax expense as Actua believes it is useful for investors to understand the effect of this item and does not consider them a part of ongoing operating results when assessing the performance of its business.

- Depreciation.Actua excludes depreciation expense as Actua believes it is useful for investors to understand the effect of these items for all periods presented and does not consider them a part of ongoing operating results when assessing the performance of its business.

Adjusted Cost of revenue excludes from GAAP Cost of revenue operating expenses the following item:

- Share-based compensation. Actua excludes share-based compensation expenses and other expenses associated with equity granted to employees and non-employee directors in the cost of revenue category on Actua's statements of operations primarily because they are non-cash expenses that Actua does not consider part of ongoing operating results when assessing the performance of its business, and the exclusion of these expenses facilitates the comparison of results over different time periods and the comparison of Actua’s results with results of other companies.

Adjusted Sales and marketing excludes from GAAP Sales and marketing operating expenses the following item:

- Share-based compensation. Actua excludes share-based compensation expenses and other expenses associated with equity granted to employees and non-employee directors in the sales and marketing category on Actua's statements of operations primarily because they are non-cash expenses that Actua does not consider part of ongoing operating results when assessing the performance of its business, and the exclusion of these expenses facilitates the comparison of results over different time periods and the comparison of Actua’s results with results of other companies.

Adjusted General and administrative excludes from GAAP General and administrative operating expenses the following item:

- Share-based compensation. Actua excludes share-based compensation expenses and other expenses associated with equity granted to employees and non-employee directors in the general and administrative category on Actua's statements of operations primarily because they are non-cash expenses that Actua does not consider part of ongoing operating results when assessing the performance of its business, and the exclusion of these expenses facilitates the comparison of results over different time periods and the comparison of Actua’s results with results of other companies.

Adjusted Research and development excludes from GAAP Research and development operating expenses the following item:

- Share-based compensation. Actua excludes share-based compensation expenses and other expenses associated with equity granted to employees and non-employee directors in the research and development category on Actua's statements of operations primarily because they are non-cash expenses that Actua does not consider part of ongoing operating results when assessing the performance of its business, and the exclusion of these expenses facilitates the comparison of results over different time periods and the comparison of Actua’s results with results of other companies.

Actua believes that the following considerations apply to the non-GAAP financial measures that it presents:

- Actua’s management uses non-GAAP net income (loss), non-GAAP net income (loss) per diluted share, adjusted EBITDA, adjusted cost of revenue, adjusted sales and marketing, adjusted general and administrative and adjusted research and development in internal reports used by management in monitoring and making decisions regarding Actua’s business, including in monthly financial reports prepared for management and in periodic reports to Actua’s Board of Directors.

- An important limitation of Actua’s non-GAAP financial measures is that they include acquired business deferred revenues and exclude expenses, some of which may be significant, that are required by GAAP to be recorded.In addition, non-GAAP financial measures are subject to inherent limitations because they reflect the exercise of judgments by management about which charges to exclude from the non-GAAP financial measures.

To mitigate the limitations associated with non-GAAP financial measures, Actua reconciles its non-GAAP financial measures to the nearest comparable GAAP financial measures and recommends that investors and potential investors do not give undue weight to its non-GAAP financial measures.

Investor inquiries: Karen Greene Actua Investor Relations 610.727.6900 IR@actua.com

Disclosure: None.