Accounting Numbers Paint Dark Picture Of Blackbaud

Providing software to nonprofits, education institutions, and foundations is certainly a noble business cause. But, as a for-profit business and publicly-traded stock, this company’s investors are still expecting profits. Instead, they are getting misleading non-GAAP metrics that enable executives to earn large profits. Our call on Valeant (VRX) showed how dangerous it is to trust non-GAAP earnings because they cannot be used to cover true cash costs. For these reasons and more, Blackbaud Inc. (BLKB: $62/share) lands in the Danger Zone this week.

Revenue Growth Is Meaningless Without Profits

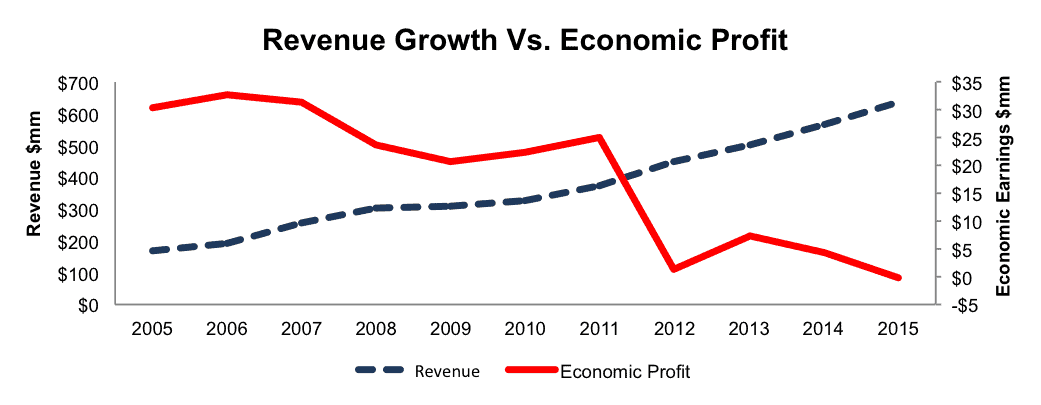

Over the past decade, Blackbaud has grown revenue at an impressive rate of 14% compounded annually. Despite strong revenue growth, Blackbaud’s economic earnings, the true cash flows, have declined from $30 million in 2005 to -$200,000 in 2015, as can be seen in Figure 1. See a reconciliation of Blackbaud’s GAAP net income to economic earnings here.

Figure 1: The Discrepancy Between Revenue & Economic Profit

Sources: New Constructs, LLC and company filings

The decline in economic earnings coincides with Blackbaud’s return on invested capital (ROIC). Since 2007, Blackbaud’s ROIC has declined from 123% to 7% over the last twelve months. What was once a highly profitable business is no longer. Blackbaud’s numerous acquisitions over the years, including Convio, MicroEdge, Smart Tuition, and Everyday Hero, have been nothing but a drag on profits, despite the additional revenue brought in.

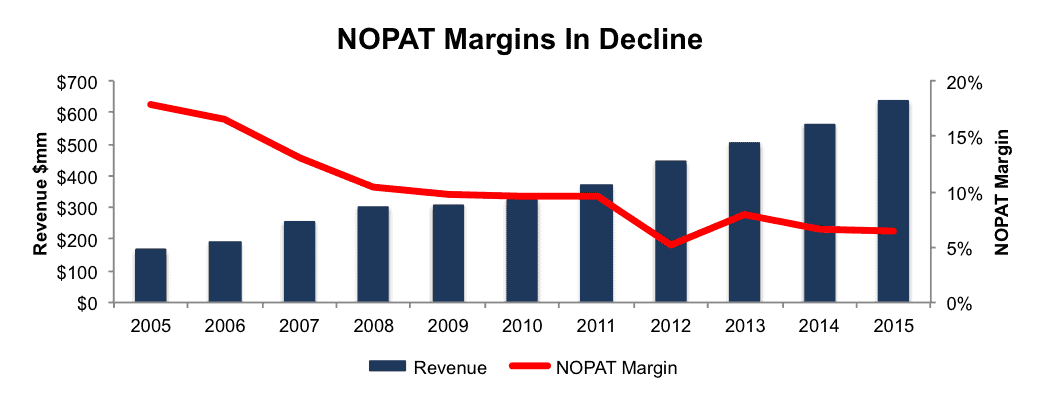

In addition to declining ROIC, which showcases Blackbaud’s inefficient management of capital, the company’s margins have been in a long-term decline. Since 2005, BLKB’s after-tax profit (NOPAT) margins have declined from 18% to 7% over the last twelve months, as can be seen in Figure 2.

