Activision Blizzard: Strong Fundamentals And An Upwardly-Sloped Trend Channel Earn The Stock A Strong Buy Rating

Video game publisher Activision Blizzard (ATVI) has seen its games gain in popularity in the past year. The company has seen earnings and revenue increase in the last few quarters and the stock has been climbing as a result. Apparently, people have been buying more video games while they were forced to stay at home. All of this adds up to a stock with strong fundamental indicators and an upwardly sloped trend channel on the chart.

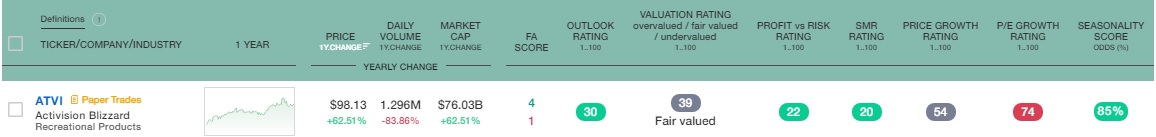

Let’s take a look at the fundamental indicators first. Tickeron’s fundamental analysis screener shows that the company scores really high on its Outlook Rating, Profit vs. Risk Rating, SMR Rating, and Seasonality Score. The only area where it scores poorly is the P/E Growth Rating. The Valuation Rating and the Price Growth Rating both fall in the average range.

(Click on image to enlarge)

If we look at some of the indicators that are included in calculating the ratings, we see why the stock ranks so highly. In the fourth quarter of 2020, Activision saw earnings jump by 23% compared to the same period in 2019. Revenue jumped by 22% for the quarter. Those growth rates are considerably higher than what we have seen in recent years, but analysts expect earnings and revenue to grow more rapidly in the coming years. Earnings are expected to increase by 14% in 2021 while revenue is expected to grow by 1.3%. The expectations for 2022 are much higher with revenue predicted to grow by 13.5%.

Activision’s profitability measurements are well above average as well. The return on equity is 17.9% and the profit margin is at 37.2%. The average ROE for the industry is only 4.78% and the average profit margin is 22.78%.

The Stock Doubled in 11 Months after the 2020 Low

Activision dropped to a low of $50.18 in March 2020 and by February of 2021, the stock had moved above the $100 mark. If we connect the low from last March with the recent low, we get the lower rail of a trend channel. The stock did drop below the lower rail last November, but it never closed a week below the rail. The parallel upper rail connects the highs from last May and from February. The stock did move slightly above the upper rail last August, but it never closed a week above it.

(Click on image to enlarge)

Looking at the overbought/oversold indicators we see that the 10-week RSI dropped down to the 50-level a few weeks ago and has now turned higher. The RSI has flirted with the 50-mark on a few occasions and it dropped considerably below that level last March.

The weekly stochastic indicators dropped below the 40-level recently and have now made a bullish crossover. We see similar circumstances in May 2019, March 2020, and October/November 2020. In all three of those instances, the stock rallied sharply in the next three to four months.

If the stock follows the pattern and moves back up to the upper rail it should move up above the $111 level, that’s where the upper rail is now and it is moving higher each week.

Sentiment is Pretty Bullish toward Activision

If there is a concern that I have for Activision is that the sentiment is pretty bullish. As a contrarian, I get concerned when the sentiment becomes extremely bullish and we’re close right now. According to the Wall Street Journal there are 34 analysts covering the stock at this time and 28 of them have the stock rated as a “buy”. There are five “hold” ratings and one “sell” rating. If we look at the buy percentage (buy ratings as a percentage of the total) it’s currently at 82.4% and the average buy percentage falls in the 65% to 75% range. The number of buy ratings has increased in the last three months which means the bullish sentiment is growing.

The short-interest ratio is at 2.58 currently and that is slightly below average. It isn’t terribly low so I wouldn’t call it extremely bullish. The number of shares sold short jumped sharply from the end of February through the mid-March report, jumping from 8.89 million to 12.5 million during that period. This suggests that short sellers are becoming more pessimistic and that is a good thing. If the stock rallies like I think it will, short-sellers can add buying pressure if they have to cover.

Overall I don’t think the sentiment is extremely optimistic right now and it seems to be warranted based on the upward trend and the strong fundamentals. If analysts continue to add buy ratings and if the short ratio were to drop back down in the next month, it could mean that the expectations are too high when we get the next earnings report at the beginning of May.

For now, the strong buy rating from Tickeron’s scorecard seems to be warranted as well. The chart suggests that another bullish run is in the beginning stages and the fundamentals point to long-term growth. I can see the stock moving up to the $115 to $120 range in the next few quarters.

Disclaimer: Although our services incorporate historical financial information, past financial performance is not a guarantee or indicator of future results. Moreover, although we believe the ...

more