Accenture: Strong Cash Generation And Reasonable Valuation

When making investment decisions, a simple and straightforward thesis can be remarkably effective. Accenture (ACN) is a high-quality business with outstanding cash flow generation, and the stock is reasonably valued at current levels. This makes Accenture stock a strong candidate to consider buying for the long term, and the stock could be particularly attractive as an opportunistic purchase on any price pullback.

Fundamental Quality And Cash Flow Generation

Accenture is arguably the most recognized brand in management consulting, systems integration, and outsourcing. The company has operations in 52 countries, and it works with 91 of the Global 100 companies and over three-quarters of the Fortune Global 500 companies.

Brand recognition and reputation are key sources of competitive strength in the industry, especially among large corporations and governments, who are notoriously risk-averse.

Management has focused on a series of businesses with particularly promising growth opportunities identified as "The New". These areas include digital, cloud, and security. In the most recent conference, call management said that Accenture is now producing 65% of revenue from these businesses, which should have positive implications in terms of growth potential going forward.

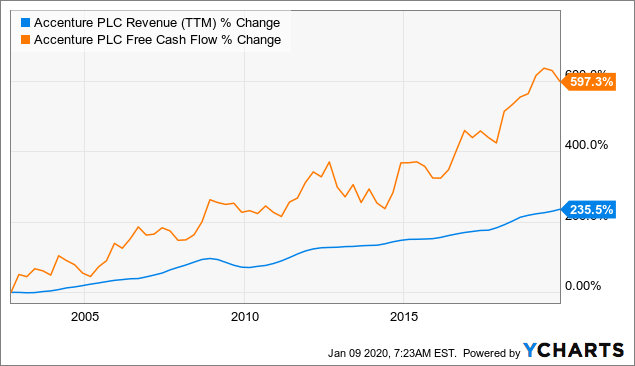

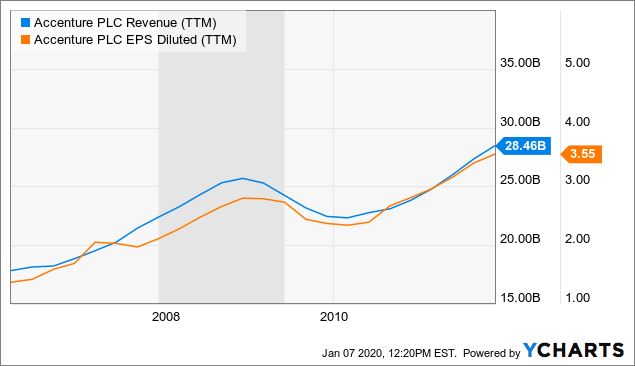

Human talent is expensive, and it is a key expense item for Accenture. But capital reinvestment needs are relatively low, and profitability tends to expand as revenue grows over the years. In this context, free cash flow growth has widely exceeded revenue growth over the past decade, which is a clear reflection on fundamental quality for the business.

(Click on image to enlarge)

Data by YCharts

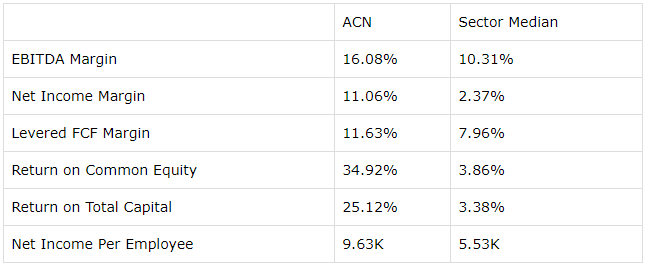

The table below compares multiple profitability metrics for Accenture versus the median player in the Information Technology industry. Looking at a wide variety of ratios, Accenture is clearly superior to the average player in the sector by a considerable margin.

(Click on image to enlarge)

Source: Seeking Alpha Essential

Reasonable Valuation

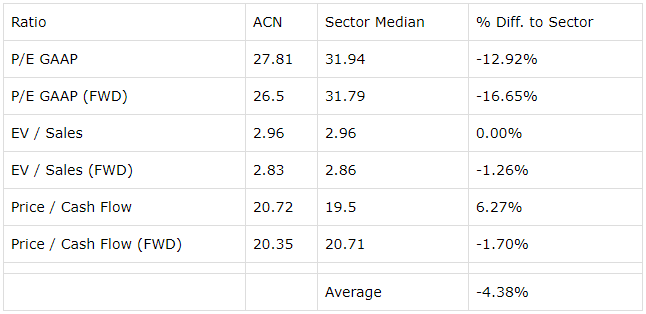

Accenture is currently trading at a forward price to earnings ratio of 26.5, and the forward price to cash flow ratio stands at 20.3. These valuation ratios are not particularly cheap in comparison to the broad market, but the stock is very reasonably priced by industry standards.

The table compares different valuation ratios for Accenture versus the median values for the sector. The stock is priced at a slight discount to peers. Importantly, Accenture is far more profitable than the median, so these valuation ratios could be considered relatively attractive by comparison.

(Click on image to enlarge)

Data Source: Seeking Alpha Essential

When considering valuation levels, it is important to keep in mind that valuation is dynamic as opposed to a static concept. Current valuation ratios are reflecting a particular set of expectations about the company's financial performance. If the company delivers earnings numbers above those expectations, this means that the stock is actually cheaper than what current valuation ratios are implying.