Figure 2: Blackbaud Margins In Long-Term Decline

Sources: New Constructs, LLC and company filings

Non-GAAP Metrics Mislead Investors and Misalign Executive Incentives

The dangers of non-GAAP metrics have been made clear, yet companies still use them to “better represent business operations.” How can a company better represent operations by removing a significant amount of operating costs? Below are the non-GAAP metrics that Blackbaud uses:

- Non-GAAP revenue – adds back acquisition-related deferred revenue write-downs because, which essentially removes the GAAP requirement to write-down acquired deferred revenue to fair value.

- Non-GAAP Operating Income –operating income that removes stock based compensation, amortization of intangibles, employee severances, acquisition-related expenses, and restructuring costs among others.

- Non-GAAP Net Income – net income that removes the items listed above in non-GAAP operating income in addition to the loss on sale of businesses and a tax adjustment related to non-GAAP items.

In 2015, Blackbaud’s non-GAAP operating income was 161% higher than GAAP operating income, and its non-GAAP net income was 171% higher than GAAP net income.

The use of non-GAAP metrics has proliferated throughout the company’s stated strategic goals. Blackbaud stated in 2014 as part of its five point growth strategy that it wanted to improve non-GAAP operating margins by 3-6 percentage points by 2017. However, as Figure 2 shows, NOPAT margins have only worsened. Even worse, executives are incentivized through non-GAAP metrics, an issue we’ve touched on before, and cover in more detail later in this report.

Low Profitability Threatens BLKB

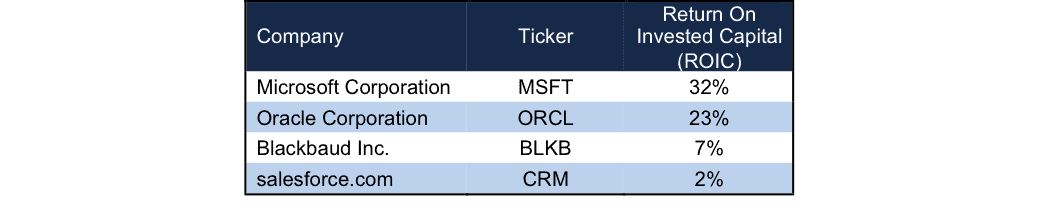

Blackbaud operates in a niche market, one that focuses solely on nonprofit organizations. However, this niche market does not mean they are without competition. The declining trend in ROIC noted above does not bode well for the future. Blackbaud recognizes that it faces competition from software developers who provide customized nonprofit solutions, general customer relationship management developers like Salesforce.com (CRM), and large international organizations like Microsoft (MSFT) and Oracle (ORCL). Each of these firms offers products for nonprofit companies. With a 7% ROIC, Blackbaud only bests CRM in terms of profitability, which is no great feat, as CRM has previously been placed in the Danger Zone. Figure 3 has more details.

Figure 3: Comparing Blackbaud’s ROIC

Sources: New Constructs, LLC and company filings

Unprofitable Market Stymies Bull Hopes

As often is the case with software and cloud providers, bulls often tout scalability, recurring revenue, market share, or some other metric as reasons the company is poised to succeed. However, none of these metrics will matter if the market itself is unprofitable. Based on the data above, there is a clear trend that growing within the nonprofit sector has been detrimental to Blackbaud’s business. Perhaps, there is a reason that Blackbaud is known as a leader in this niche market, as larger, more profitable competition has deemed its profitability prospects too low to devote time and resources.

Adding trouble to bull arguments, BLKB’s current valuation implies the company will achieve revenue nearly 150% higher than the all current revenue from Blackbaud’s stated addressable market, which the company estimates at $6.3 billion. Read below to see how the stock’s current valuation implies BLKB will generate over $9 billion in revenue.

Acquisition Hopes Are Not Justification For Valuation

With Blackbaud operating in a niche market, and larger competitors possessing ample cash resources, it would seem likely that if a larger competitor wants to expand into this market, it would look to acquire BLKD or similar smaller competition. However, Blackbaud is not as attractive an acquisition target as many think.

First, Blackbaud has large (hidden) liabilities that make it more expensive than the accounting numbers would initially suggest.

- $73 million in off-balance sheet debt (3% of market cap)

- $25 million in net deferred tax liabilities (1% of market cap)

After adjusting for these hidden liabilities, we can model a scenario in which Oracle purchases BLKD, something we would advise against per our Open Letter to Larry Ellison. Nevertheless, modeling different scenarios allows us to show you just how expensive BLKB is.

