According To One Indicator, Apple Is The Most Oversold It Has Been Since 2019

So far, 2021 hasn’t been a very good year for FAANG stocks, at least not as a whole. Of the five stocks that make up the group, only Alphabet (GOOGL) and Facebook (FB) are higher on the year. The S&P is up a modest 4% and the other three stocks are in negative territory so far in 2021. Apple (AAPL) is down 7.5% so far in 2021 and that is the worst performance of the bunch. The good news is that at least one indicator is pointing to a possible rebound in the stock.

Image Source: Pexels

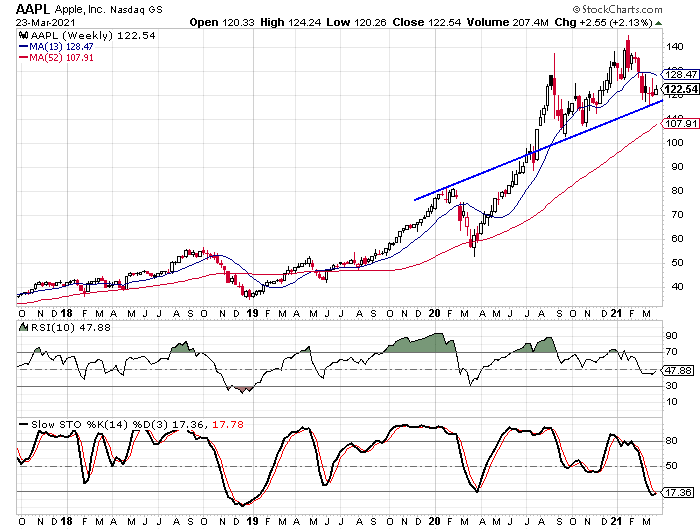

If we look at the weekly chart for Apple, the weekly stochastic indicators are in oversold territory and recently hit their lowest level since December 2018. At this point in time, it looks like the indicators are about to make a bullish crossover. The last time we saw that happen the stock was trading under $40. The stock would go on to double in just over a year before falling in the first quarter of last year. Of course, like many stocks, Apple rallied sharply off last March’s low and would eventually peak just shy of $145.

(Click on image to enlarge)

Besides the oversold readings from the stochastic indicators, something else that caught my eye was the trend line that I drew. We see a series of higher lows over the last six months and that trend line also connects to the pre-pandemic high from last January.

I wrote another article a few weeks ago about the FANG stocks, not including Apple, and one of the reasons I excluded Apple was due to how long the company has been around compared to the other members of the group.

Another reason for not including Apple was the current valuations of each of the companies. Apple has the second-lowest trailing P/E, second only to Facebook. The current rotation away from growth and toward value doesn’t seem to be part of the reason for Apple’s underperformance.

Apple is Still Seeing Solid Earnings Growth and Highly Profitable

Apple does very well on the fundamental analysis scorecard from Tickeron, it has five positive ratings and only two neutral ratings. The best ratings come from the Profit vs. Risk rating and the P/E Growth rating. The company also ranks highly in the SMR rating and the Valuation rating.

Over the last three years, Apple has seen its earnings grow by an average of 11% per year while sales have increase by 5% per year. In fiscal first quarter 2021 results, the company saw earnings jump 34% while sales rose 21%. Second-quarter results are due out at the end of April and analysts are looking for EPS growth of 53.1% with revenue growth of 31.9%. For 2021 as a whole, earnings are expected to increase by 35% and revenue is expected to jump 21.5%.

In addition to the recent strong growth and the expected growth, Apple’s profitability measurements are really good. The return on equity is 73.7% and the profit margin is 24.4%. These two stats combine with the revenue growth to create the SMR rating. Thus the reason the company scores so well in this category.

Despite Fluctuations, Sentiment has Changed Very Little

Since the March low last year, Apple is up over 130%, but the sentiment toward the stock has changed very little. Investors and analysts seem content with their views toward the stock. There are 42 analysts covering the stock with 29 “buy” ratings, 10 “hold” ratings, and three “sell” ratings. That means the percentage of buy ratings as a whole is 69% and that falls in the average range.

The short-interest ratio is at 1.03 which is low compared to other stocks, but that has been the case for a long time with Apple. The ratio has been just below or just above 1.0 for the past year. The short interest did increase to 100,799,312 at the end of February and that is the highest reading since last July.

Looking at the options activity, the put/call ratio is at 0.67 at this time with 2,647,868 puts open and 3,930,035 calls open. Like the short-interest ratio, this reading is low compared to other stocks but seems to in the normal range for Apple. Going back to the end of December, the ratio has ranged from a low of 0.56 to a high of 0.72.

The Overall Outlook for Apple

With the stock being oversold for the first time since the end of 2018, the most recent downswing appears to be providing investors with a buying opportunity. The last two times the stochastic indicators have been anywhere near this low, the stock has rallied sharply in the quarters that followed.

The fundamental ratings for Apple are well above average in terms of earnings growth, revenue growth, ROE, and profit margin. The valuation ratings are very reasonable, arguably even low considering the growth rates.

The sentiment toward the stock seems to suggest that investors and analysts are complacent or accepting of where they stand on the stock. It’s hard to believe that a stock could rally over 130% in a year and not have a change in the overall sentiment outlook.

I can see Apple rallying over the next year, just like it did from December ’18 and March ’20. In each of those cases, the stock more than doubled, but of course, that doesn’t mean it will double again. It also doesn’t mean it won’t. The one thing I noticed on the chart about the peaks in January 2020 and in August 2020 is they came when the 10-week RSI hit 90. That may be a better target than a specific price or specific percentage gain.

Disclaimer: Although our services incorporate historical financial information, past financial performance is not a guarantee or indicator of future results. Moreover, although we believe the ...

more

@[Tickeron](user:150728) sell it. Got it.