In other words, when you look at ratios such as forward price to earnings, expected earnings are the key input in this equation. If actual earnings turn out to be higher than expected, then the stock price needs to increase in order for the valuation to remain constant.

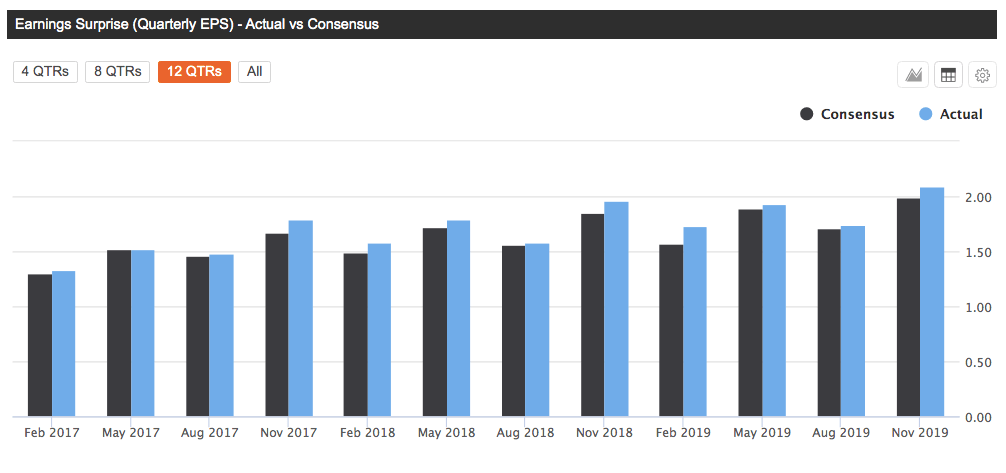

Accenture has an impressive track record of delivering earnings figures above or in-line with Wall Street estimates over the long term.

(Click on image to enlarge)

Source: Seeking Alpha Essential

The fact that the company has outperformed expectations in the past does not guarantee that it will continue doing so in the future. However, it's good to know that management likes to under promise and overdeliver when it comes to earnings guidance and managing expectations.

Valuation needs to be analyzed in the context of other return drivers. A company producing strong profitability and consistently delivering above expectations deserves a higher valuation than a business producing mediocre financial performance and underperforming expectations.

But sometimes it can be challenging to incorporate multiple factors into the analysis in order to see the complete picture from a quantitative perspective. In that spirit, the PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors, such as financial quality, valuation, fundamental momentum, and relative strength.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and this has bullish implications for Accenture.

The company has a PowerFactors ranking of 88 as of the time of this writing, meaning that Accenture is solidly in the top quintile of stocks based on financial quality, valuation, fundamental momentum, and relative strength combined.

Risk And Reward Going Forward

Corporate spending depends on economic conditions to a good degree, which exposes Accenture to considerable macroeconomic risk. The good part is that IT spending and outsourcing are related to cost-cutting efforts in many areas, which makes the business more resilient.

Looking at both revenue and earnings during the financial crisis in 2008 and 2009, the company managed to sustain solid performance during tough times, and it emerged from the crisis in stronger shape than ever.

(Click on image to enlarge)

Data by YCharts

But still, major economic trends and corporate spending levels could generate uncertainty around Accenture, so this is a relevant risk factor to assess when evaluating a position in the stock.

Accenture is also prone to acquisitions, the company has made over 130 purchases in the past 5 years. While Accenture has a solid trajectory of successfully incorporating these purchases, integration risk is always a relevant factor to keep in mind.

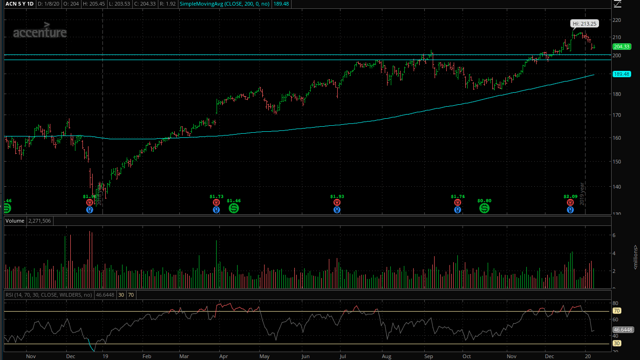

In terms of price action, Accenture is in a beautiful uptrend, the stock made new highs reaching overbought levels around $213 at the end of 2019. Since then, it has pulled back somewhat and it looks no longer overbought. The area around $200 is quite important and price action should be considered bullish as long as the stock remains above such a level.

(Click on image to enlarge)

Source: TOS

Overall, Accenture is a high-quality business positioned on the right side of major economic trends such as technology investing, business innovation, and outsourcing. Besides, the company is widely profitable and it produces strong cash flows. This makes Accenture a solid name to consider holding for the long term.

The stock price is not materially undervalued at current prices, but it's not overvalued either. At these prices, chances are that Accenture stock will continue producing solid returns with moderate downside risk, and any substantial pullback down the road should be considered an opportunity to buy a top-quality business for a more attractive valuation.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more