Second, after we analyze how much the business might be worth to a potential suitor, we see that, even in the absolute best-case scenario, the stock is worth less, not more, than where it trades today.

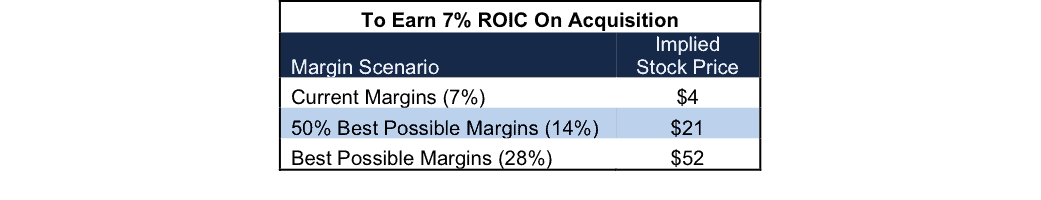

Figures 4-6 show the implied stock prices that Oracle should pay for BLKB to achieve different “Goal ROICs” assuming different levels of profit margins. There are limits on how much Oracle should pay to earn a proper return, given the NOPAT or cash flows being acquired. For each scenario, we show the max price Oracle can pay and still achieve the “goal ROICs”.

Figure 4: Implied Acquisition Prices For Oracle To Achieve 7% ROIC

Sources: New Constructs, LLC and company filings. See the underlying calculations here.

The first “goal ROIC” is Oracle’s WACC or 7%. Figure 4 shows the acquisition stock prices implied by different margin levels for Blackbaud post acquisition. While we think it is highly unlikely that Blackbaud’s business would ever earn the same high margin as Oracle’s existing business, we include it in our analysis to show the best case scenario. At 7% ROIC, this deal would be “value neutral”, as the ROIC earned on the deal would equal Oracle’s weighted average cost of capital (WACC). Even in this “best case scenario”, the most Oracle should pay is $52/share (16% downside).

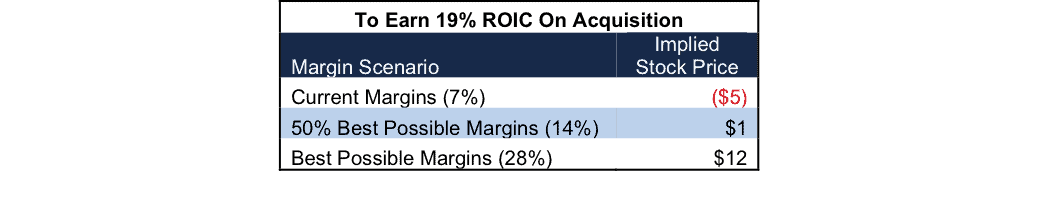

Figure 5: Implied Acquisition Prices For Oracle To Achieve 19% ROIC

Sources: New Constructs, LLC and company filings. See the underlying calculations

.Figure 5 shows the second “goal ROIC” of 19%, which is the roughly ROIC implied by Oracle at $36/share, the price of the stock when we wrote our “Open Letter to Larry Ellison”. In order to achieve a 19% ROIC, the most Oracle should pay is $12/share, and only if management is confident BLKB can immediately achieve Oracle’s 28% NOPAT margin upon acquisition.

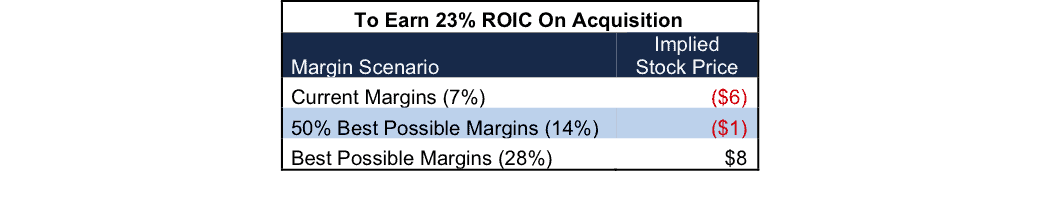

Figure 6: Implied Acquisition Prices For Oracle To Achieve 23% ROIC

Sources: New Constructs, LLC and company filings. See the underlying calculations

.Figure 6 shows the last “goal ROIC” of 23%, which is Oracle’s current ROIC. Any deal that doesn’t earn a return of 23% or above is bad for shareholders as it signals to the market that Oracle’s ROIC will continue its decline. Assuming management no longer wants to drive down its ROIC, the most Oracle should pay for BLKB is $8/share (87% downside). This purchase price assumes BLKB can immediately achieve Oracle’s 28% NOPAT margin. Any other margin scenario results in a negative implied stock price, which means, there is no positive value Oracle could pay, when including liabilities, that would earn a 23% ROIC.

In each of the scenarios above, there are implications to Oracle’s stock price. If Oracle aims to earn a 19% ROIC, which is the current ROIC implied by $36/share, investors can expect the stock to settle around $36/share. However, if management completes an acquisition that only earns a 7% ROIC, ORCL investors should expect significant downside. For more information, see the model in our Open Letter to Larry Ellison.

Organic Growth Can’t Justify Valuation Either

To justify its current stock price ($62/share) via organic growth, Blackbaud must grow NOPAT by 21% compounded annually for the next 15 years. To put this scenario into perspective, based on current margin estimates, the company would be generating $9.8 billion in revenue 15 years from now, which is slightly greater than MasterCard’s (MA) fiscal 2016 revenue and $3 billion greater than salesforce.com’s fiscal 2015 revenue. It is also greater than the current addressable market ($6.3 billion).

In a more realistic scenario, where Blackbaud can grow NOPAT by 11% compounded annually for the next decade, the stock is worth only $11/share today – an 82% downside.

Failure to Reach “Goals” Could Sink BLKB

Blackbaud laid out its plan for growth in pretty clear terms. Any failure to reach these goals could result in shares falling back to reality. One caveat is that if management is able to continue misleading investors with non-GAAP metrics, the moment of reckoning could take longer. Three of Blackbaud’s keys to growth strategy are below:

- Continue moving services to the cloud. Our Danger Zone reports our filled with software/cloud companies, such as Demandware (DWRE), Splunk (SPLK), and Marketo (MKTO), each of which lack profitability to reach scale or any competitive advantage. These stocks are down 45%, 29% and 35% since publishing our reports. BLKB does not want to follow in those footsteps.

- Drive sales effectiveness, which we assume will be key to reversing the long-term decline in economic earnings. The company cannot continue spending significant amounts (44% of revenue in 2015) on sales & marketing, research & development, and general & administrative costs if it plans to increase margins and return to profitability.

- Increase non-GAAP operating margin by 3-6 percentage points by 2017. Unfortunately, non-GAAP margins fail to measure real cash flows and are easily manipulated. Any further decline in margins will only increase pressure on management to come up with “better ways to measure operational success”.

Given the past decade of operational deterioration, it seems unlikely that BLKB can meet these goals and the high expectations baked into the stock price.

Insider Sales and Short Interest Remain Low

Over the past 12 months 486,000 shares have been purchased and 138,000 shares have been sold for a net effect of 348,000 insider shares purchased. These purchases represent <1% of shares outstanding. Additionally, there are 2.3 million shares sold short, or just over 5% of shares outstanding.

Executive Compensation Focuses On Wrong Metrics

Blackbaud executives receive annual cash bonuses and equity awards for meeting business performance goals. Cash bonuses are awarded for meeting “adjusted revenue” and “adjusted EBIT,” which is another term for the company’s non-GAAP operating income. Executives are incentivized to grow revenue by any means, such as acquisition, and then can achieve performance goal #2 by removing common costs, such as acquisition costs, stock based compensation charges, and integration costs. Similarly, executives receive equity awards for achieving “adjusted revenue” and “adjusted EBIT as a percentage of adjusted revenue.” Misaligned executive compensation poses significant risks to Blackbaud’s investors. We would much prefer executive compensation be based upon ROIC, which has a clear correlation between ROIC and shareholder value.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Blackbaud’s 2015 10-K:

Income Statement: we made $29 million of adjustments with a net effect of removing $16 million in non-operating income (3% of revenue). We removed $22 million related to non-operating expensesand $7 million related to non-operating income.

Balance Sheet: we made $244 million of adjustments to calculate invested capital with a net decrease of $41 million. The most notable adjustment was $139 million (21% of net assets) related to midyear acquisitions.

Valuation: we made $507 million of adjustments that decreased shareholder value There were no adjustments that increased shareholder value. The largest adjustment was the removal of $482 million (18% of market cap) in total debt, which includes $73 million in off balance sheet operating leases.

Dangerous Funds That Hold BLKB

The following fund receives our Dangerous rating and allocates significantly to Blackbaud Inc.

Disclosure: New Construct Staff receive no compensation to write about any specific stock, sector or theme.